POPULAR ARTICLES

Ethereum price today: $2,960

- Ethereum weekly active addresses have declined by 116K in December.

- Declining Coinbase premiums and outflows in spot ETH ETFs show rising selling pressure from US-based investors.

- ETH bounced off $2,850, but its technical indicators show bearish momentum continues to dominate market activity.

Ethereum (ETH) weekly active addresses have plunged sharply in December, declining from 440K to 324K, levels last visited in May. The decline in active addresses has also pushed down the number of transactions on the network to July lows.

A sustained decline in active addresses and transaction count implies investors are moving to the sidelines. The absence of demand could cause prices to decline or move sideways until network activity picks up again.

-1765941211786-1765941211788.png)

This is visible across US spot Ethereum exchange-traded funds (ETFs), which posted a third consecutive day of net outflows worth $224.78 million, per SoSoValue data. Since December 10, the total net assets of the products have plunged from $21.43 billion to $18.27 billion.

Meanwhile, US selling returned to dominate market activity after the Coinbase Premium Index crossed into negative territory. The index falls below 0 when ETH's price on Coinbase is lower than on Binance, and vice versa when Coinbase's price is higher.

-1765941238498-1765941238500.png)

The move follows a strong job market report, where the unemployment rate hit 4.6%, its highest level since 2021.

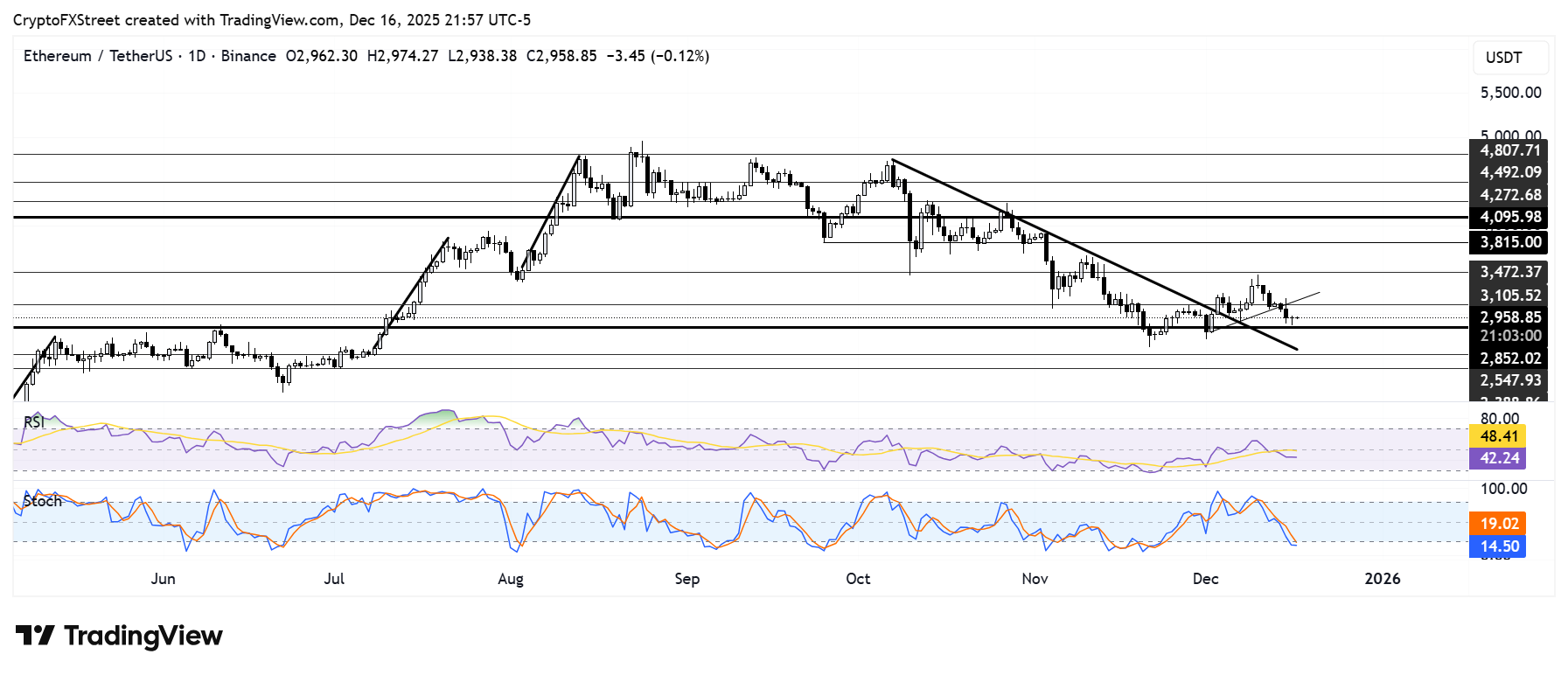

Ethereum Price Forecast: ETH bounces near $2,850, but bearish pressure persists

Ethereum recorded $104.9 million in liquidations over the past 24 hours, led by $73.6 million in long liquidations, according to Coinglass data.

ETH bounced off the $2,850 support level and could retest $3,100, but bearish momentum remains dominant.

The Relative Strength Index (RSI) continues to trend downward below its neutral level, while the Stochastic Oscillator (Stoch) has crossed into the oversold region. Oversold conditions in the Stoch could spark a short-term reversal.

As a result, ETH could target $3,470 if it rises above $3,100. On the downside, the top altcoin could fall toward the support range around $2,400-$2,600 if it breaches $2,850.