POPULAR ARTICLES

Ethereum price today: $3,120

- Ethereum Net Taker Volume on Binance has flipped positive for the first time since last July, indicating buyer dominance across ETH derivatives.

- Increasing retail distribution and US selling pressure have offset buying momentum from whales and derivatives traders.

- ETH is struggling to find direction between the 20- and 50-day EMAs.

Buyers are now leading the Ethereum (ETH) derivatives market on crypto exchange Binance, following a positive flip in the Net Taker Volume.

The metric tracks the difference between the buying and selling volumes of derivatives traders purchasing ETH contracts with market orders. The Net Taker Volume flipped positive last week for the first time since July, rising from a low of -$570 million in September to $51 million on Monday.

-1768232434397-1768232434399.png)

The move indicates most short traders booked profits by covering their short positions following the price decline in the last quarter.

A positive flip in Net Taker Volume when prices are lower has often marked a market bottom and sparked a price rally, as evidenced by ETH's price surge in Q2 '25.

The return of buyer dominance coincides with a resumption in whale accumulation. Investors with a balance of 10K-100K ETH accumulated 360K ETH over the past week, reversing the previous week's distribution.

ETH retailers distribute alongside US investors

However, the buying momentum across takers and whales was offset by intense distribution among retailers. Wallets with a balance of 100-1K ETH and 1K-10K ETH offloaded combined holdings of 830K ETH last week.

-1768232480302-1768232480303.png)

A similar activity is evident in the Coinbase Premium Index, which measures the difference between ETH's price on Coinbase Pro and Binance. The index declined sharply again last week after a brief recovery at the beginning of the year, signalling increased selling by US investors.

Additionally, Ethereum investment products saw outflows of $116 million last week, according to CoinShares data.

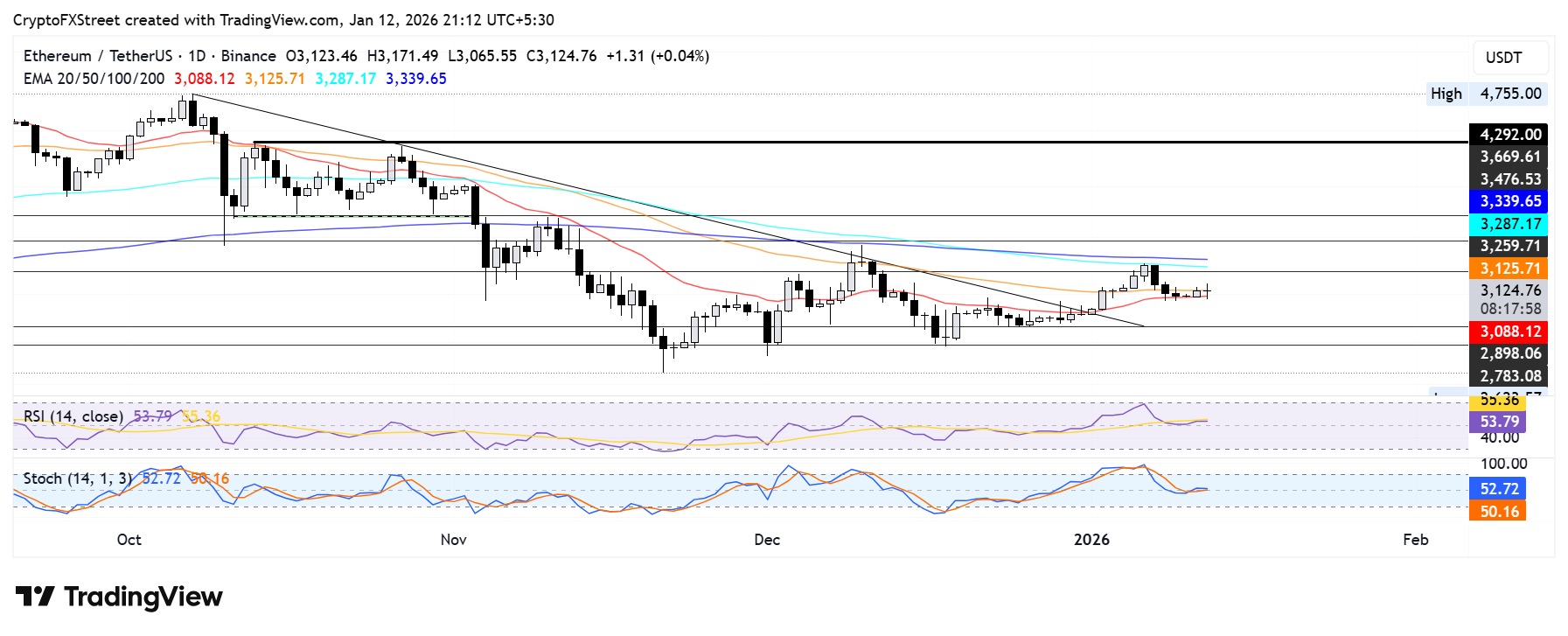

Ethereum Price Forecast: ETH struggles for direction within a tight 20- and 50-day EMA range

Ethereum saw $52.5 million in futures liquidations over the past 24 hours, led by $30.6 million in long liquidations, per Coinglass data.

ETH is testing the 20-day Exponential Moving Average (EMA) — just above the $3,000 psychological level — which served as support throughout the weekend. At the same time, the top altcoin is facing resistance near the 50-day EMA around $3,130.

A firm move above the 50-day EMA could push ETH to test the $3,260 resistance, just below the 100-day EMA, which pushed prices back down last Wednesday.

A breakdown below the 20-day EMA could see ETH find support near $2,900.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downward and testing their neutral levels. A firm decline below could accelerate the bearish momentum.