POPULAR ARTICLES

- Dogecoin extends its decline as risk-off sentiment dominates across the crypto market.

- DOGE’s derivatives market remains weak amid suppressed futures Open Interest and perpetual funding rate.

- The MACD indicator rises on the daily chart, signaling a potential turnaround if investors buy the dip.

Dogecoin (DOGE) is hammering on $0.13 support at the time of writing on Tuesday as overhead pressure continues to spread across the crypto market. The largest meme coin by market capitalization faces a deteriorating technical structure, weighed down by a weak derivatives market.

Dogecoin derivatives market stays silent

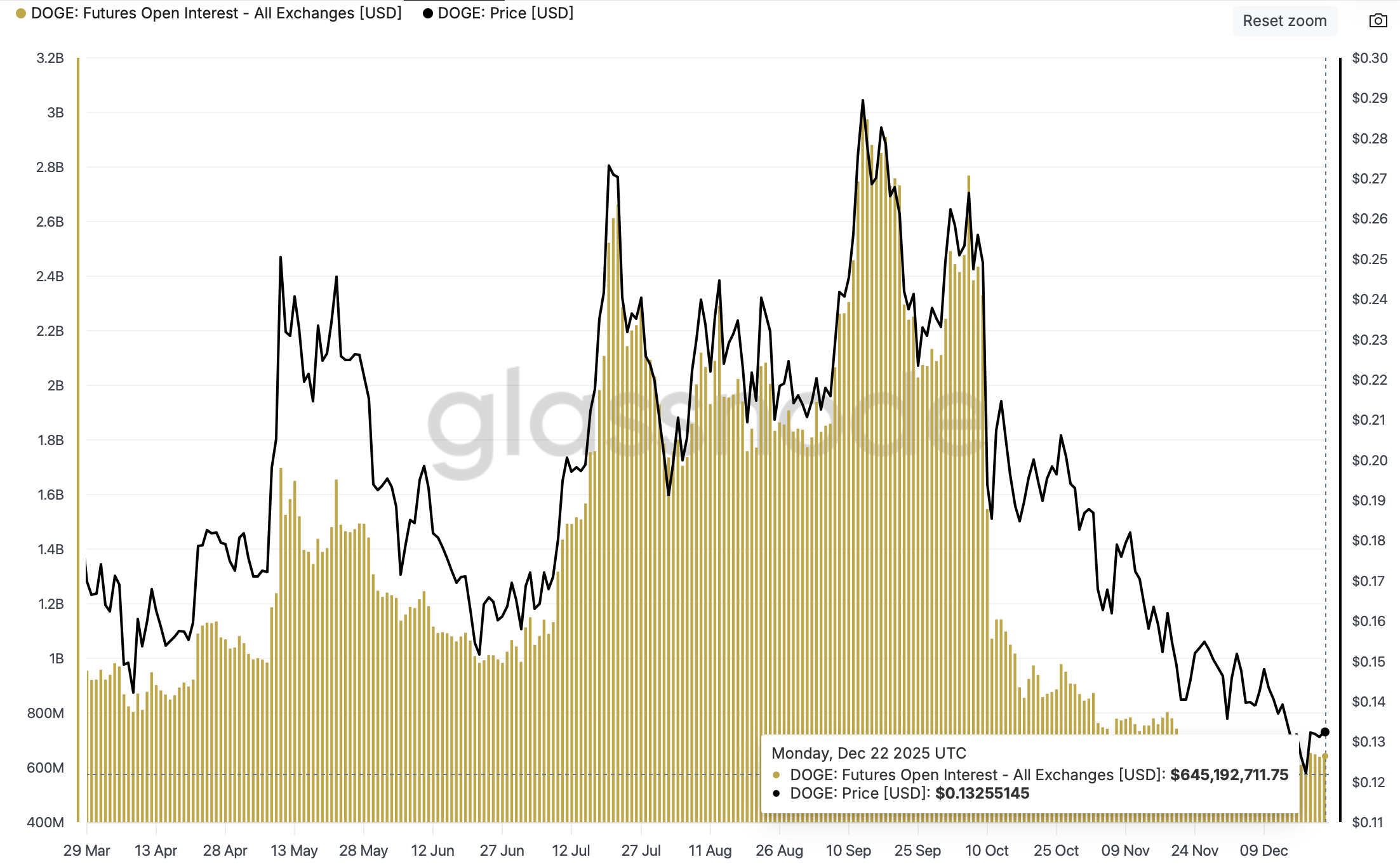

The Dogecoin derivatives market has remained significantly suppressed since the October 10 crash, which led to extensive deleveraging. According to Glassnode’s data, futures Open Interest (OI) across all exchanges stood at approximately $645,000 as of Monday, up slightly from roughly $640,000 the previous day but significantly below the $1.5 billion recorded on October 10.

Dogecoin’s OI hit a record high of approximately $3 billion on September 13, which emphasizes the significant decline in trader interest and confidence. The suppressed OI suggests that traders are unwilling to take on risk, a situation that continues to limit rebounds.

