- Ethereum regains bullish momentum above $3,300, signaling a potential shift to risk-on sentiment.

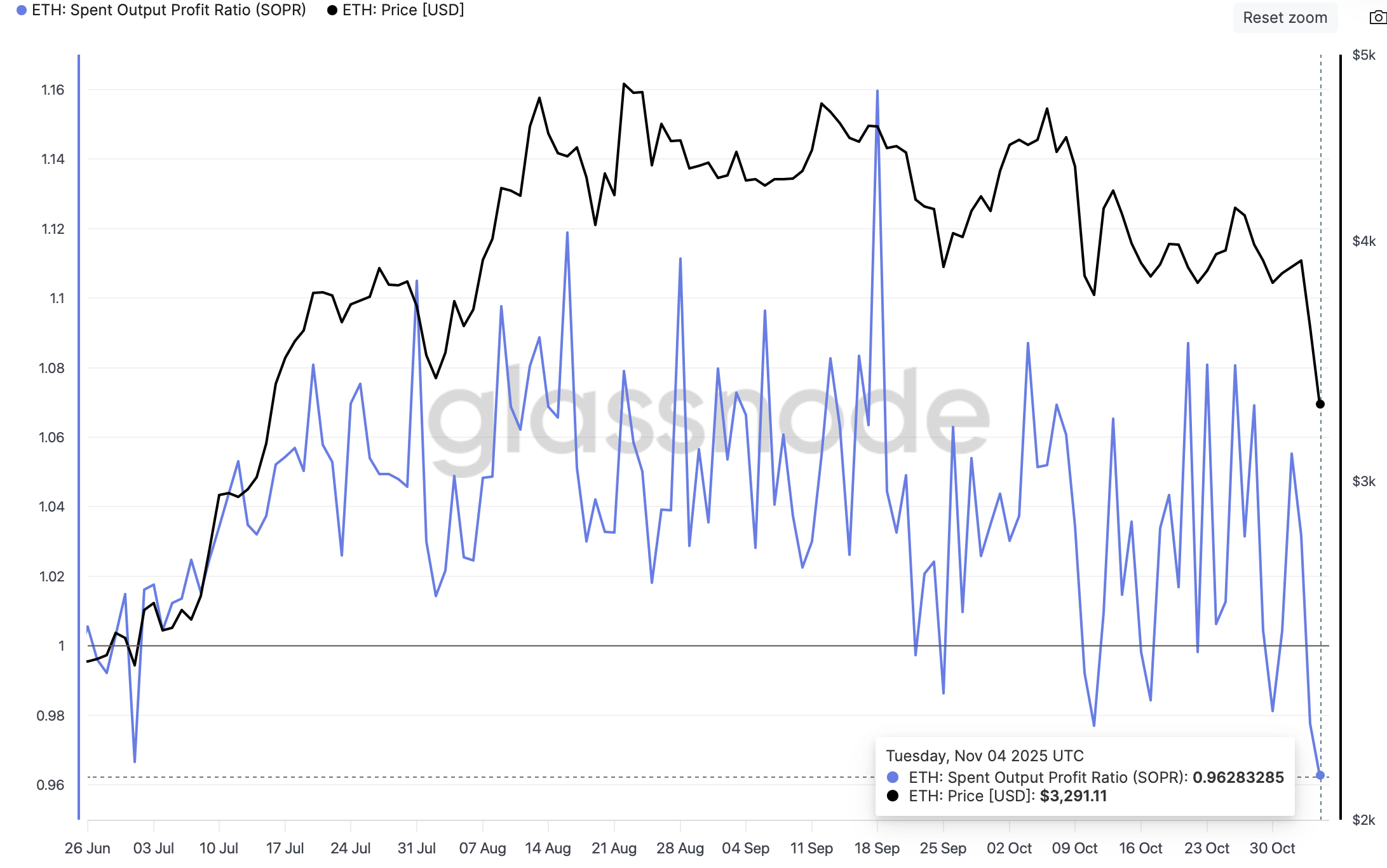

- Ethereum SOPR metric drops below 1.00, implying that traders are selling and realizing losses.

- Ethereum's supply in profit has declined by 32% from its October peak of 78 million ETH.

Ethereum (ETH) is trading upward, building on the short-term support at $3,350 at the time of writing on Wednesday, following two days of steady declines in the broader cryptocurrency market.

