POPULAR ARTICLES

- Ethereum price rebounds after retesting its daily support at $3,730, keeping intact the chances to reach $4,000.

- On-chain data shows that ETH whale wallets continue to accumulate ETH tokens, while exchange reserves hit a 9-year low.

- Ether Machine announced on Ethereum's 10th birthday that its subsidiary has purchased nearly 15,000 ETH.

Ethereum (ETH) marked its 10th anniversary this week with growing signs of bullish momentum, trading above $3,800 at the time of writing after bouncing off a key support level the previous day.

On-chain data shows a steady accumulation of ETH tokens by whale wallets during July, while exchange reserves have dropped to a 9-year low. This supply crunch, combined with the rising institutional and corporate interest, could set the stage for a breakout toward $4,000.

The Ether Machine adds 15,000 ETH

The Ether Machine, the ether generation company, announced on Wednesday that on Ethereum's 10-year anniversary, its subsidiary, The Ether Reserve LLC, purchased nearly 15,000 ETH at an average price of $3,809.9, totaling $56 million.

This purchase is a part of The Ether Machine's long-term accumulation strategy, bringing the total to 334,757 ETH. The firm said it still has up to $407 million available for additional ETH purchases.

"We couldn't imagine a better way to commemorate Ethereum's 10th birthday than by deepening our commitment to ether," said Andrew Keys, Chairman and Co-Founder of The Ether Machine, in a press release.

"We are just getting started. Our mandate is to accumulate, compound, and support ETH for the long term – not just as a financial asset, but as the backbone of a new internet economy," he added.

