According to people familiar with the matter, HSBC’s Global Head of Metals Trading and its Head of Precious-Metals Financing for Europe, the Middle East and Africa will join the crypto firm in the coming months.

In recent years, Tether has been expanding aggressively in precious metals, amassing one of the world’s largest gold reserves not held by a bank or a sovereign state. These holdings form part of its more than $180 billion in reserve assets.

HSBC is a heavyweight in precious metals—widely viewed as the sector’s leader after JPMorgan—with businesses spanning futures trading, bullion vaulting, and global bar logistics.

As talent competition intensifies, the departures are a blow to HSBC’s metals franchise. This year, gold has delivered its best annual performance since 1979, repeatedly setting new records. Trading houses, hedge funds, and banks are all expanding their precious-metals teams.

Tether’s flagship U.S. dollar stablecoin (USDT) includes gold within its reserve assets. Its latest reserve report shows that, as of September, the company held more than $12 billion worth of gold.

Bloomberg’s calculations indicate that over the year through September, the El Salvador-based company added, on average, more than one ton of gold per week. That makes Tether one of the largest buyers in the market. The tally does not include gold backing for its gold stablecoin (XAUT), nor private gold investments financed by Tether’s multibillion-dollar profits.

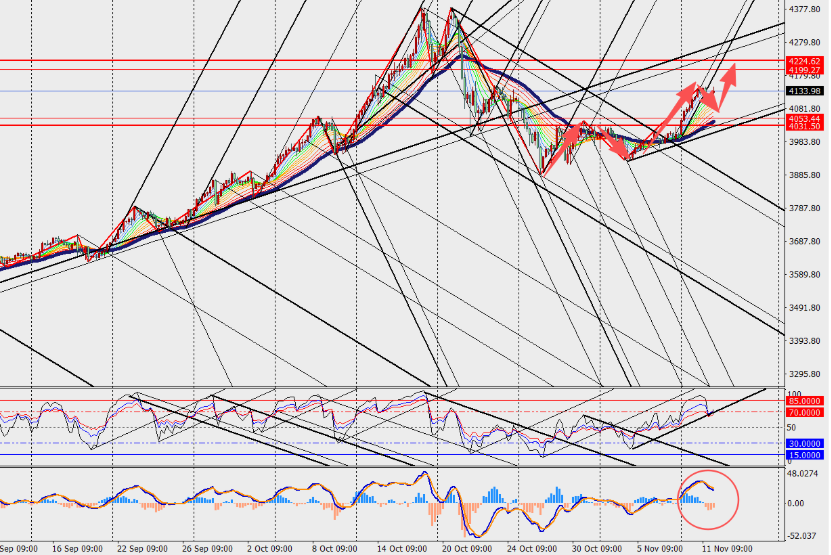

Market commentary:

On the 4-hour chart, gold is grinding higher in a range, with MACD lines and histogram converging above the zero line. The upside in gold has been supported by steady central-bank buying and trend-following inflows. Investors, worried that sovereign debt and the currencies it’s denominated in may erode in value over time, are gradually rotating out of those assets and into gold as a replacement.