POPULAR ARTICLES

- Dogecoin extends the uptrend to $0.2000 and declines slightly afterwards amid strong interest from retail investors.

- Prices of meme coins collectively surged more than 12% over the past 24 hours, outperforming smart contracts platform and Layer-1 protocols.

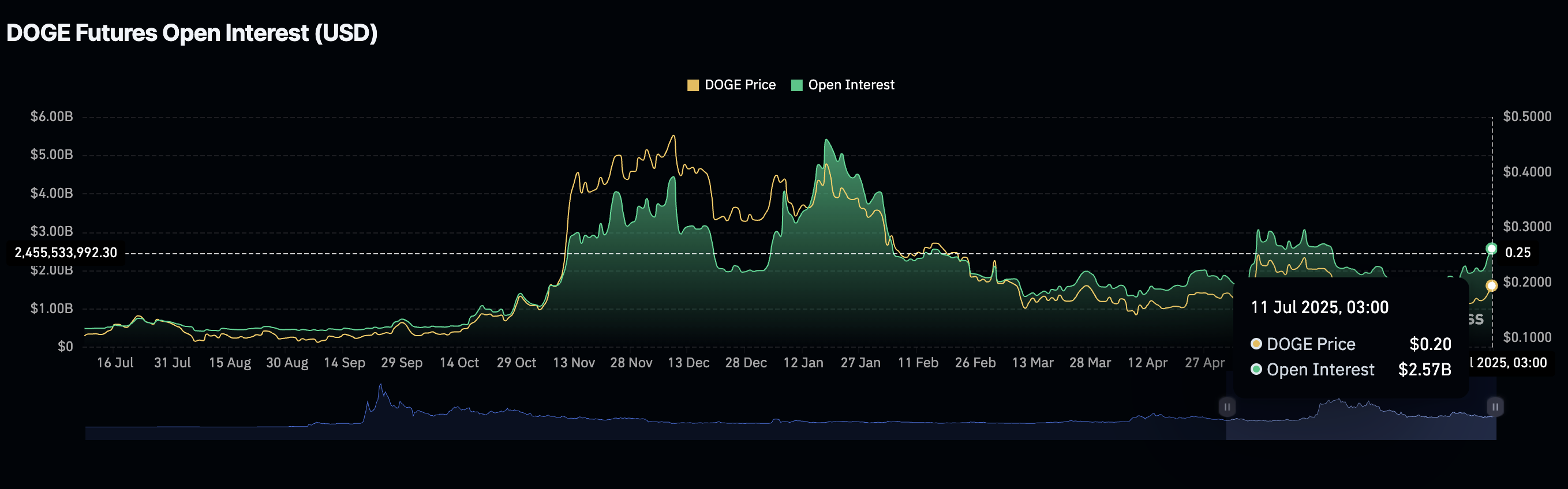

- Dogecoin derivatives market Open Interest increases to $2.65 billion alongside the rise in trading volume to $7.20 billion.

Dogecoin (DOGE) is rising alongside other major cryptocurrencies to trade at around $0.1990 on Friday. Interest in the largest meme coin is at an elevated level, approaching the highs seen in May, when DOGE rallied to $0.2597. This is evidenced by the steady rise in the futures contracts of Open Interest (OI), indicating heightened risk-on sentiment.

Dogecoin rallies as meme coins outperform

The meme coin sector is rapidly accelerating gains and outperforming other major categories, including smart contracts platforms and Layer-1 protocols. According to CoinGecko data, meme coins have collectively surged more than 12% over the past 24 hours, bringing their total market capitalization to approximately $71 billion.

Protocols in the smart contracts platform category edged higher but accrued an average of 6.2% gains in the same period, with a total market capitalization of $3.2 trillion. As for Layer-1 tokens, the price increase in the last 24 hours stands at 6.1%, while their market share holds slightly above $3.1 trillion.

Interest in meme coins could continue to grow as investors diversify their portfolios or consider capital rotation from Bitcoin (BTC) after it hit a new all-time high of $118,869 earlier on Friday.

The Dogecoin futures Open Interest, which represents the value of all the futures and options contracts that have not been settled or closed, stands at $2.57 billion, per CoinGlass data.

Traders have, since the drop to $1.7 billion on July 2, increased their appetite for DOGE, reflected by the surge in the derivatives market volume to $7.2 billion.

Dogecoin futures data | Source: CoinGlass

The increase in price to $0.2000 has also left many short-positioned traders counting losses. According to the chart below, a total of $13 million in liquidations occurred in the last 24 hours, with $10 million wiped out in short positions compared to roughly $3 million in longs. With the long-to-short ratio now above 1.0000, Dogecoin could extend the uptrend backed by a robust tailwind and trader confidence.

Dogecoin derivatives market data | Source: CoinGlass

Technical outlook: Dogecoin nurtures key bullish signals

Dogecoin price is trading slightly below the critical resistance level at $0.2000, with its uptrend bolstered by rising trader interest and risk-on sentiment in the broader cryptocurrency market.

The meme coin offers a bullish outlook, with its current position elevated significantly above the upward-trending moving averages. For instance, the 200-day Exponential Moving Average (EMA) is currently at $0.1818, the 100-day EMA at $0.1748, and the 50-day EMA at $0.1725, which back the uptrend but could also serve as tentative support areas to absorb selling pressure if Dogecoin pulls back, possibly due to profit taking.

DOGE/USDT daily chart

The path of least resistance is currently upward, with bulls looking forward to a daily close above $0.2000. Bullish momentum is still intact, with the Relative Strength Index (RSI) facing north at 80. However, due to overbought conditions, traders may temper expectations and prepare for potential pullbacks in upcoming sessions.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.