POPULAR ARTICLES

- Pi Network extends the decline after breaking below the $0.2565 support level the previous day.

- Two major Pi Network transactions are user deposits to OKX, suggesting investors are reducing their exposure.

- PI risks further losses as it targets the $0.2000 round figure, with selling pressure growing.

Pi Network (PI) price is down 3% at press time on Wednesday, following a 6% decline from the previous day. Both large transaction records on the network and the technical outlook indicate heightened selling pressure, which could further extend the losses to $0.2000 round figure.

Supply pressure on the rise

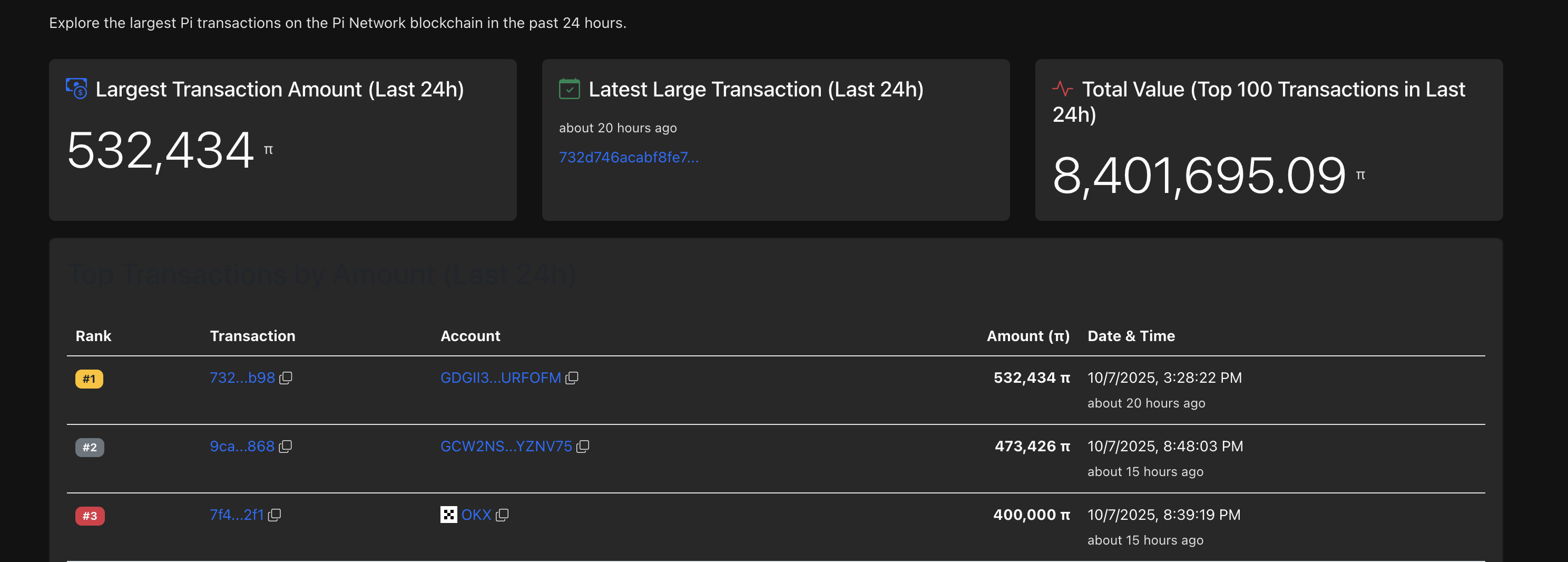

The retail interest in Pi Network is gradually declining as users deposit to Centralized Exchanges (CEX) in large numbers. PiScan data shows that two of the largest transactions on the Pi Network, based on volume, are user deposits of 532,434 PI and 473,426 PI tokens. Typically, tokens that shift from on-chain to exchanges are considered part of the supply pressure.

