POPULAR ARTICLES

Ethereum price today: $3,820

- The Ethereum Coinbase Premium Index and ETF flows indicate that demand from US investors has weakened.

- The futures market also shows reduced US exposure, as evidenced by compressed CME Futures annualized basis.

- ETH could decline to the $3,470 support if it moves below $3,700.

US investors have consistently scaled down demand for Ethereum (ETH) over the past few days, with the decline visible across the spot and derivatives markets.

The Ethereum Coinbase Premium Index plunged into negative territory for the first time since September 9 on Thursday, reaching -2.8%, according to CryptoQuant data. The decline shows that ETH is trading lower on Coinbase than on most crypto exchanges, indicating a slowdown in spot demand from US investors.

-1761934649080-1761934649087.png)

ETH Coinbase Premium. Source: CryptoQuant

A similar picture is evident across US spot ETH exchange-traded funds (ETFs), which have recorded net outflows of 158,374 ETH since October 8, according to Coinglass data. On Thursday, the products logged net outflows of $184.2 million, with the largest distribution coming from BlackRock's iShares Ethereum Trust (ETHA).

Investors in the US ETH futures market have also been reducing exposure or gradually turning bearish, as indicated by a declining ETH CME Futures annualized basis for contracts with six months and above expiry.

The metric dropped to 3.0% on Wednesday, marking one of its second-lowest levels since July 29.

-1761934785940-1761934785941.png)

ETH CME Futures Annualized Basis. Source: CryptoQuant

The reduced enthusiasm from US institutions and retail investors alike indicates that the "current phase reflects profit-taking and cautious positioning rather than renewed accumulation," CryptoQuant analysts noted in a Wednesday report.

The drop in US demand follows the Federal Reserve's (Fed) hawkish tone at its October meeting on Wednesday, despite cutting rates by 25 basis points (bps).

ETH shows mild signs of returning accumulation

Despite that, Ethereum whales — wallets with a balance of 10K-100K ETH — resumed accumulation after scaling down their holdings last week, adding over 210K ETH between Sunday and Thursday.

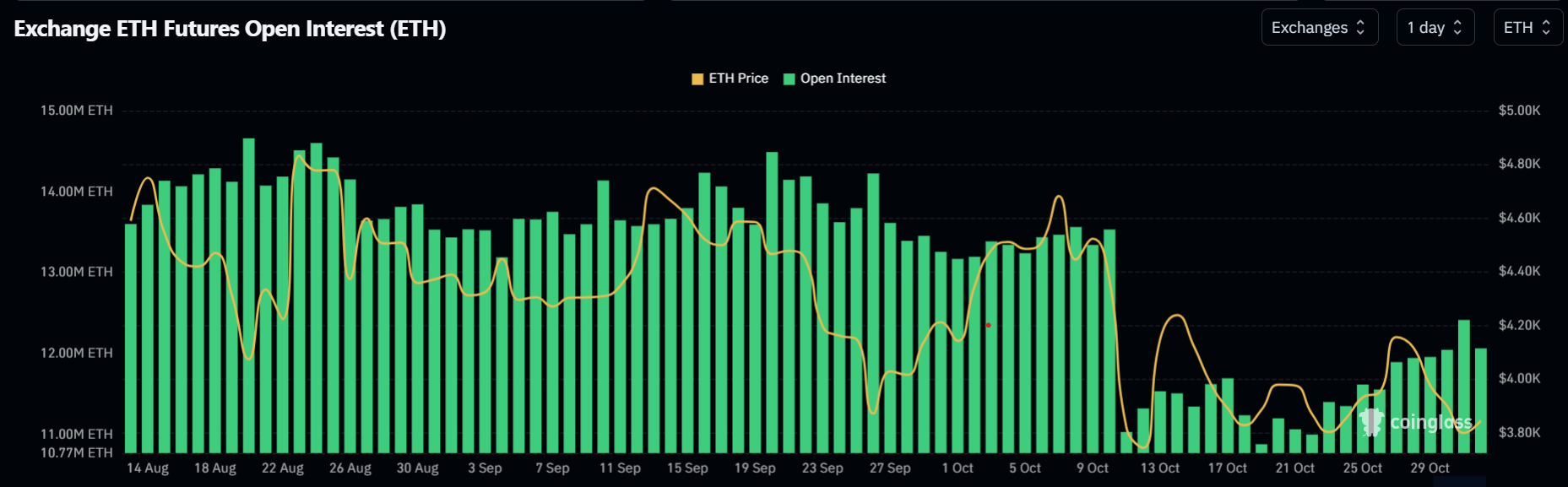

Ethereum open interest across global exchanges also recovered slightly, rising from last week's low of 11 million ETH to 12.4 million ETH on Thursday before a slight decline on Friday. Open interest is the total value of unsettled contracts in a derivatives market.

