CFDs vs Stocks: Which Trading Instrument is Right for You?

Global financial markets offer many opportunities for traders and investors, making it critical to understand the available instruments. Two popular choices often mistaken for each other are contracts for difference (CFDs) and stocks, which have similarities and deviations. Let’s delve into these financial instruments' commonalities, differences, and associated risks and why understanding them can empower your trading decisions. By the end, you’ll have a clearer picture of CFDs vs Stocks, helping you determine which might suit your financial goals better.

Key Takeaways

CFDs are derivatives used to speculate on price changes without owning the asset, while stocks represent direct ownership with potential voting rights and dividends.

Leverage is common with CFDs and can magnify profits and losses, whereas stocks are typically purchased without leverage and require full payment.

Costs differ by product type. CFDs can include spreads, commissions, and overnight funding. Stock trading usually involves broker and exchange fees with no holding charges.

Time horizon often guides the choice. CFDs tend to suit short term trading, while stocks generally align with longer term investing and dividend income.

Protections vary. Stockholders have investor rights under exchange rules, while CFD trading depends on the broker and jurisdictional regulation, so risk management is essential.

What Are CFDs and Stocks?

CFDs (Contracts for Difference)

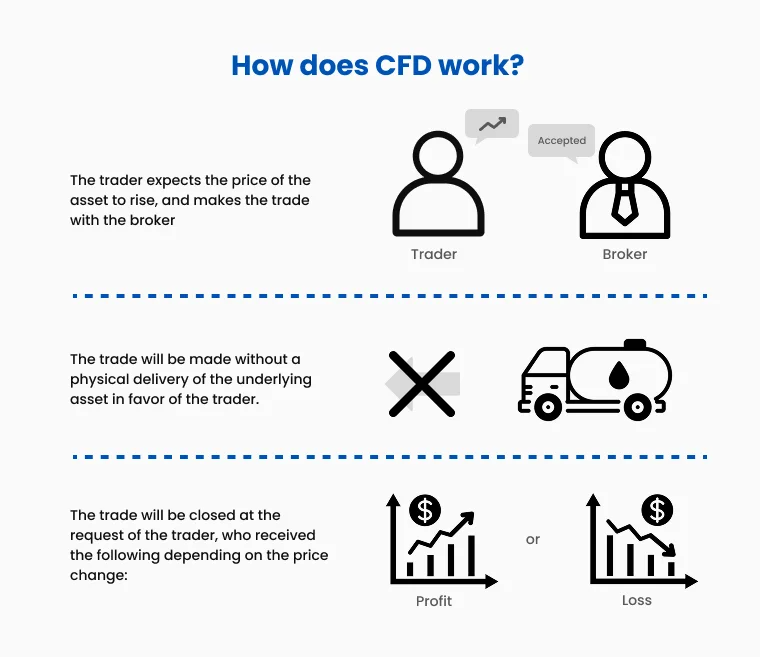

Derivative products allow traders to speculate on the price movements of various assets without owning the underlying asset.

Used to trade on stocks, commodities, forex, and indices.

The difference in the opening and closing prices of the contract determines profits or losses.

Stocks

Represent partial ownership in a company, giving shareholders a stake in its assets and profits.

Traded on stock exchanges like the NYSE, NASDAQ, and LSE.

Investors benefit through capital appreciation and dividends over time.

Key Similarities Between CFDs and Stocks

Market Access: CFDs and stocks offer exposure to the equity markets, allowing traders and investors to speculate on company performance.

Price Movements: Both instruments are influenced by earnings reports, economic indicators, and global events.

Trading Platforms: CFDs and stocks can be traded online, which offers convenience and accessibility to participants worldwide.

Risk and Reward: Both carry risks, such as market volatility, but when approached strategically, they also present opportunities for gains.

Major Differences Between CFDs and Stocks

Ownership

CFDs: No ownership of the underlying asset; purely speculative.

Stocks: Direct ownership of the asset, providing voting rights and dividends.

Leverage

CFDs: Typically allow trading with leverage, magnifying both gains and losses.

Stocks: Usually traded without leverage, requiring full upfront payment of the share price.

Cost Structure

CFDs: May include spreads, overnight holding fees, and commissions.

Stocks: Costs typically include broker commissions and exchange fees, with no holding costs.

Time Horizon

CFDs: Suited for short-term trading due to leveraged positions and overnight fees.

