POPULAR ARTICLES

On 11 December, the Federal Reserve voted 9–3 to cut the benchmark interest rate by 25 basis points to 3.50%–3.75%, marking a third consecutive rate cut. Spot gold broke above the 2,200 level (USD 4,200 in the article’s ounce-based setup), and after stabilising above that mark, continued trading above 4,220 dollars per ounce.

During the press conference, Powell repeatedly stressed that the US economy is not running hot. Overall, it is still expanding steadily at a moderate pace, with no signs of overheating.

Looking at the core growth drivers, consumer spending has shown very strong resilience and has become a key pillar supporting the economic backdrop. At the same time, corporate fixed investment — especially capex related to AI data centres — continues to grow rapidly and has become a new engine of economic growth.

Regarding the upward revision of the 2026 GDP growth forecast, Powell clearly explained that it is the result of three factors working together:

- After the end of the government shutdown, previously suppressed economic activity experienced a natural rebound;

- The AI investment boom continues to ferment, with investment scale expanding across the related industrial chain;

- Fiscal policy continues to provide strong support, injecting stable momentum into economic growth.

In addition, Powell specifically pointed out that current US productivity is at a structurally high level not seen for many years. The positive supply shock brought by AI technology is gradually emerging, which will lay a solid foundation for long-term economic growth.

Overall, this Fed decision strikes a balance between easing and caution, emphasising data dependence rather than a preset policy path. Against a backdrop of still-elevated inflation and a stable labour market, the signal of only one rate cut in 2026 may be conservative, but it nonetheless injects confidence into the market.

A deterioration in the labour market is a clear precursor to recession. Therefore, the rise in gold prices in 2025 driven by rate-cut expectations is intrinsically linked to these increasingly heated recession concerns.

Market Commentary:

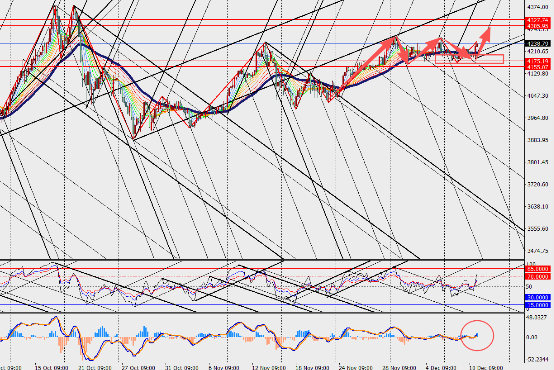

On the 4-hour chart, gold has broken out to the upside, with MACD lines and histogram expanding further near the zero line. Looking ahead, as more data are released and potential geopolitical factors come into play, the Fed’s policy path remains highly uncertain. Gold has become a prime choice for investors seeking to diversify risk. The market will need to closely monitor gold price action in order to capture potential swings arising from global economic volatility.