Transaction records. Source: PiScan

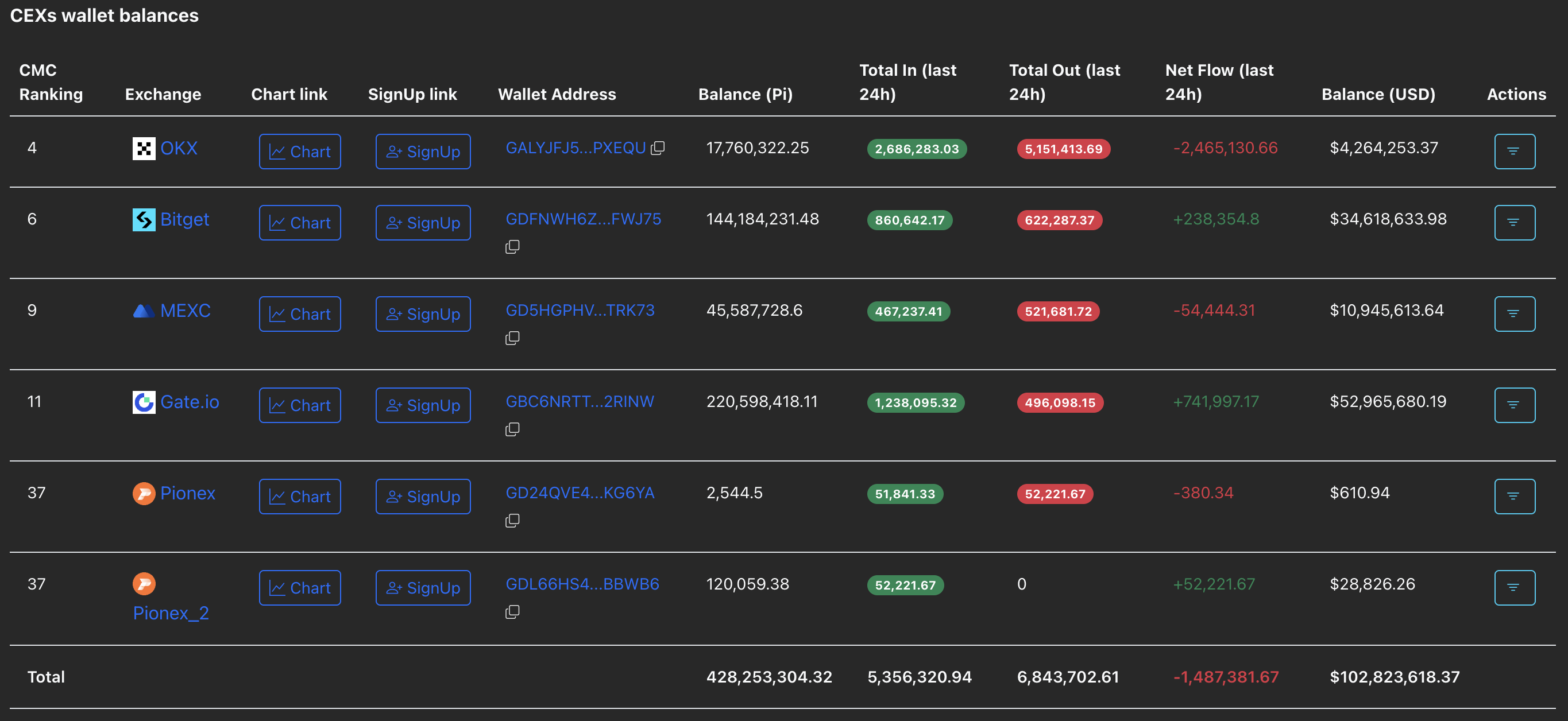

However, the CEX reserves continue to decline over the same period by over 1.37 million PI tokens, suggesting that the majority of the supply pressure is coming from direct on-chain transfer, bypassing the CEXs. Out of the 8.246 billion PI in circulation, just 428.26 million PI is held by CEXs, which accounts for slightly over 5%, as previously reported by FXStreet.

CEXs wallet balances. Source: PiScan

Pi Network risks further losses

Pi Network trades below $0.2400 at press time on Wednesday, extending its third consecutive week of losses. The mobile mining cryptocurrency failed to recover as the market rebounded last week, but suffered a pullback amid the broader market decline, indicating weakened investor sentiment.

If the declining trend in PI persists, it could find support at the S3 and S4 Pivot Point levels, located at $0.2259 and $0.2113, respectively. Meanwhile, the market anticipates a potential drop to the $0.2000 psychological support.

Despite Decentralized Finance (DeFi) protocols such as Decentralized Exchange (DEX), Automated Market Maker (AMM), and a token creation tool in the pipeline for the mainnet, the lack of transparency on the launch date, development progress, and the ongoing update to the Stellar protocol version 23 keeps the investors on edge.

The technical indicators on the 4-hour chart indicate strong bearish momentum, as the Relative Strength Index (RSI) has dropped to 23, entering the oversold zone. Meanwhile, the Moving Average Convergence Divergence (MACD) corroborates the rise in selling pressure with successive rises in red histogram bars and declining average lines.

PI/USDT daily price chart.

Looking up, a bounce back in PI could be limited by the S2 and S1 support-turned-resistance Pivot Point levels at $0.2404 and $0.2505, respectively.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.