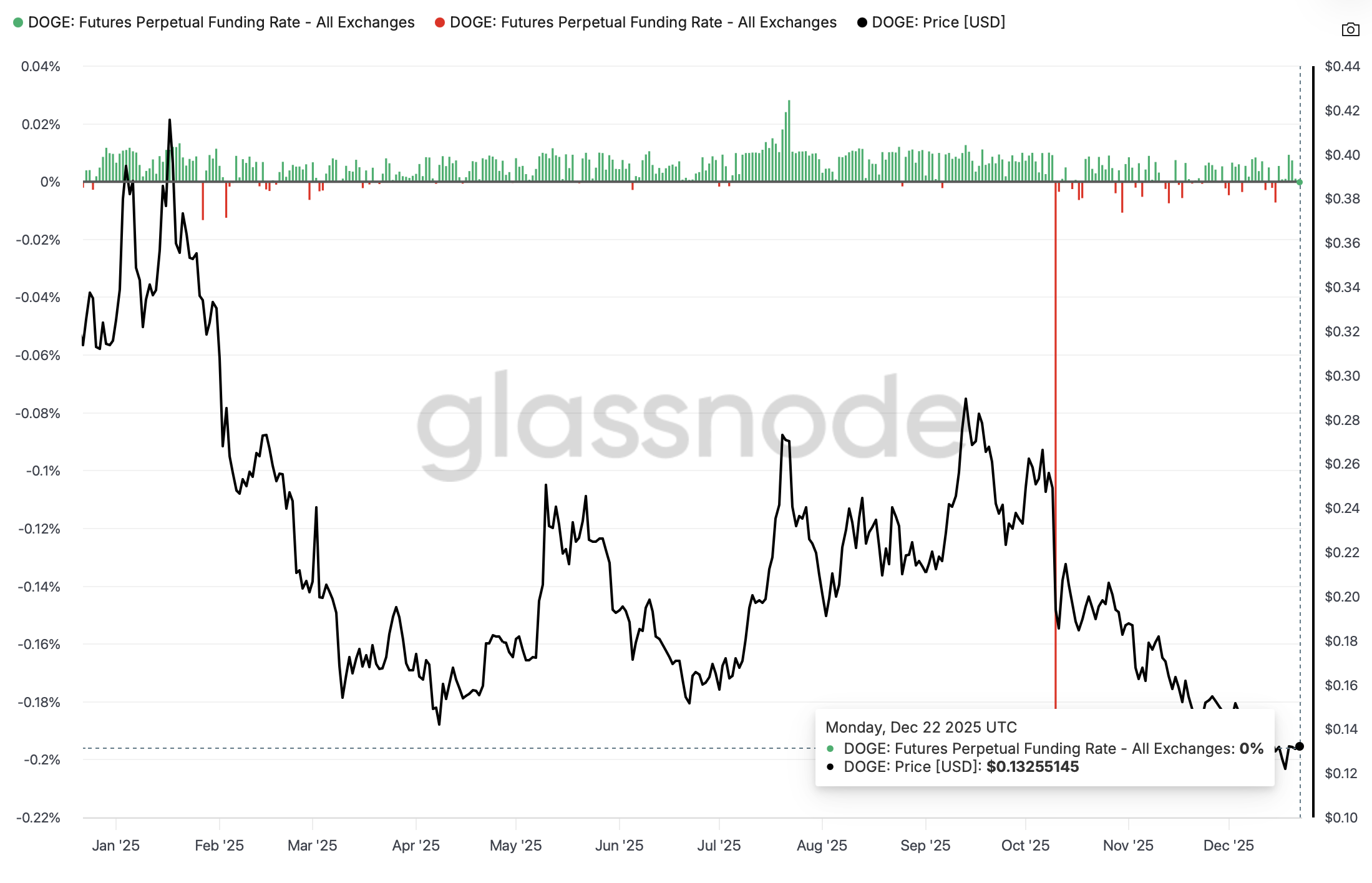

Dogecoin’s futures perpetual funding rate continues to fluctuate, depriving the meme coin of the tailwind it needs to sustain its recovery. According to Glassnode’s data, the funding rate is silent at zero as of Monday, down from 0.001% the previous day and 0.007% on Sunday.

A negative funding rate indicates that traders are piling into short positions, helping keep the price suppressed. A positive but low funding rate suggests that fewer traders are increasing exposure to the meme coin. On the other hand, a rising funding rate would support the bullish outlook and increase the odds of a steady uptrend.

Technical outlook: Dogecoin trades sideways and under pressure

Dogecoin is trading above $0.13 at the time of writing on Tuesday. The meme coin holds below the falling 50-day Exponential Moving Average (EMA) at $0.15, the 100-day EMA at $0.17 and the 200-day EMA at $0.19, all of which underscore a bearish setup.

The Relative Strength Index (RSI) stands at 41, below the midline on the daily chart, confirming restrained buying interest. If the RSI declines further toward oversold territory, the path with the least resistance would stay downward, increasing the odds of DOGE retesting support at $0.12.

Still, a bullish crossover emerges as the Moving Average Convergence Divergence (MACD) line climbs above the signal line on the same chart. The green histogram bars have turned slightly positive above the mean line, suggesting improving momentum.

However, a sustained break above $0.15 resistance could open the way toward the 100-day EMA at $0.17. Failure to reclaim that barrier would keep bears in control beneath the 200-day EMA at $0.19. Meanwhile, the Average Directional Index (ADX) at 36 continues to fade, pointing to softer trend strength and a consolidative tone until a clear break.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

(The technical analysis of this story was written with the help of an AI tool)