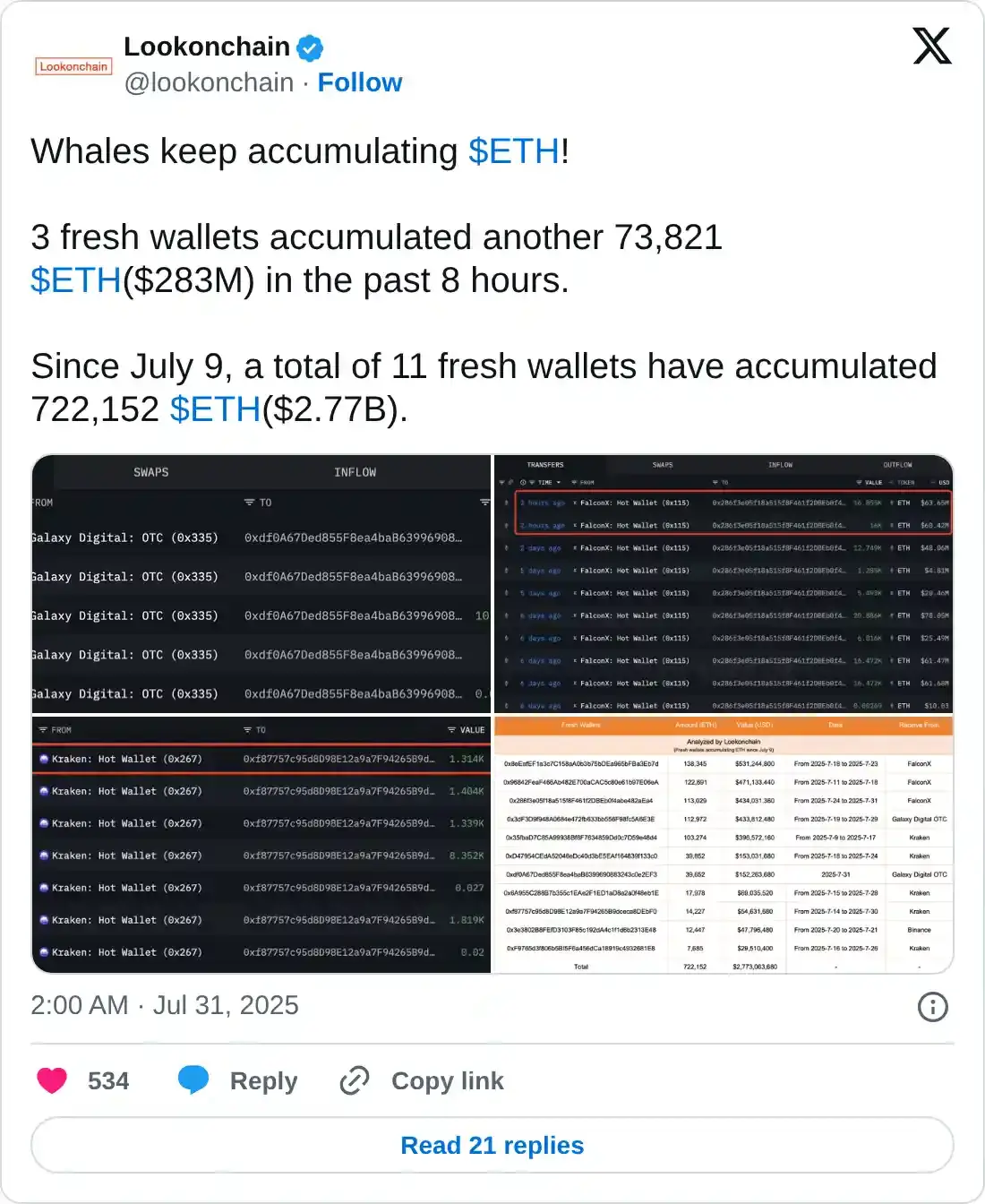

Whales are accumulating ETH tokens

Lookonchain data shows that whale wallets are accumulating ETH tokens. The data shows that three fresh wallets have added another 73,821 ETH worth $283 million in the past 8 hours. Since July 9, a total of 11 new wallets have accumulated 722,152 ETH worth $2.77 billion.

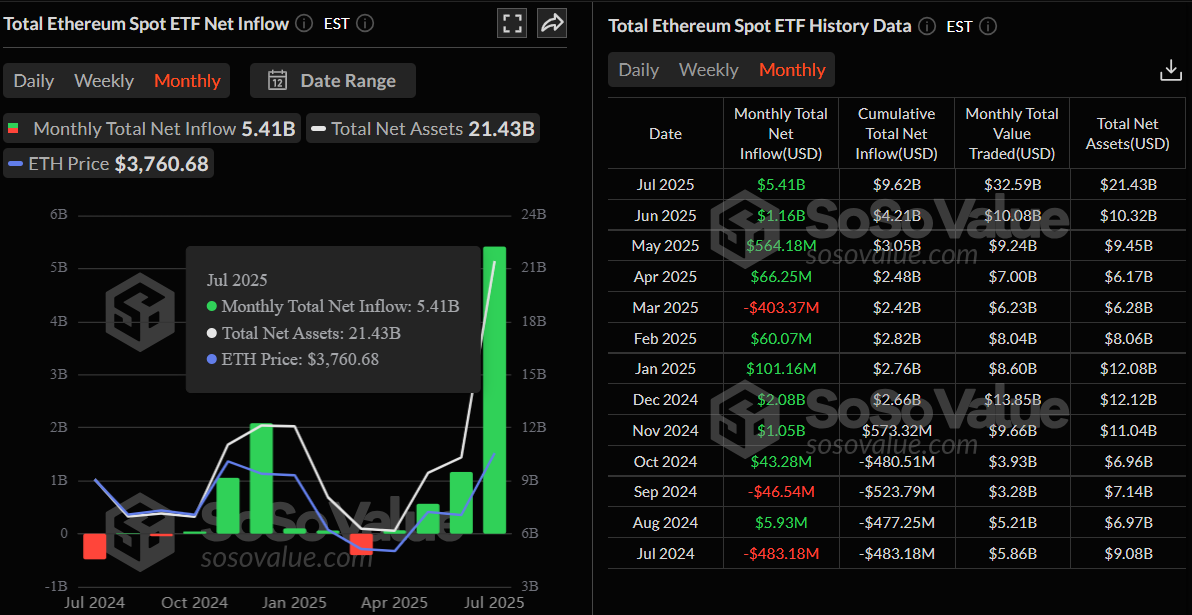

Institutional demand is also rising, albeit by less than earlier in July. According to the SoSoValue data, US spot Ethereum Exchange Traded Funds (ETFs) recorded a mild inflow of $5.79 million on Wednesday, continuing its streak of positive flows since July 3. So far in July, the monthly flows have reached $5.14 billion, the highest level since their launch.

