熱門文章

In January 2026, Alibaba Group once again became the focus of both capital markets and the tech community. According to the latest data from global AI open-source platform Hugging Face, cumulative downloads of Alibaba Cloud’s Qwen (Tongyi Qianwen) model family have now exceeded 700 million, making it the most downloaded open-source AI model series on the platform. In December 2025 alone, its monthly downloads surpassed the combined total of the models ranked from second to eighth, underscoring its influence and appeal within the global AI developer ecosystem.

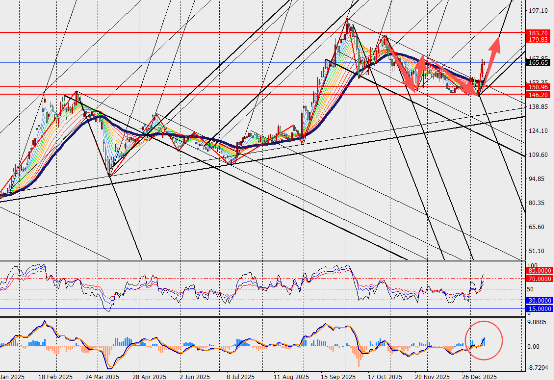

This milestone has had a clearly positive impact on market sentiment, with Alibaba’s share price posting notable gains over several trading sessions. Data shows that on 12 January, Alibaba’s US-listed ADRs saw intraday gains expand to over 7%, and the stock ended up more than 10% higher in US trading, reflecting investor recognition of the company’s AI strategy and growth outlook.

Market analysts generally believe that Alibaba’s investments in AI and cloud computing are steadily translating into tangible business momentum. JPMorgan is optimistic about Alibaba’s cloud revenue growth over the coming quarters, and expects that as generative AI workloads move from pilot projects to large-scale deployment, the company’s cloud business will continue to accelerate, helping lift its overall valuation.

At the same time, Alibaba is ramping up its efforts in China’s on-demand retail market. Its Taobao Flash Sale (Taobao Shan’gou) business made progress in the latest quarter, and company strategy has made it clear that it will continue to increase investment to win a decisive lead in market share, with the goal of achieving a “clear number-one position” in the segment. This strategy highlights Alibaba’s push to cultivate new growth engines within its core e-commerce ecosystem.

However, some analysts also point out that despite strong growth in cloud and AI, the core e-commerce business still faces competitive pressure and rising cost inputs, which are weighing on profitability. As a result, some investment banks have adjusted their target prices for Alibaba.

Market Commentary:

On the daily chart, Alibaba’s share price continues to trend higher. At the start of 2026, the company is seeing positive developments both in technological innovation and in market performance. Its leading position in global AI applications and cloud services is expected to provide a more solid foundation for its long-term growth.