POPULAR ARTICLES

- XRP falls for four consecutive days, moving in tandem with other crypto majors on Friday.

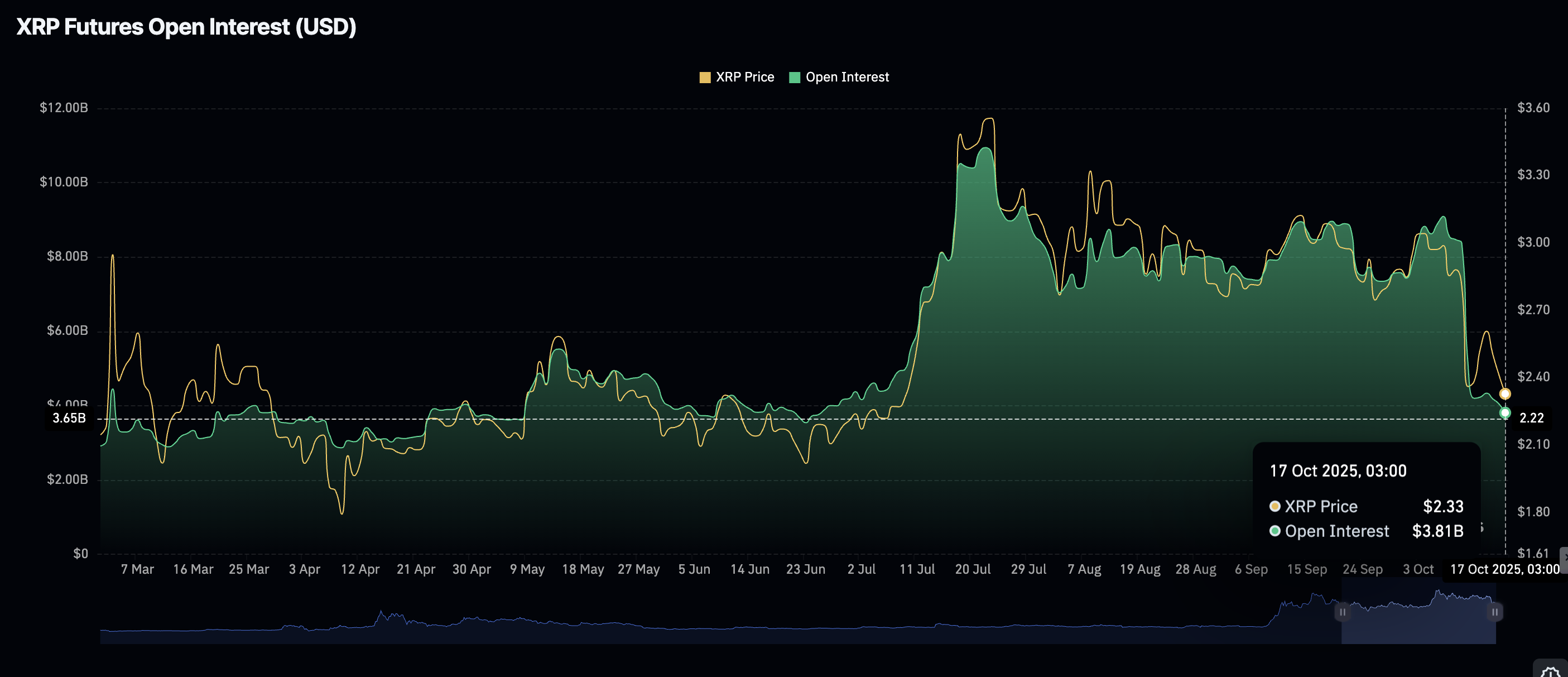

- Retail traders stay on the sidelines as the futures Open Interest dips below $4 billion for the first time since June.

