How to Choose the Right Broker for CFD Trading

Choosing the right CFD broker requires evaluating regulatory compliance, fee structures, and execution quality. To find the best fit, prioritize brokers licensed by Tier-1 authorities (like the FCA or ASIC), check for "hidden" costs like overnight swap rates, and ensure the platform offers Guaranteed Stop Loss Orders (GSLO) to manage volatility risks effectively.

Key Takeaways

Tier-1 Regulation is Essential: Ensure the broker is licensed by a major authority (FCA, ASIC, CySEC) to guarantee segregated client funds and negative balance protection.

Look Beyond Spreads: Evaluate total trading costs, including overnight financing (swap rates) and inactivity fees, which erode long-term profits.

Risk Management Tools: Prioritize brokers offering Guaranteed Stop Loss Orders (GSLO) to prevent slippage during market gaps.

Market Depth: Verify the broker offers the specific assets you need (e.g., specific Crypto pairs or ETFs) with competitive leverage caps.

Regulation & Security

Security is the non-negotiable starting point. While many brokers claim to be "regulated," the quality of that regulation dictates the safety of your capital so always choose a Tier-1 cfd broker that offers the below features.

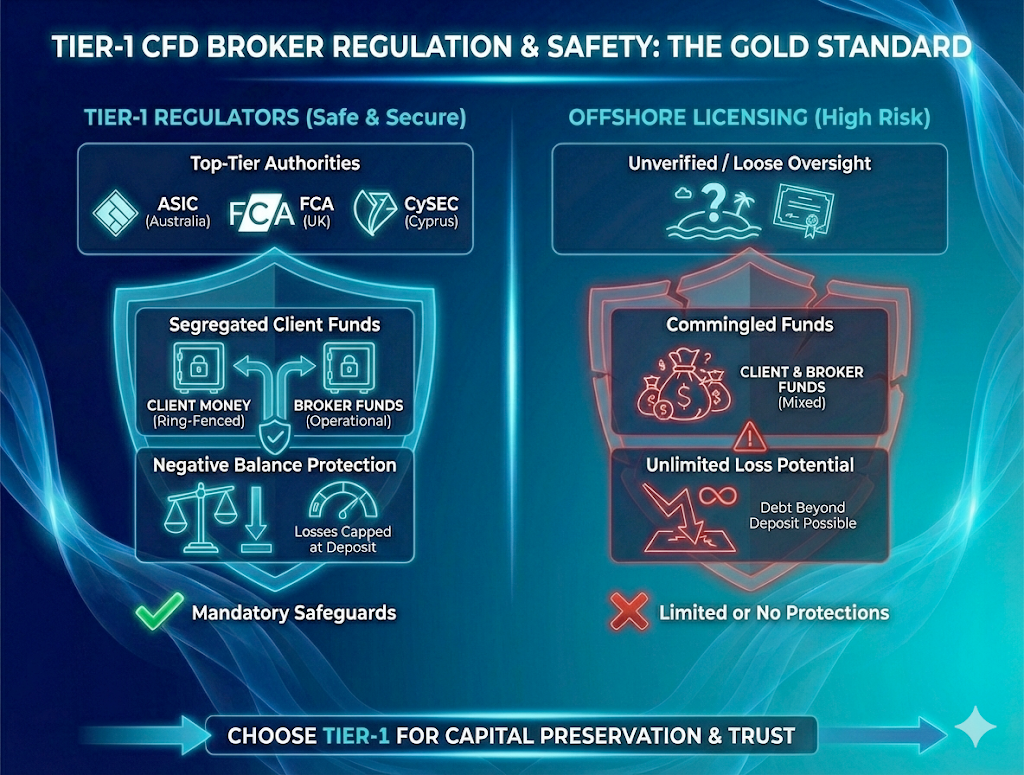

Tier-1 vs. Offshore Licensing

Not all licenses are equal. You should prioritize brokers regulated by Tier-1 authorities such as the ASIC (Australia), FCA (UK), or CySEC (Cyprus). These regulators enforce strict capital requirements and regular audits. In contrast, brokers with "offshore" licenses (e.g., from small island nations) often lack the legal framework to protect you if the brokerage goes bankrupt.

Segregated Client Funds & Negative Balance Protection

A critical requirement of Tier-1 regulation is Segregated Accounts. This means your trading capital is held in a separate bank account from the broker’s operational funds. Additionally, ensure the broker provides Negative Balance Protection, which guarantees you can never lose more money than you deposited—a crucial safety net during extreme market crashes.

