熱門文章

- The Dow Jones recovered over 700 points on Friday as equities recover their footing.

- Fed officials may be leaning further toward a December interest rate cut than previously expected.

- Rumors are swirling that the Trump administration may allow Nvidia to sell Ai chips in Chinese markets.

The Dow Jones Industrial Average (DJIA) caught a healthy rebound on Friday, climbing over 700 points to round out an otherwise bearish trading week. Key Federal Reserve (Fed) officials sounded more willing to deliver an upcoming interest rate cut than rate markets previously expected, bolstering investor sentiment across the board, and the Trump administration is rumored to be weighing another walkback on arbitrary tech trade restrictions aimed at China.

Despite Friday upswing, indexes still on the defensive

Despite an upbeat Friday session, the Dow is still in the red for the week, down 1.33% from the previous week’s close and mired in defensive technical territory near the 46,000 handle. The major equity index has closed bearish for all but one of the last six straight trading days, and Friday’s upswing is pushing the Dow into a tricky technical zone that includes old support zones that may act as resistance moving forward, as well as key moving averages, which could turn into price action ceilings.

December Fed rate cut back on the table

Fed Bank of New York President John Williams stated on Friday morning that he sees a high likelihood of a “further adjustment in the near term” for interest rates, sending markets piling back into bets of a third straight interest rate cut on December 10. Divisions within the Fed’s rate-setting Federal Open Market Committee (FOMC) have widened in recent months, giving traders a wide array of policy opinions to focus on. According to the CME’s FedWatch Tool, rate markets are now pricing in a 70% chance of a third consecutive quarter-point rate trim on December 10, versus the roughly 40% odds that were on the tape as recently as Thursday afternoon.

The Trump administration has hit a steady stream of trade policy walkbacks and tariff cancellations over the past week, and the trade war cancellation train is beginning to gather steam. According to fresh rumors, the Trump team is weighing walking back its decision to restrict the sale of AI-focused chipsets to China. The move, if it goes through, would allow AI darling Nvidia (NVDA) to continue selling even more shovels during the LLM gold rush. The alleged topic on the table is Nvidia’s H200-series GPUs, which typically sell for around $30,000 and make up a growing bulk of Nvidia’s unsold product inventory, which has swelled rapidly over the past quarter.

Consumers tilt back toward hope

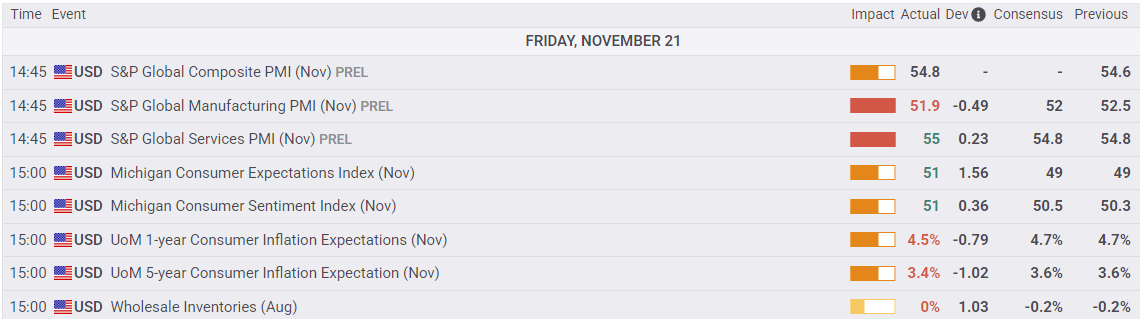

University of Michigan (UoM) consumer sentiment survey results also came in better than expected, further bolstering investor sentiment to wrap up an overwhelmingly fearful week in markets. The UoM Consumer Sentiment and Expectations Indexes both rose more than expected for November, and 1-year and 5-year Consumer Inflation Expectations also eased lower.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.