Stocks: Better for longer-term investment strategies, benefiting from potential capital growth and dividends.

| Feature | CFD Trading | Stock Trading |

|---|---|---|

| Ownership | No ownership. You speculate on price movement only. | Direct ownership. You hold the actual asset and have voting rights. |

| Leverage | High. Trade with a small deposit (Margin). Magnifies P&L. | None. Typically requires full payment of the asset price upfront. |

| Profit Direction | Trade both Rising (Long) and Falling (Short) markets easily. | Primarily profit from rising prices (unless using complex borrowing). |

| Costs | Spreads, Commissions & Overnight Financing (Swap) fees. | Broker Commissions & Exchange fees. No overnight holding costs. |

| Best For | Short-term trading, Hedging, Day Trading. | Long-term investing, "Buy and Hold", Dividend income. |

CFD Example vs Stock Example

To clear up any confusion about the financial difference between these two methods, let's look at a concrete calculation of the same trade executed via Stocks vs. CFDs. This scenario highlights how leverage impacts your initial capital outlay.

Stock Example

Suppose you buy 50 shares of NVIDIA (NVDA) at $140 each. Your initial investment is $7,000. If the stock price rises to $150, your shares are now worth $7,500, giving you a profit of $500. If the price falls to $130, your investment is worth $6,500, resulting in a $500 loss.

CFD Example

Instead of buying the actual shares, you decide to trade a CFD on NVIDIA. With leverage of 10:1, you only need $700 to open a position equivalent to $7,000 worth of stock. If the price rises to $150, your profit is still $500. However, if the price falls to $130, your loss is also $500. Because you are trading on margin, this loss represents a much larger percentage of your initial $700 deposit.

Risks of CFDs vs Stocks

#1 CFD Risks

Leverage can amplify losses, potentially exceeding initial deposits.

Subject to overnight fees, eroding profits for longer-term trades.

Requires constant monitoring due to higher volatility.

#2 Stock Risks

Market volatility can impact stock prices, leading to capital losses.

Lower liquidity in smaller stocks can make trading challenging.

Long-term investments are exposed to macroeconomic and company-specific risks.

Still unsure which method fits your style? Here is a breakdown of the key advantages and disadvantages of both instruments.

Advantages and disadvantages of CFDs

✅ Advantages

- Leverage: Control large positions with small capital.

- Short Selling: Profit from falling prices easily.

- Global Access: Trade thousands of markets (Indices, Crypto, Forex) from one account.

❌ Disadvantages

- High Risk: Leverage magnifies losses rapidly.

- No Ownership: You have no voting rights.

- Overnight Fees: Swap rates can eat into long-term profits.

Want to dive deeper? Discover the full list of benefits of CFD trading in our detailed guide here

Advantages and disadvantages of Stocks

✅ Advantages

- Ownership: You own the asset and get voting rights.

- Dividends: Receive direct payments (great for compounding).

- Lower Risk: No leverage means you can't lose more than you invest.

❌ Disadvantages

- High Capital: You must pay the full share price upfront.

- Hard to Short: Profiting from market drops is difficult/complex.

- Limited Hours: You can only trade when the specific exchange is open.

Which Instrument Suits You?

Choose CFDs if:

You prefer short-term speculative opportunities.

You want to trade on margin to maximize capital efficiency.

You’re looking to diversify across multiple markets like forex or commodities.

Choose Stocks if:

You aim for long-term wealth creation and value investing.

You prefer the security of owning assets with shareholder rights.

Dividends are a key factor in your investment strategy.

Final Thoughts: CFDs vs Stocks

The difference between CFDs and stocks lies in how they are traded and the level of flexibility they offer. Recognizing this difference can help you align your strategy with your financial goals.

While CFDs provide greater flexibility and access to a wide range of markets, stocks offer long-term stability and ownership advantages. Regardless of which you choose, a well-researched approach is essential.

Ready to trade?

TMGM is a leading, regulated CFD broker known for its lightning-fast execution and deep liquidity. With access to over 12,000 markets across Forex, Stocks, Indices, and Commodities, TMGM empowers traders with competitive spreads and advanced trading tools. Whether you are a scalper or a day trader, our technology infrastructure is designed to give you a professional edge.

For those interested in exploring CFD trading, it is advisable to test trading strategies first before committing any real funds, using a TMGM demo account. Once users become more accustomed to the platform and trading mechanics, they can sign up for a live trading account with TMGM, using the TMGM Mobile App or desktop app.

Trade Smarter Today

FAQs About CFDs vs Stocks

What is the difference between CFD and stock?

Which suits short term vs long term?

What costs will I pay on CFDs vs stocks?

What are the main risks with CFDs and stocks?

How does leverage change the trade compared with buying shares outright?

Account

Account

Instantly