Fees & Commissions

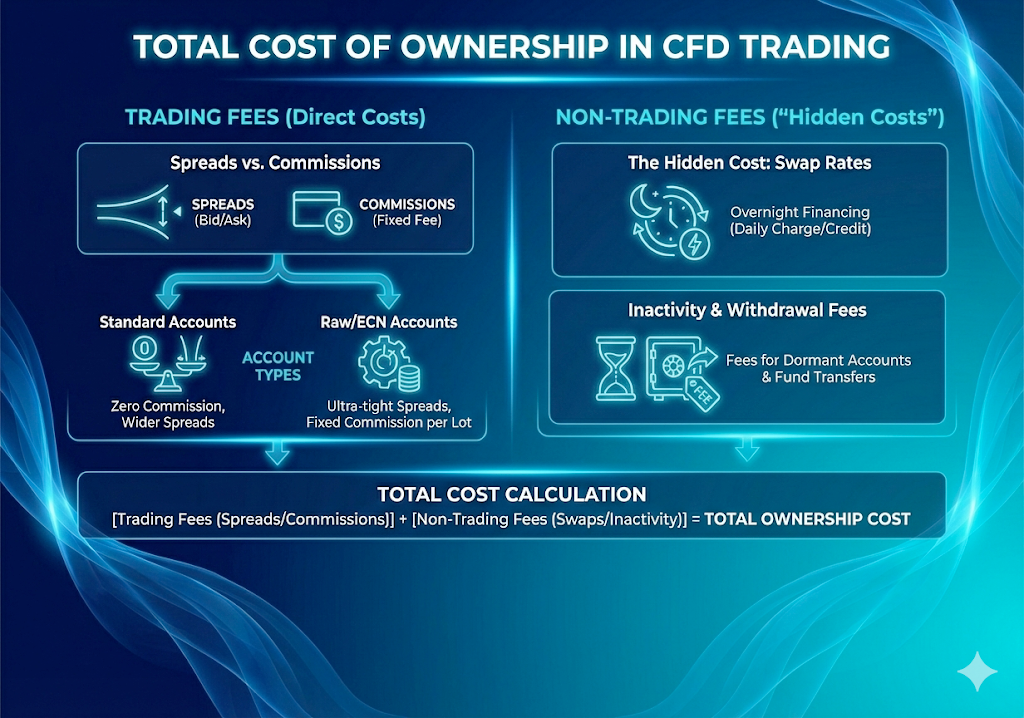

Most beginners only look at the "Spread" (the difference between the Buy and Sell price), but this is only one part of the cost equation. A professional analysis looks at the Total Cost of Ownership.

Spreads vs. Commissions

Standard Accounts: Usually offer "Zero Commission" but have wider spreads. Best for swing traders who trade less frequently.

Raw/ECN Accounts: Offer ultra-tight spreads (sometimes 0.0 pips) but charge a fixed commission per lot. This is usually cheaper for high-volume scalping and day trading.

The Hidden Cost: Swap Rates (Overnight Financing)

If you hold a CFD position past a certain time (usually 5 PM EST), you pay or receive a Swap Rate. For swing traders holding positions for weeks, negative swaps can be more expensive than the spread itself. Always check the broker’s "Contract Specifications" to see if their swap rates are competitive.

Inactivity & Withdrawal Fees

Check the fine print for non-trading fees. Some brokers charge an "Inactivity Fee" (e.g., $10/month) if you don't trade for three months. Avoid brokers that charge high fees just to withdraw your own money.

Range of Markets

Don't just do a quick check if a broker offers "Stocks" or "Crypto"—check the depth of those offered markets.

Asset Variety & Liquidity

A top-tier broker shouldn't just offer the major tech stocks like "Magnificent 7" (TSLA, AAPL, MSFT, GOOG, AMZN, META, NVDA); they should offer a wide range of global equities, commodities, and ETFs. Limited asset lists can restrict your choices, and ability to hedge or diversify.

For example, if you are more of a skilled stock trader, where you use both technical and fundamental analysis to trade stocks, if the cfd broker that you have chosen only offer say 100 stocks, you might very often find most stocks do not fit your technical and fundamental requirements, putting yourself in an ‘untradable’ situation.

Another issue is crypto restrictions. Many brokers offer Crypto CFDs, but the terms vary wildly in terms of leverage amount and trading hours. Always check the leverage caps (often lower for crypto) and weekend trading hours. Some CFD brokers close crypto trading on weekends, preventing you from reacting to Saturday/Sunday news.

How to assess a CFD Broker: Asset Class Nuances

A deep asset list is meaningless if the trading conditions for those assets are poor. You must verify the specific "Contract Specifications" for your preferred market:

Forex: Look for Raw Spreads (e.g., EUR/USD averaging < 0.2 pips) and deep liquidity. Avoid brokers that widen spreads excessively during the Asian session.

Indices: Check the trading hours. Top-tier brokers offer 24-hour trading on major indices (like the US500), whereas others close markets during daily breaks, trapping your positions.

Shares/Equities: Verify how the broker handles corporate actions. Ensure they pay Dividend Adjustments on long positions rather than absorbing them.

Commodities: Check the Contract Size. Professional brokers often offer "Mini" contracts (e.g., 10oz Gold instead of 100oz), which allows for finer position sizing on smaller accounts.

Trading Platforms & Execution

Your platform is your gateway to the market. A clumsy interface or slow execution speed can result in Slippage—where your order is filled at a worse price than you intended.

Execution Speed (Latency)

For strategies like scalping, milliseconds matter. You need a broker that offers Low Latency execution (ideally under 100ms) to ensure you enter and exit at the exact price you see on the screen.