Total Ethereum spot ETF net inflow daily chart. Source: SoSoValue

Total Ethereum spot ETF net inflow monthly chart. Source: SoSoValue

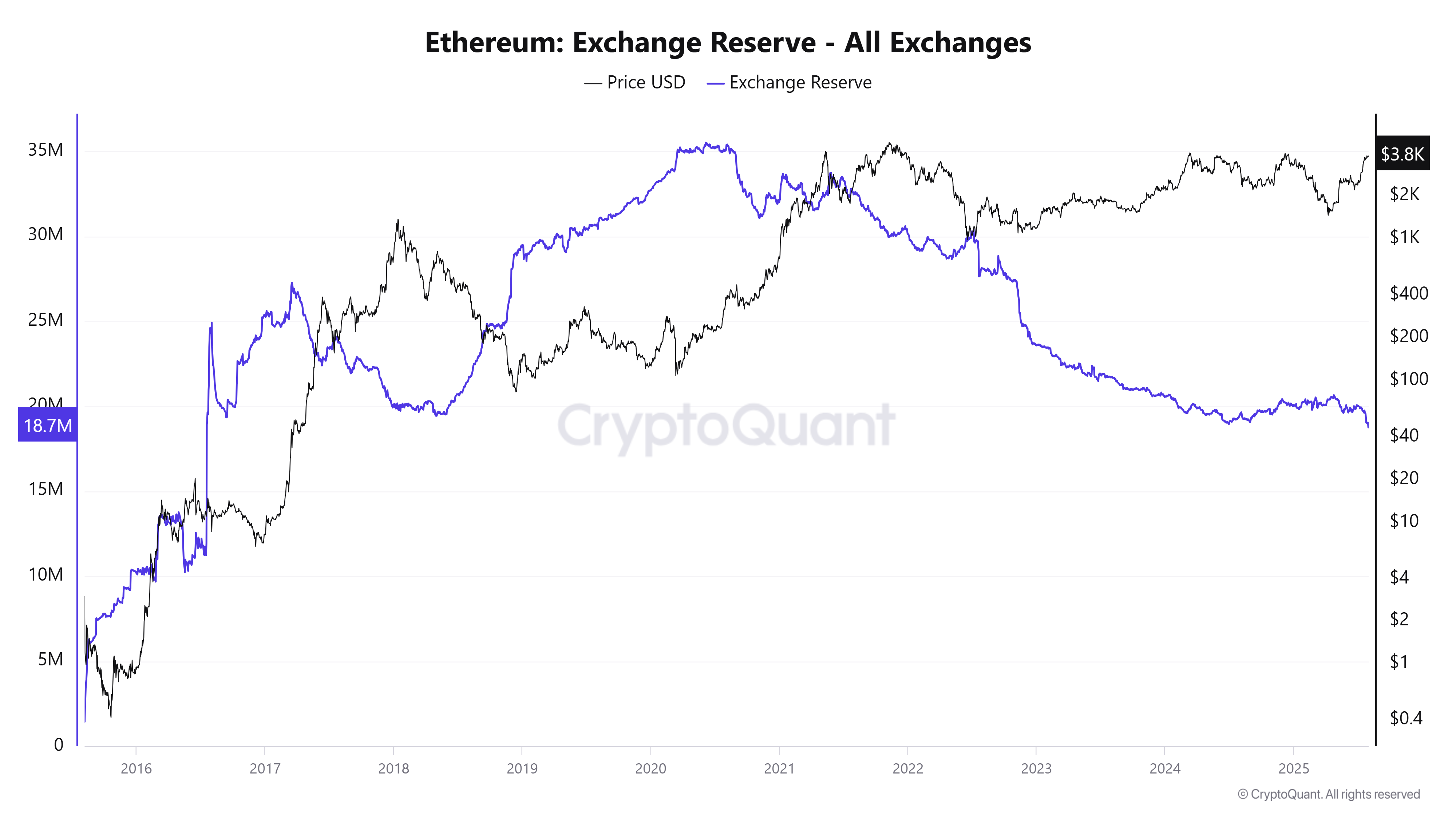

Ethereum exchange reserve drops to a 9-year low

CryptoQuant data indicate that the ETH reserves in exchanges have dropped to 18.7 million as of Thursday, extending the decline seen since early July 2024. Reserves have reached its lowest level since 2016, indicating lower selling pressure from investors and a reduced supply available for trading.

A drop in reserve also signals an increasing scarcity of coins, an occurrence typically associated with bullish market movements.