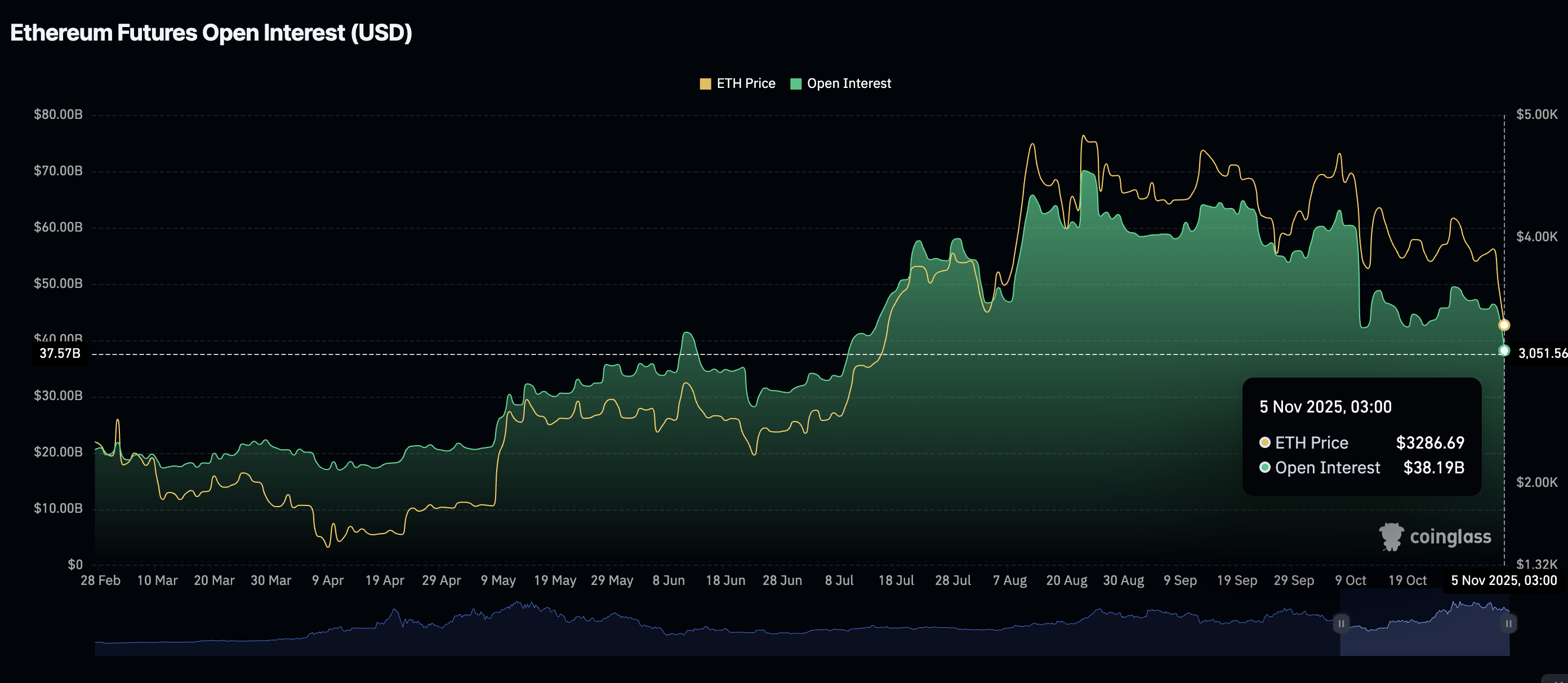

Despite the knee-jerk recovery from ETH's weekly low of $3,057, retail demand remains significantly suppressed. CoinGlass data shows the futures Open Interest (OI) averaging $38 billion, down 19% from approximately $47 billion on Saturday and 47% from its historical peak of $70 billion reached in August.

The steady decline mirrors the risk-off sentiment surrounding Ethereum, prompting traders to retreat into the sidelines until stability returns.

Ethereum bulls eye recovery amid bearish exhaustion

Ethereum has consistently faced a cascade of losses since its record high of $4,956 in late August. Profit-taking, macroeconomic uncertainty and a lack of price catalysts are among the factors that continue to suppress recovery, leaving ETH vulnerable to headwinds.

According to Glassnode's data, the Spent Output Profit Ratio (SOPR) metric – which measures the ratio of the realized value in US Dollar (USD) at the time of spending to the cost basis in USD at the time of purchase for all ETH outputs – has declined to 0.97 as of Tuesday from 1.08 in early October, coinciding with the prolonged price correction. This suggests investors are selling amid panic and extreme fear, realizing losses.

However, a SOPR resetting below 1.00 implies potential exhaustion of weak hands, which could present fresh buying opportunities as selling pressure eases. Ideally, investors buy when the SOPR is below 1.00 and sell when it rises above that threshold, due to the risk of overheating.

Glassnode also highlights a significant drop in Ethereum's supply in profit from approximately 78 million ETH to 53 million ETH recorded on October 6. This represents a 32% decrease in supply in profit, subsequently reducing potential selling pressure and predisposing ETH to a recovery in the short to medium term.

Technical outlook: Ethereum bulls seek to regain control

Ethereum is trading above $3,300 at the time of writing on Wednesday, bolstered by macro news after China suspended reciprocal tariffs on some United States (US) agricultural goods.

The Relative Strength Index (RSI), which is currently at 32, up from slightly oversold levels, indicates that bearish momentum is decreasing. Higher RSI readings would tighten the bullish grip, increasing the odds of Ethereum reclaiming the 200-day Exponential Moving Average (EMA) at $3,601.

Still, traders should be cautiously optimistic as the Moving Average Convergence Divergence (MACD) indicator has upheld a sell signal since Monday. Investors may keep leaning bearishly and deleveraging as long as the blue MACD line holds above the red signal line. Key areas of interest for traders if selling pressure increases are $3,057, tested as support on Tuesday and $2,880, tested as resistance in June.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.