المقالات الشائعة

- XRP reclaims support at $1.90 but faces headwinds from ETF outflows and a weakening derivatives market.

- Binance adds RLUSD support on the Ethereum blockchain, with support for the XRP Ledger coming soon.

- The listing covers spot trading support for RLUSD, portfolio margin eligibility and inclusion in Binance Earn.

Ripple (XRP) is navigating a critical juncture as price action stabilizes above $1.90 at the time of writing on Wednesday. The cross-border remittance token came under aggressive selling earlier this week as macroeconomic and geopolitical tensions escalated.

Meanwhile, institutional and retail interest continue to weaken, significantly lowering the odds of a steady recovery.

XRP under pressure amid ETF outflows, deteriorating derivatives sentiment

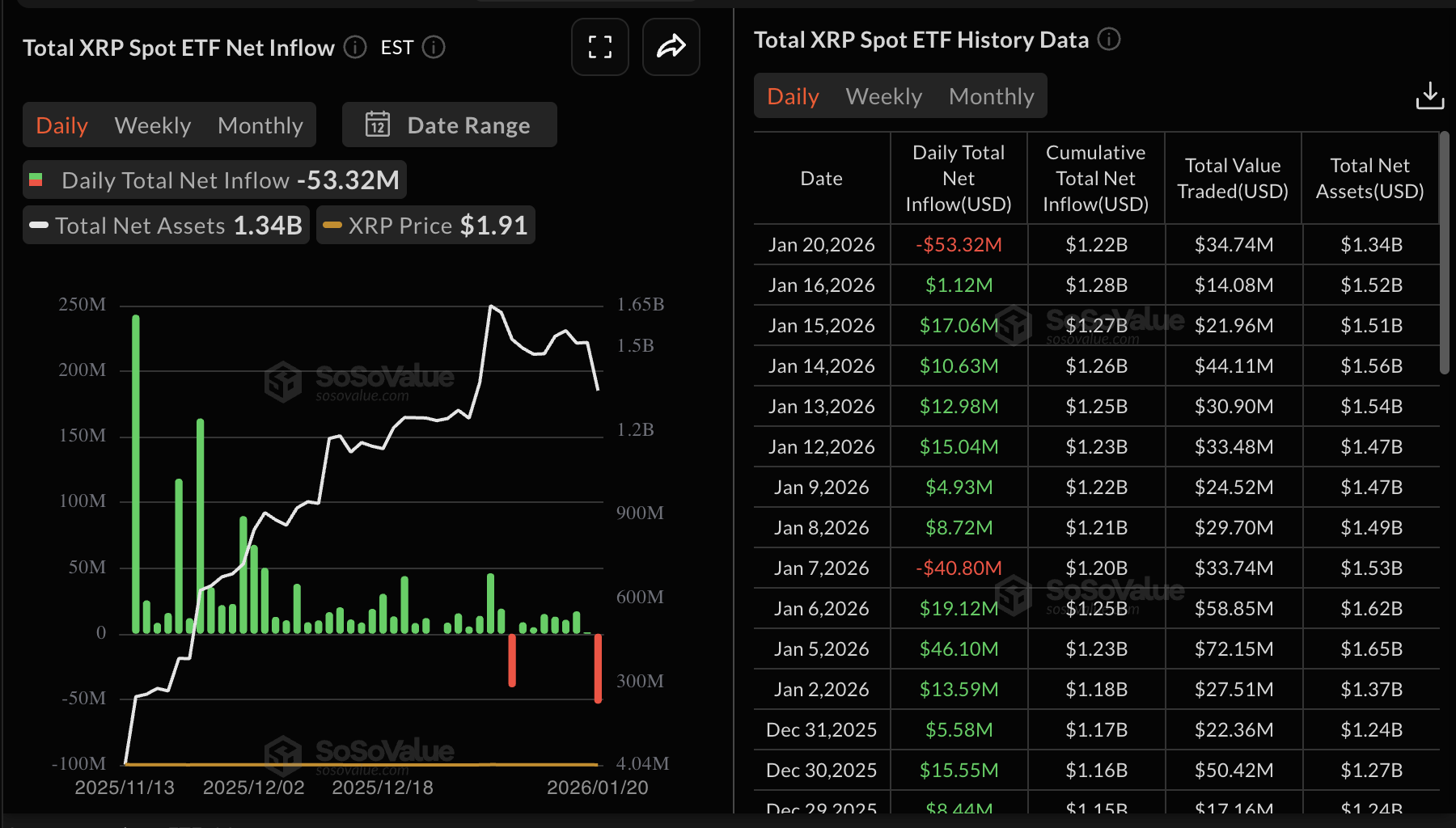

The XRP spot Exchange Traded Funds (ETFs) recorded their second outflow since their launch in November, as investors withdrew approximately $53 million on Tuesday. The outflow came after seven consecutive days of inflows, reflecting ongoing macroeconomic headwinds and risk-off sentiment in the broader crypto market.

The cumulative total inflow stands at $1.22 billion, with net assets at $1.34 billion, according to SoSoValue data. The performance of XRP spot ETFs would help shape market sentiment going forward.

Meanwhile, XRP continues to face a deteriorating retail market, as evidenced by the derivatives market’s futures Open Interest (OI) falling to $3.35 billion on Wednesday – the lowest level since January 1. The OI averaged $3.53 billion on Tuesday and $4.55 on January 6.

The persistent decline in OI indicates that traders are losing interest and confidence in the token’s ability to sustain recovery. If the trend progresses without changing course, XRP may extend its decline toward the April low of $1.61.

Ripple’s stablecoin RLUSD gains traction with Binance listing

Binance has added support for Ripple USD (RLUSD), a dollar-backed stablecoin. The listing includes support for the Ethereum blockchain, with the integration with the XRP Ledger (XRPL) expected to follow.

According to a statement released by Ripple, the listing spot trading for RLUSD, portfolio margin eligibility and the stablecoin inclusion in Binance Earn.

Ripple stated that “This multichain listing ensures greater accessibility for users and institutions, whether they operate natively on XRPL or within the Ethereum ecosystem.”

The integration opens RLUSD to increased on-chain liquidity while paving the way for real-world payments and cross-network interoperability at a larger scale.

Stablecoin demand continues to shape on and off-ramps for the crypto industry’s seamless mutual coexistence with the traditional finance ecosystem.

Technical outlook: XRP stabilizes above key support

Meanwhile, XRP is pressing down support at $1.90 amid weakening derivatives and a deteriorating market structure. Despite the support, the Moving Average Convergence Divergence (MACD) on the daily chart remains below its signal line, indicating a strong bearish bias. The histogram bars below the zero line are expanding, supporting the downward thesis and prompting investors to reduce their risk exposure.

A daily close below support at $1.90 may invalidate potential recovery and trigger an extended decline toward the April low of $1.61.

The Relative Strength Index (RSI) on the daily chart should extend recovery above the midline to influence the next bullish phase. Traders will watch for a close above the $2.00 hurdle before activating risk-on mode.

The 50-day Exponential Moving Average (EMA) caps the upside at $2.06, the 100-day EMA at $2.18 and the 200-day EMA at $2.31. Breaking above this moving average resistance cluster would reinforce a bullish price reversal in XRP.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.