النقاط الرئيسية

عقود الفروقات (CFDs) هي مشتقات تُستخدم للمضاربة على تغيرات الأسعار دون امتلاك الأصل، بينما تمثل الأسهم ملكية مباشرة مع حقوق تصويت محتملة وتوزيعات أرباح.

الرافعة المالية شائعة في عقود الفروقات ويمكن أن تضخم الأرباح والخسائر، في حين تُشترى الأسهم عادة بدون رافعة مالية وتتطلب الدفع الكامل.

تختلف التكاليف حسب نوع المنتج. قد تشمل عقود الفروقات فروق الأسعار، العمولات، وتمويل الليل. عادة ما تتضمن تداولات الأسهم رسوم الوسيط والبورصة دون تكاليف احتفاظ.

غالبًا ما يوجه أفق الزمن الاختيار؛ تميل عقود الفروقات إلى التداول قصير الأجل، بينما تتماشى الأسهم عمومًا مع الاستثمار طويل الأجل ودخل توزيعات الأرباح.

تختلف الحمايات؛ يمتلك حملة الأسهم حقوق المستثمرين بموجب قواعد البورصة، بينما يعتمد تداول عقود الفروقات على الوسيط والتنظيم القضائي، لذا فإن إدارة المخاطر ضرورية.

ما هي عقود الفروقات والأسهم؟

عقود الفروقات (Contracts for Difference)

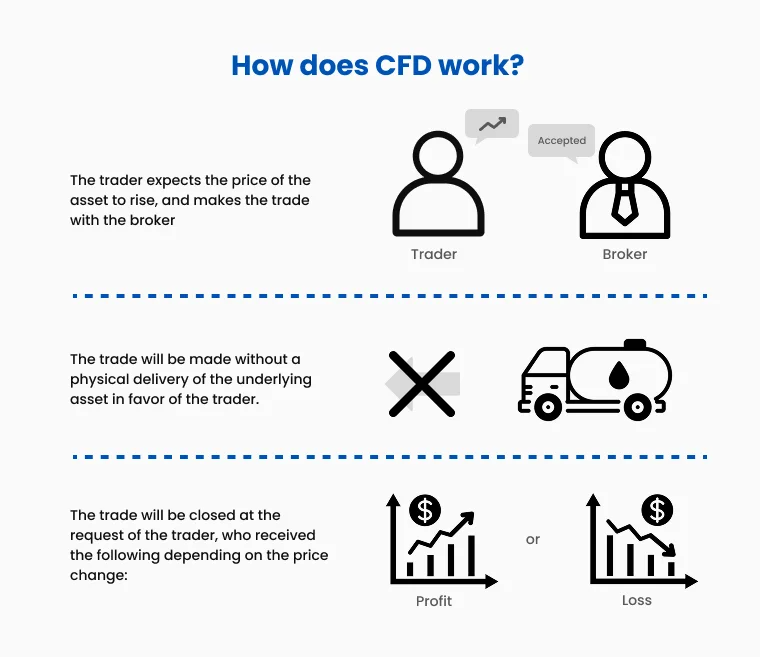

هي منتجات مشتقة تتيح للمتداولين المضاربة على تحركات أسعار أصول مختلفة دون امتلاك الأصل الأساسي.

يحدد الفرق بين سعر فتح وإغلاق العقد الأرباح أو الخسائر.

الأسهم

تمثل ملكية جزئية في شركة، مما يمنح المساهمين حصة في أصولها وأرباحها.

تُتداول في بورصات الأسهم مثل NYSE وNASDAQ وLSE.

يستفيد المستثمرون من ارتفاع رأس المال وتوزيعات الأرباح مع مرور الوقت.

أوجه التشابه الرئيسية بين عقود الفروقات والأسهم

الوصول إلى السوق: توفر عقود الفروقات والأسهم تعرضًا لأسواق الأسهم، مما يسمح للمتداولين والمستثمرين بالمضاربة على أداء الشركات.

