POPULAR ARTICLES

Ethereum price today: $4,480

- Ethereum's profit-taking activity has remained modest amid sustained accumulation from institutional and corporate investors.

- The top altcoin's open interest has failed to pick up, despite Bitcoin's reaching a new all-time high.

- ETH could decline to $4,100 if bulls fail to defend the 50-day SMA.

Ethereum (ETH) dips 4% on Tuesday despite a mild profit realization and robust demand from institutional and corporate investors.

Ethereum dips amid low profit-taking activity, institutional investors accumulate

Ethereum declines more than 4% on Tuesday, tapering gains recorded from its rise over the past week.

Despite reaching a three-week high of $4,755 before declining in the early Asian session, profit-taking has remained modest compared to previous price rises. Unwillingness to expand profit realization indicates optimism among traders for a resumption of the bullish wave.

[20-1759865869836-1759865869842.30.23, 07 Oct, 2025].png)

ETH Network Realized Profit/Loss. Source: Santiment

A similar trend is evidenced across institutional and corporate holders of ETH. Ethereum products across the globe saw combined net inflows of $1.48 billion last week, stretching their inflows in 2025 to $13.7 billion — almost triple the size of last year's total, according to CoinShares data. US spot ETH ETFs were responsible for a majority of the flows, pulling in $1.3 billion.

On Monday, the products continued their positive run, with $181.7 million in net inflows, per SoSoValue data. Notably, Grayscale became the first issuer to enable staking within its Ethereum ETFs, pledging about 32,000 ETH within the past 24 hours, per Lookonchain data.

During the same period, Ethereum treasury firm BitMine Immersion Technologies (BMNR) bought over $800 million worth of ETH. As a result, the combined holdings of ETH ETFs and treasuries focused on the top altcoin have reached 12.49 million ETH, about 10.3% of the total ETH circulation, according to the StrategicETHReserve.

On the derivatives side, Ethereum's open interest saw a mild uptick to 13.71 million ETH but remains far below its all-time high of 15.33 million ETH seen in July. In contrast, Bitcoin's open interest surged to a new high on Monday, indicating a potential rotation toward the top crypto.

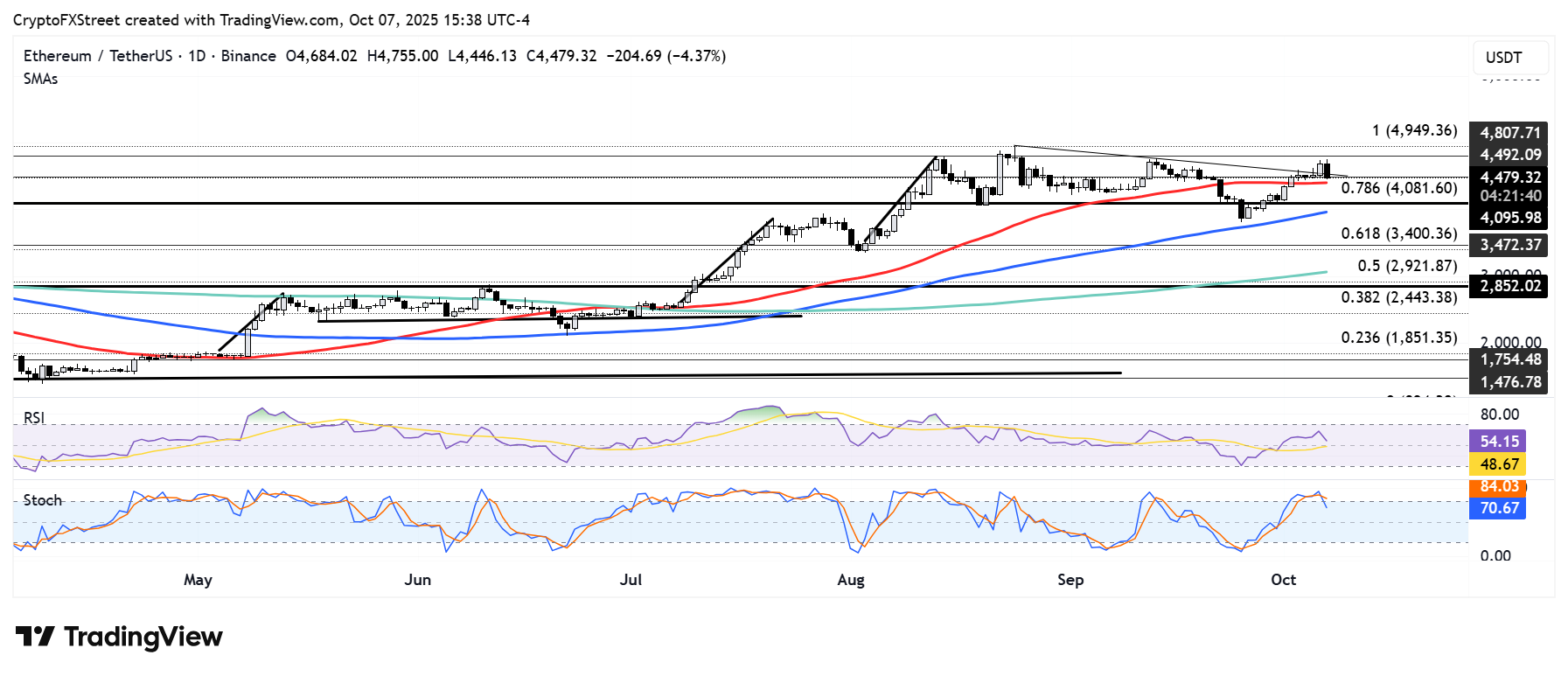

Ethereum Price Forecast: ETH drops 4%, tests 50-day SMA support

Ethereum experienced $161.1 million in futures liquidations over the past 24 hours, comprising $120 million and $41.1 million in long and short liquidations, respectively, per Coinglass data.

The spike in long liquidations follows a 4% decline in ETH, as it saw a rejection just below the $4,800 resistance — a level prices have failed to maintain a rise above since August.

ETH/USDT daily chart

ETH could decline to $4,100 if bulls fail to defend the 50-day Simple Moving Average (SMA) level. A move below $4,100 could bring the 100-day SMA in focus — a level that served as a key support during major price declines in June and September.

The Relative Strength Index (RSI) is trending downward while the Stochastic Oscillator (Stoch) has retreated from its overbought region, signaling a weakening bullish momentum.