المقالات الشائعة

At a time when most major non-USD currencies are under pressure, the renminbi is tracing a very different path. The latest figures from the State Administration of Foreign Exchange (SAFE) act like a shot in the arm, revealing the solid logic underpinning the RMB’s strength.

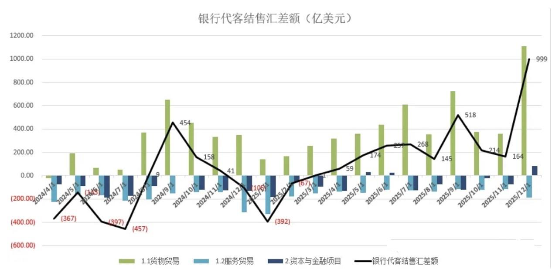

December’s USD 99.9 billion FX settlement-surplus is driven by two powerful engines.

First, goods trade is the single biggest contributor. In December, exports denominated in US dollars reached USD 357.78 billion, a new monthly record, with a trade surplus of USD 114.14 billion. This brings a steady stream of foreign currency into the banking system and serves as the most fundamental “ballast” for the renminbi exchange rate.

Second, cross-border capital flows remain highly active. In December 2025, banks’ FX receipts on behalf of clients totalled USD 824.4 billion, while external payments reached USD 710.9 billion, reflecting a clear net inflow of cross-border funds. This shows that, supported by solid economic fundamentals, the scale of international trade and capital flows remains elevated.

From a behavioural perspective, stronger willingness to sell FX (settle into RMB) and relatively stable demand to buy FX together drove the large surplus. This intuitively reflects how market participants’ expectations for the renminbi have shifted from “wait-and-see” or “concern” toward a clear appreciation bias. In short, market sentiment, capital flows and trade fundamentals are working together to form a three-part symphony behind the RMB’s rise against the tide.

Three Drivers Behind the RMB Appreciation Consensus

Taken together, this historic FX settlement number reflects three forces that have combined into a powerful tailwind at the turn of the year.

1. Solid foundations in the real economy

Persistently strong exports are delivering real, tangible FX inflows. December’s record export value confirms the strong competitiveness and resilience of Chinese manufacturing. This is the firmest and most durable source of the renminbi’s purchasing power.

2. Macro fundamentals as an anchor

Banks’ client FX receipts and payments data show large-scale net capital inflows, reflecting robust cross-border economic activity. A broadly balanced and stable balance-of-payments position gives the RMB an important buffer against external volatility.

3. Self-reinforcing market sentiment

Once USD/CNY broke below key psychological levels, expectations for RMB appreciation were quickly ignited and amplified. This significantly boosted corporates’ willingness to sell FX and suppressed their demand to buy FX, turning the usual year-end seasonal FX settlement wave into a powerful appreciation force.

While the renminbi has been edging higher against the US dollar, it has also strengthened in effective terms against a basket of currencies. The CFETS RMB Index breaking above 99 is especially significant, because it reflects the renminbi’s overall purchasing power in global trade.

The stronger CFETS index first stems from the RMB’s relative pricing advantage versus other basket currencies. In a rising US dollar environment, the euro has been dragged down by geopolitical risks, while the yen and won have weakened sharply due to ongoing capital outflows. For example, the Korean won fell to its weakest level since 2009 in early 2026, as domestic capital flowed heavily into overseas markets.

When several major currencies in the basket are “underperforming,” even a modest RMB appreciation against the dollar can translate into a much stronger overall purchasing power, pushing the CFETS index higher.

New CFETS Weights: More Structural Support for an Independent RMB

More importantly, the new CFETS basket weights that took effect on 1 January 2026 add fresh institutional support for the RMB’s independent strength. The latest adjustment, based on 2024 trade data, introduces two key changes to the currency basket’s structure.

First, the weight of the US dollar and other developed-market currencies has been further reduced. Second, the weight of emerging-market currencies with closer trade links to China has been increased, better reflecting China’s evolving trade landscape.

As a result, the US dollar’s share in the CFETS basket has now fallen for four consecutive years, reaching 18.31% in 2026. This change has lowered the sensitivity of the RMB central parity rate to moves in the dollar index, with the correlation coefficient slipping from 0.337 to 0.331.

In practical terms, when the dollar strengthens, the pass-through pressure for RMB depreciation is now smaller. Conversely, when the dollar weakens, the renminbi has greater flexibility to reflect its own economic fundamentals rather than simply tracking the dollar’s direction.

The weight changes also mirror China’s increasingly diversified trade patterns. The rising weights of ASEAN, Middle Eastern and other emerging-market currencies mean the stability of the RMB exchange rate is more deeply rooted in broad-based, real trade activities, rather than being dictated solely by international capital flows or the dollar cycle.

In sum, the CFETS index’s break above 99 is far more than just a number. It marks a new stage in the evolution of how the RMB exchange rate is determined and understood by the market.

Rather than being driven mainly by “passive swings” following the US dollar, the RMB is increasingly moving toward a regime of “active stability”. In this new phase, its behaviour is more anchored by domestic economic fundamentals, guided by policy intent, and supported by a broader, more diversified global trade network.

This growing “decoupling capability” allows the renminbi to display more of a safe-haven character during bouts of global FX market turbulence, while giving policymakers greater room for manoeuvre.

Looking ahead, as long as export resilience is maintained and the trend of net inflows under the capital account continues, the RMB will have a solid basis to stay strong against a basket of currencies.

At the same time, regulators will remain alert to the potential impact of an overly strong currency on exports, and can use tools such as the central parity fixing to conduct “counter-cyclical adjustments,” ensuring that the pace of appreciation remains manageable and orderly.