POPULAR ARTICLES

BoJ is set to stay cautious and keep the policy rate on hold in October, prioritizing stability amid persistent inflation and uneven growth. December hike remains our base case, contingent on sustained core CPI near 3% and continued wage momentum through winter bonus rounds. Political transition under PM Takaichi and FM Katayama reinforces medium-term normalization prospects, but not alter BoJ’s near-term data-driven approach, in our view, Standard Chartered's economist Chong Hoon Park and Nicholas Chia report.

Be patient and move with the data

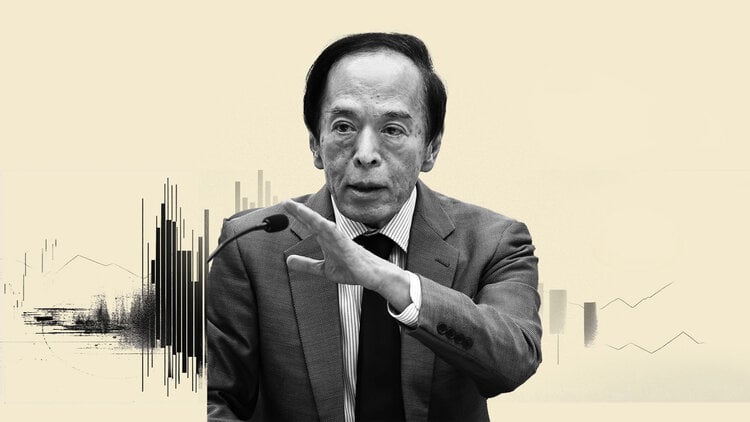

"We expect the Bank of Japan (BoJ) to stay on hold on 30 October as it tries to balance initiating monetary policy normalisation with navigating the complex political and international trade environment. The new administration’s expansionary fiscal stance is in contrast to Finance Minister Satsuki Katayama’s stance favouring JPY stability and fiscal discipline, as well as the BoJ’s hawkish stance; this underscores the need for tight coordination of opposing interests, but this does not materially alter the BoJ’s near-term policy direction, in our view. We think the BoJ will remain focused on the timing and scale of rate normalisation over responding directly to political change."

"Recent comments from BoJ board member Hajime Takata add a hawkish voice to the policy debate, indicating an urgency for further rate hikes to anchor inflation expectations. Takata urged the central bank to capitalise on the "prime opportunity" to raise rates, advocating an increase the short-term interest rate to 0.75% from the current 0.5%, citing inflation having been above the 2% target for over three years. His sentiment is grounded in recent inflation dynamics, with core CPI rising 2.7% y/y in September. Persistent inflation, along with growing wage gains and robust corporate profits, suggests that a less accommodative monetary stance may be warranted to prevent the entrenchment of inflation expectations."