ETH Open Interest. Source: Coinglass

Meanwhile, Bernstein analysts predicted in a Thursday note that ETH's value will grow alongside the economic assets secured on its chain, while noting that it should be valued as a reserve asset of the Ethereum network.

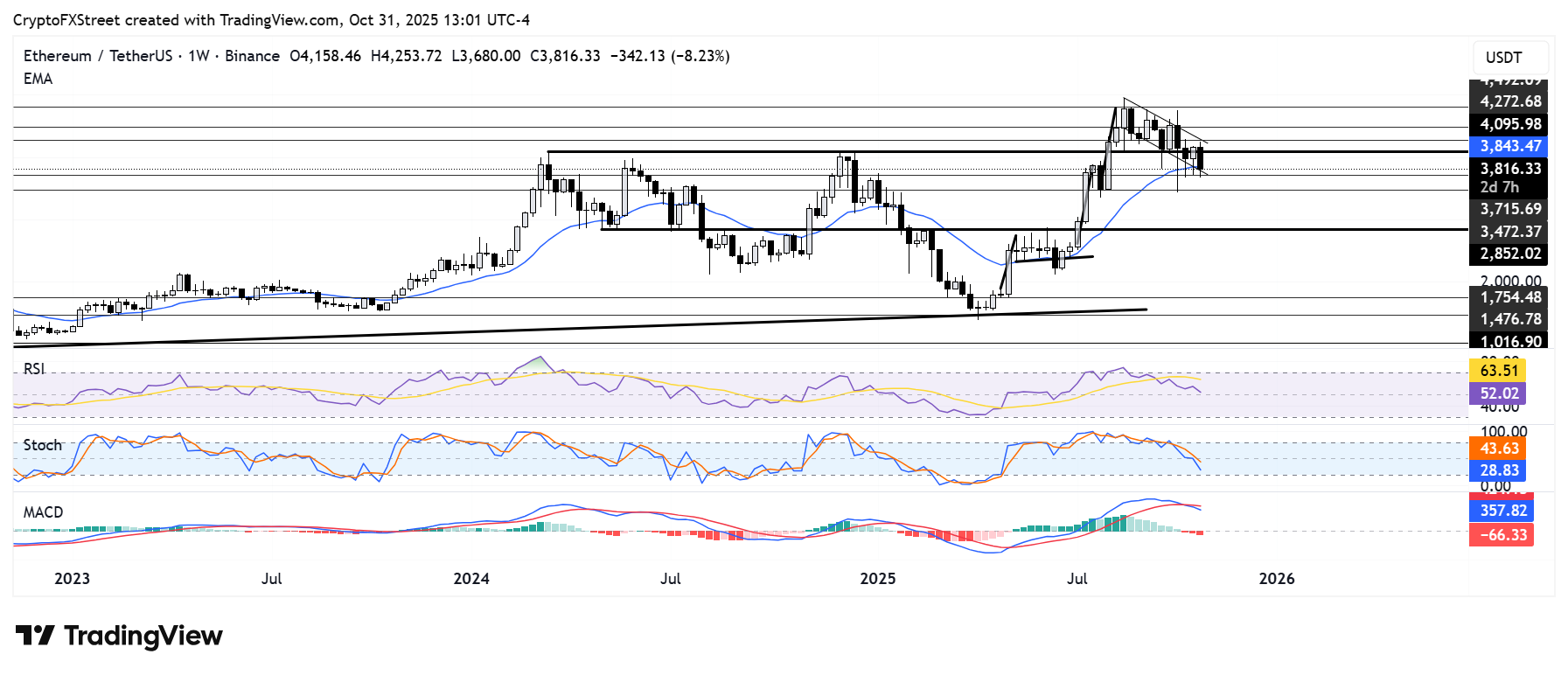

Ethereum Price Forecast: ETH could decline to $3,470

Ethereum recorded $126.3 million in liquidations over the past 24 hours, led by $99.5 million in long liquidations, according to Coinglass data.

On the weekly chart, ETH is trading within a descending channel after hitting the support near $3,700. The top altcoin risks a decline to $3,470 if it falls below $3,700. Further down is the historic support level near $2,850.

ETH/USDT weekly chart

On the upside, ETH has to overcome the upper boundary of the descending channel to test the $4,800 key resistance level.

The Relative Strength Index (RSI) is trending downwards while the Moving Average Convergence Divergence (MACD) histograms are below their neutral levels. This indicates a dominant bearish momentum.