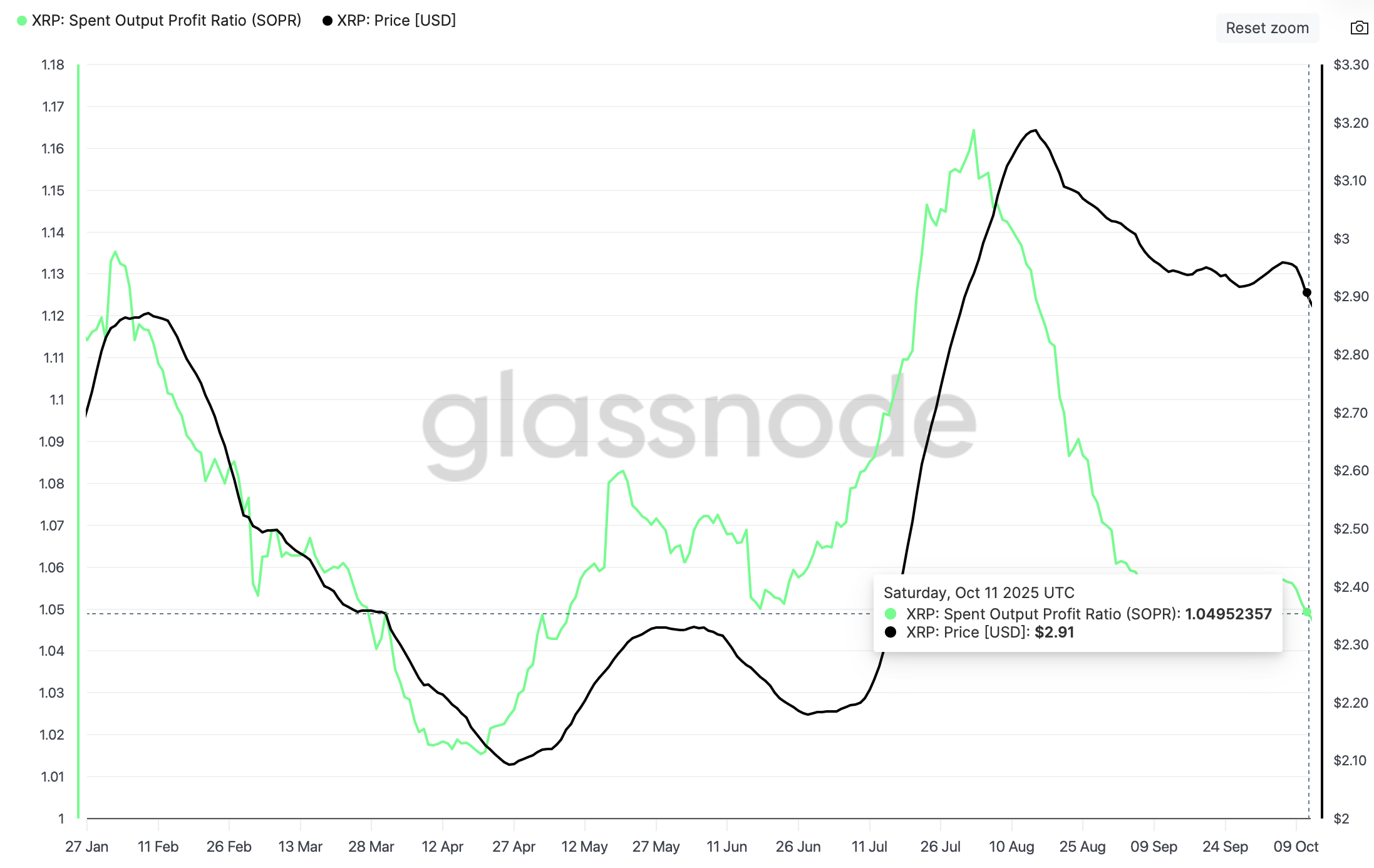

- XRP SOPR metric drops toward 1.00 as crypto market capitulation persists, likely signaling a reset.

Ripple (XRP) is struggling to hold above a key support, trading at around $2.26 on Friday. The cross-border money remittance token has deepened its correction for four consecutive days amid a sticky bearish sentiment in the broader cryptocurrency market.

Concerns over macroeconomic uncertainty due to the trade standoff between the United States (US) and China, along with the lack of price catalysts in the cryptocurrency market, are contributing factors to the sell-off.

XRP shows weakness as retail demand shrinks

The sell-off on October 10 marked the largest deleveraging event in the history of the crypto industry, with liquidations totaling $611 million in XRP longs and $90 million in related short positions.

XRP Futures Liquidations | Source: CoinGlass

According to CoinGlass data, retail demand for XRP remains suppressed, as evidenced by a massive drop in the futures Open Interest (OI), which averages $3.81 million on Friday.

The OI is a measure of the notional value of outstanding futures contracts. It peaked at $10.94 billion after XRP achieved a new record high of $3.66 in mid-July. The persistent decline in OI suggests that the pool of XRP buyers is shrinking amid increasing bearish pressure.

XRP Futures Open Interest | Source: CoinGlass

XRP’s Spent Output Profit Ratio (SOPR), an on-chain metric used to gauge whether tokens are being sold at a profit or loss, has declined to 1.04, according to CoinGlass data.

The SOPR calculates the ratio of the price at which a spent output (transaction) was acquired compared to the price at which it was spent. An SOPR value above 1.00 implies that investor are selling their assets at a profit. On the other hand, a value below 1.00 shows that holders are selling in distress or realizing losses.

When the SOPR is falling toward 1.00, it signals a reset as market capitulation continues. In other words, weak hands are exiting their positions at a break-even point or realizing losses. In the process, this rids the market of excessive selling pressure, signaling a bullish contraction signal.

XRP SOPR | Source: Glassnode

The XRP SOPR has been falling since early August, when it peaked at around 1.16. An extended correction toward 1.00 would indicate low potential selling pressure, increasing the odds of a bullish reversal as the market stabilizes without downside momentum from profit-taking.

Technical outlook: XRP bears tighten grip

XRP declines consecutively for four days, mirroring negative sentiment surrounding the cryptocurrency market on Friday. Traders appear to be leaning bearishly, evidenced by the Moving Average Convergence Divergence (MACD), which has maintained a sell signal since October 9.

The Relative Strength Index (RSI) has also dropped to 30 from highs around 57 at the beginning of this month, indicating that bearish momentum is increasing.

For now, key areas of interest for traders are the immediate $2.22 support, the next demand zone at $1.90, which was tested in June, and the buyer congestion at $1.61, which was last tested in April.

XRP/USDT daily chart

Still, a knee-jerk reversal cannot be ruled out, especially with the RSI hovering above the oversold region. If sentiment across the market improves and investors buy the dip, XRP may reverse the trend, aiming for highs above the 200-day Exponential Moving Average (EMA) at $2.62 and the confluence resistance formed by the 50-day EMA and the 100-day EMA at $2.78.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.