BELIEBTE ARTIKEL

Spot silver remains firmly bid, with the latest surge driven primarily by a macro repricing triggered by renewed tariff uncertainty. If no agreement is reached on the Greenland issue, the United States may impose a 10% tariff from 1 February on imports from several European countries, including the United Kingdom, France and Germany. If the situation remains unresolved, tariffs could be raised to 25% from 1 June.

Such “front-loaded tariff path with back-loaded conditions” rhetoric tends to quickly amplify market concerns over a combination of sticky inflation and growth headwinds, thereby strengthening the defensive appeal of precious metals.

From a trading perspective, silver carries a dual nature as both a precious and an industrial metal. When macro uncertainty rises, safe-haven and inflation-hedging demand first pushes up the precious-metal premium. But as policy expectations swing back and forth, silver’s higher volatility often results in sharper pullbacks and renewed spikes.

Markets are also watching for a possible re-emergence of the so-called “TACO trade,” where tough talk initially drives risk premia higher, only for prices to give back part of the gains once the tone softens or signs of de-escalation emerge. Looking ahead, whether silver can turn its record highs into a new trading base will depend less on a single data point and more on whether tariff-related rhetoric continues to escalate or starts to show clear signs of cooling.

In the near term, attention will focus on US ADP employment data, initial jobless claims and the US composite PMI flash reading. Stronger-than-expected labour and activity data could lift rate expectations and suppress the sentiment premium in precious metals; weaker-than-expected numbers would more easily reinforce the “slowing growth” narrative and support defensive buying in silver.

When tariff rhetoric is choppy, timelines are explicit but conditions are uncertain, markets typically price in tail-risk scenarios with a higher risk premium first, to the benefit of precious metals. At the same time, silver’s sentiment elasticity is much greater: any sign of de-escalation can trigger rapid profit-taking by momentum chasers and leveraged short-term players, leading to swift pullbacks; conversely, if hawkish rhetoric intensifies, short covering and trend-following flows can again push prices higher.

Market Commentary:

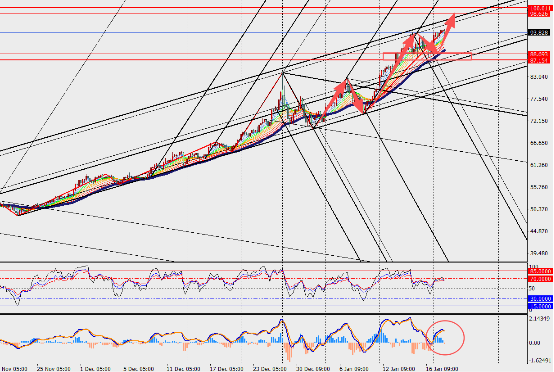

On the 4-hour chart, spot silver is in a clear uptrend, consistently printing higher highs and higher lows in a textbook trend-continuation pattern. The USD 94 level is the most important near-term resistance. If prices break above it on strong volume and hold, the move could enter an acceleration phase, with volatility rising in tandem.