POPULAR ARTICLES

- Bitcoin is showing historic signs seen in the late stages of a bull cycle.

- Bitcoin's demand has also weakened despite hitting a new all-time high last week.

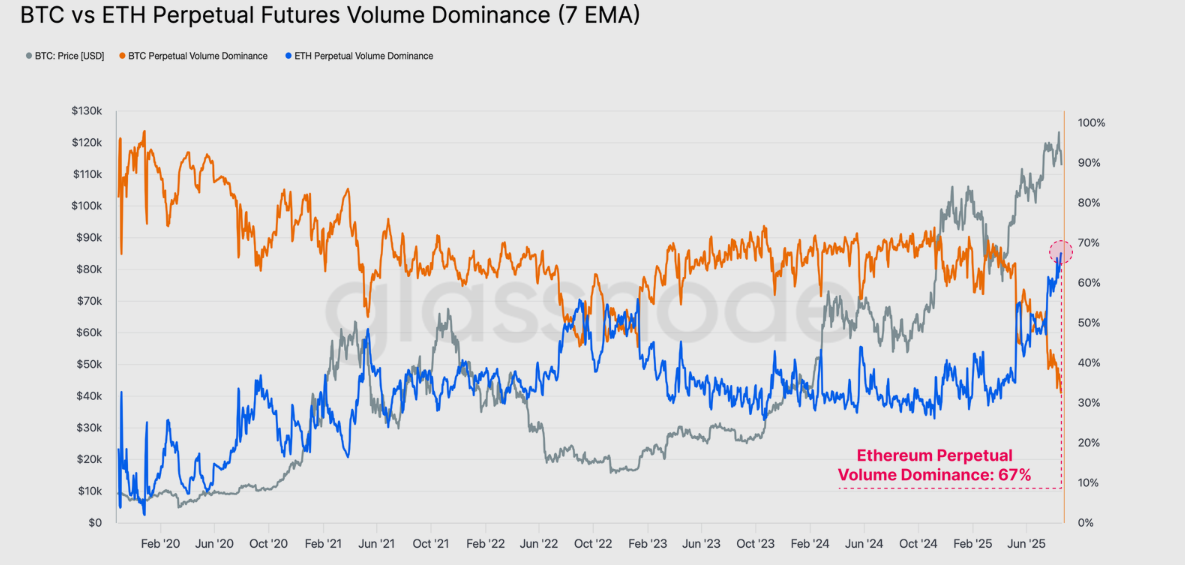

- Ethereum's perpetual futures volume dominance surged to a new all-time high above Bitcoin's, reflecting rising capital rotation toward altcoins.

Bitcoin (BTC) is exhibiting signs of a late-stage bull cycle, echoing patterns from previous market uptrends, noted analytics firm Glassnode in a Wednesday report.

Bitcoin could be nearing late phase of bull cycle amid weak demand

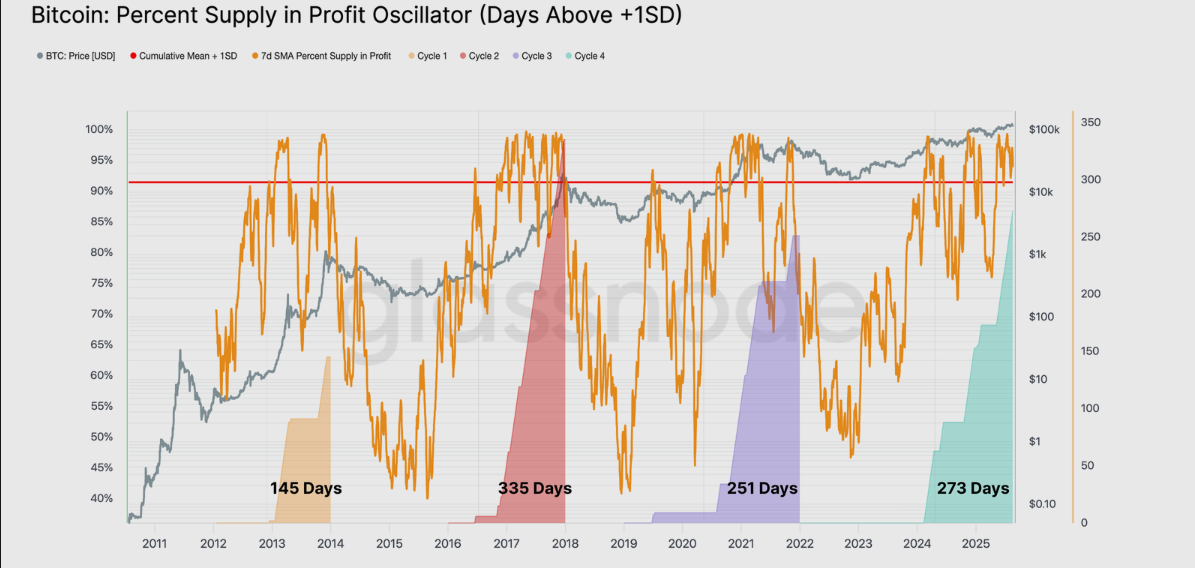

The report highlights that Bitcoin's current performance is showing similarity with the 2015-2018 and 2018-2022 cycles. A measure for evaluating this correlation is the number of days BTC's circulating supply has remained above the +1 standard deviation band, wrote Glassnode analysts. So far, the current period has stretched to 273 days, marking the second-longest run on record, behind the 335 days seen in the 2015–2018 cycle.

BTC Percent Supply in Profit (Days Above +1SD)

Bitcoin demand also dropped over the past week, marked by weak capital inflows despite hitting an all-time high of $124,000. Sell-side pressure also slowed following the record high, as realized profits declined compared to previous all-time high surges.

"The market failed to sustain upwards momentum, even though the sell-side pressure coming from existing holders was softer," Glassnode added.

Additionally, long-term holders, who are usually more active during market peaks, have realized more profit this cycle than in prior ones, except for 2016–2017.

"Taken together, these signals reinforce the view that the current cycle is firmly in its historically late phase," the analysts wrote.

With Bitcoin's diminishing demand, altcoins saw renewed interest in recent weeks, particularly across the derivatives market. Before the recent correction, open interest across major altcoins climbed to a record $60.2 billion over the weekend, largely driven by speculative activity around Ethereum.

The top altcoin's perpetual futures volume dominance surged to a new all-time high above Bitcoin's, reflecting rising capital rotation toward altcoins, Glassnode analysts noted. "Such a pronounced rotation in trading activity reinforces the growing focus of investors on the altcoin sector..."

BTC vs ETH Perpetual Futures Volume Dominance. Source: Glassnode

Historically, capital rotates from Bitcoin to altcoins during the late phase of the crypto bull market cycle. This often precedes the beginning of an altseason.

Bitcoin and Ethereum (ETH) are changing hands at $112,800 and $4,250 in Asian trading hours on Friday.