Ethereum Exchange Reserve– All Exchanges chart. Source: CryptoQuant

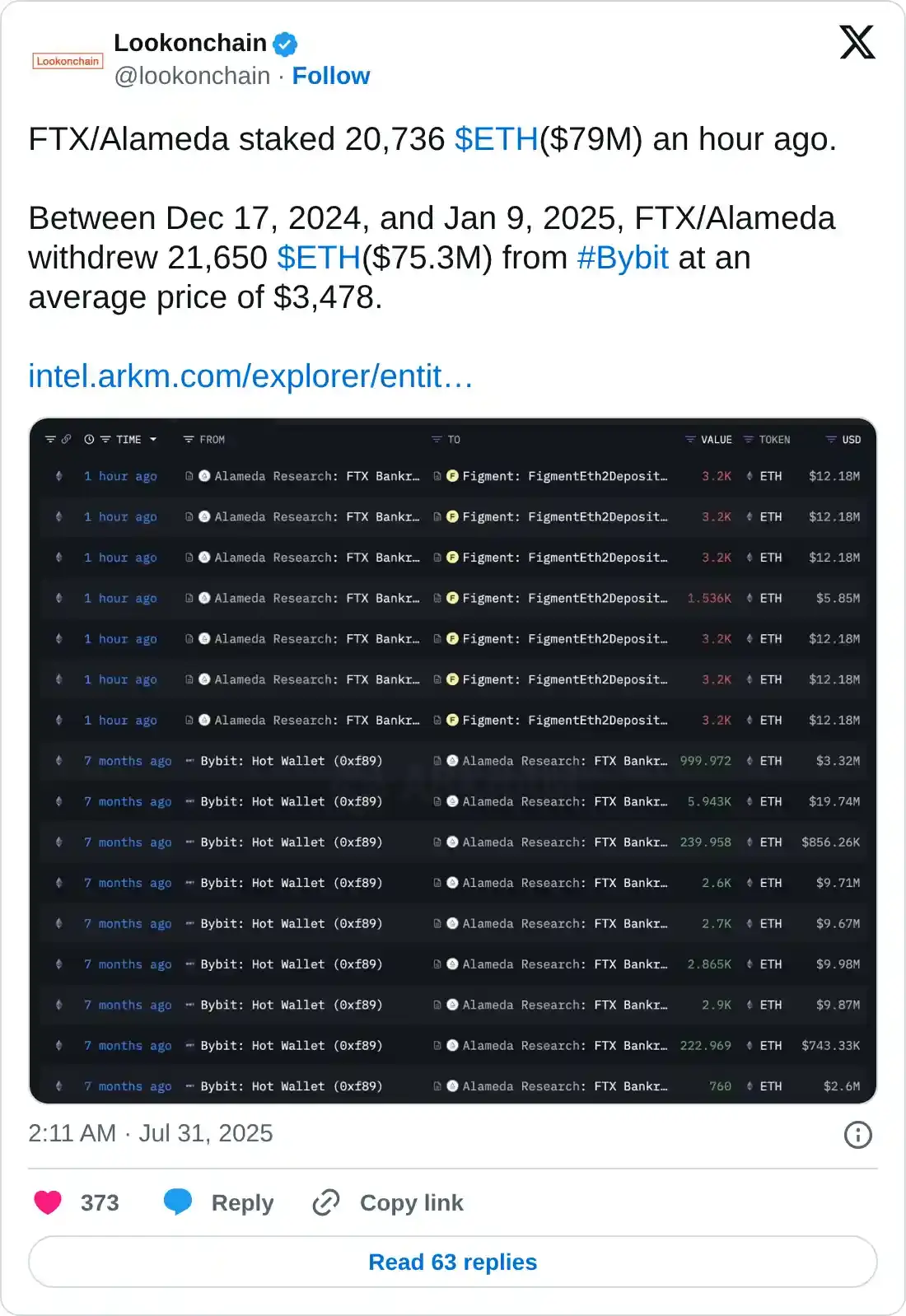

Apart from the falling exchange reserve, Lookonchain data shows that FTX/Alameda has staked 20,736 ETH worth $79 million on Thursday. From mid-December to early January, FTX/Alameda withdrew 21,650 ETH from the Bybit exchange, thereby reducing selling pressure and increasing the scarcity of coins.

Ethereum Price Forecast: ETH bulls aiming for levels above $4,000

Ethereum price faced rejection just below its $4,000 psychological level on Monday and declined slightly to find support around the daily level at $3,730 the next day. On Wednesday, ETH rebounded after retesting this support level. At the time of writing on Thursday, it continues to recover, trading above $3,800.

If the daily support at $3,730 holds, ETH could continue its upward momentum targeting its key psychological level of $4,000. A close above this level could extend additional gains toward the December 9, 2021, high of $4,488.

The Relative Strength Index (RSI) indicator on the daily chart reads 77, above its overbought level of 70. Traders should keep a watch as the Moving Average Convergence Divergence (MACD) showed a bearish crossover on Wednesday, suggesting early signs of bearish momentum and a potential downward trend ahead.

ETH/USDT daily chart

If ETH faces a correction and closes below the daily support at $3,730, it could extend the decline to the next support at $3,500.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.