تحركات الأسعار: تتأثر الأداتان بتقارير الأرباح، المؤشرات الاقتصادية، والأحداث العالمية.

منصات التداول: يمكن تداول عقود الفروقات والأسهم عبر الإنترنت، مما يوفر سهولة الوصول للمشاركين حول العالم.

المخاطر والمكافآت: كلاهما يحمل مخاطر مثل تقلبات السوق، ولكن عند التعامل الاستراتيجي، يقدمان فرصًا لتحقيق الأرباح.

الفروقات الرئيسية بين عقود الفروقات والأسهم

الملكية

عقود الفروقات: لا تمثل ملكية للأصل الأساسي؛ هي مضاربة بحتة.

الأسهم: ملكية مباشرة للأصل، مع حقوق تصويت وتوزيعات أرباح.

الرافعة المالية

عقود الفروقات: تسمح عادة بالتداول ب رافعة مالية، مما يضخم الأرباح والخسائر.

الأسهم: تُتداول عادة بدون رافعة مالية، وتتطلب الدفع الكامل لسعر السهم مقدمًا.

هيكل التكلفة

عقود الفروقات: قد تشمل فروق الأسعار، رسوم الاحتفاظ الليلي، والعمولات.

الأسهم: تشمل التكاليف عادة عمولات الوسيط ورسوم البورصة، دون تكاليف احتفاظ.

أفق الزمن

عقود الفروقات: مناسبة للتداول قصير الأجل بسبب المراكز المرفوعة والرسوم الليلية.

الأسهم: أفضل للاستراتيجيات الاستثمارية طويلة الأجل، مستفيدة من النمو الرأسمالي المحتمل وتوزيعات الأرباح.

التنظيم والحمايات

عقود الفروقات: تعمل تحت أطر تنظيمية مختلفة حسب الوسيط والاختصاص القضائي، وغالبًا بدون حماية للمساهمين.

الأسهم: تخضع لقوانين بورصة صارمة، توفر حقوق وحمايات للمستثمرين.

مخاطر عقود الفروقات مقابل الأسهم

#1 مخاطر عقود الفروقات

يمكن للرافعة المالية تضخيم الخسائر، مما قد يتجاوز الودائع الأولية.

تخضع لرسوم الاحتفاظ الليلي، مما يقلل الأرباح في التداولات طويلة الأجل.

تتطلب مراقبة مستمرة بسبب تقلبات أعلى.

#2 مخاطر الأسهم

يمكن لتقلبات السوق أن تؤثر على أسعار الأسهم، مما يؤدي إلى خسائر رأسمالية.

السيولة المنخفضة في الأسهم الصغيرة قد تجعل التداول صعبًا.

الاستثمارات طويلة الأجل معرضة للمخاطر الاقتصادية الكلية ومخاطر خاصة بالشركة.

أي الأداتين تناسبك؟

اختر عقود الفروقات إذا:

تفضل فرص المضاربة قصيرة الأجل.

ترغب في التداول بالهامش لزيادة كفاءة رأس المال.

تبحث عن’تنويع عبر أسواق متعددة مثل الفوركس أو السلع.

اختر الأسهم إذا:

تهدف إلى بناء ثروة طويلة الأجل واستثمار القيمة.

تفضل أمان امتلاك الأصول مع حقوق المساهمين.

توزيعات الأرباح عامل رئيسي في استراتيجيتك الاستثمارية.

الخلاصة: عقود الفروقات مقابل الأسهم

يكمن الفرق بين عقود الفروقات والأسهم في طريقة التداول ومستوى المرونة التي يقدمانها. فهم هذا الفرق يمكن أن يساعدك على مواءمة استراتيجيتك مع أهدافك المالية.

بينما توفر عقود الفروقات مرونة أكبر والوصول إلى مجموعة واسعة من الأسواق، تقدم الأسهم استقرارًا طويل الأجل ومزايا الملكية. بغض النظر عن اختيارك، فإن اتباع نهج مدروس هو أمر أساسي.