Platform Stability & Tools

Ensure the broker supports industry-standard platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5). These platforms support custom indicators and automated trading (Expert Advisors). The brokers’ own platforms are often easier to use than MT4 or MT5 but lack the advanced charting tools required for technical analysis.

Risk Management Features

In CFD trading, leverage can amplify losses. Your broker must provide tools that help you cap your downside risk definitively.

Guaranteed Stop Loss Orders (GSLO)

Standard stop-loss orders do not guarantee your exit price. In a volatile market (like during a news event), the price might "gap" past your stop, filling you at a much lower price (Slippage). A Guaranteed Stop Loss Order (GSLO) charges a small premium but guarantees your exit price, regardless of market volatility.

Margin Call & Stop Out Policies

Every broker has a "Stop Out Level" (e.g., 50% margin level). This is the threshold where they will forcibly close your losing trades to protect their funds. You must understand exactly what this percentage is. A higher stop-out level (e.g., 50-80%) gives you less breathing room for drawdowns compared to a broker with a lower level (e.g., 20-30%), though a lower level increases the risk of total account depletion.

Negative Balance Protection

As mentioned in the Regulation section above, negative balance protection is a strong risk management feature. It ensures that even if a "Black Swan" event causes the market to crash instantly, your account balance will never drop below zero, protecting you from owing debt to the broker.

Customer Support

In trading, support isn't just about password resets—it's about crisis management. In many situations like order issues, platform freezes or even margin calls, you will need a human support agent rather than a recurring bot chat.

Human vs. Bot: Avoid brokers that trap you in infinite chatbot loops. Look for Live Chat with human agents who can resolve trade disputes or platform freezes immediately.

24/7 Availability: If you trade crypto or global markets, ensure support is active 24/7. A platform glitch on a Sunday is disastrous if support doesn't open until Monday morning.

The Competence Test: Open the Live Chat and ask a technical question (e.g., "What is the swap rate for XAU/USD on Wednesdays?"). A competent support team should answer immediately; generic answers indicate outsourced, low-quality support.

Account Types & Stress Testing CFD Broker

Before risking real capital, you should "stress test" the broker’s environment.

The Volatility Test: Demo Reality Check

Use a Demo account not just to learn the buttons, but to test the broker's spread stability during big news events to avoid slippage, amongst many other reasons. (Note: Demo execution is often faster than Live execution because it bypasses real liquidity pools, so treat it as a "best-case scenario").

The Latency Test

Place a Market Order during active hours. The fill should be instant (<100ms). If you see a "Processing..." wheel for more than a second, you are at risk of slippage.

Live Account Tiers

Check if the broker offers tiered benefits. Some "VIP" or "Pro" accounts offer significantly lower spreads or free VPS (Virtual Private Server) hosting once you deposit above a certain threshold, which can drastically reduce your trading costs.

Defining Your Trading Profile

Before comparing brokers, you must define your profile. Under strict regulatory frameworks (such as ASIC’s Design and Distribution Obligations), brokers are required to ensure their product suits your objectives.

Question 1 [Risk Appetite]: Are you a long-term investor looking for steady growth without leverage, or a speculator comfortable with high-risk, high-reward short-term moves?

Question 2 [Experience Level]: Beginners should look for "Standard" accounts with no commissions to simplify cost calculations, while experienced traders require "Raw" or "ECN" accounts for direct market access.

Question 3 [Trading Goals]: Define if you are hedging a physical portfolio or trading for income. If a broker does not assess your suitability during onboarding, they may be non-compliant with modern regulatory standards.

Conclusion: The Final Verdict

Choosing the right CFD broker is not about finding the platform with the flashiest ads; it is about finding a partner that prioritizes fund safety, transparent pricing and advanced tools.

While low spreads are attractive, they are meaningless if the broker lacks Tier-1 regulation or reliable execution during market volatility. By following the criteria outlined above—prioritizing fund safety, analyzing the total cost of ownership (including swaps), and demanding robust risk management tools like GSLO—you position yourself for longevity in the markets.

The Golden Rule: Never deposit more than you can afford to lose, and never trade with a broker that cannot prove your funds are segregated. Start with a Demo account, stress-test their support, and only fund your live account when they have earned your trust.

Why We Trade with TMGM

If you are looking for a broker that strictly follows the criteria outlined in this guide—specifically Tier-1 Safety and Low Trading Costs—we recommend TMGM.

They tick every box for the serious trader:

Tier-1 Regulation: Fully licensed by ASIC (Australia), ensuring your funds are segregated and protected.

Institutional Pricing: Their "Edge" account offers Raw Spreads from 0.0 pips, effectively eliminating the "hidden spread cost" we warned about above.

Execution Speed: With servers located in the NY4 Equinix Data Center, they offer lightning-fast execution (often <30ms) to minimize slippage during volatile news events.

Trade Smarter Today

Frequently Asked Questions (FAQ) about How to Choose a CFD Broker

Which regulator is best for CFD trading?

What is the difference between a Standard and ECN account?

Can I trade CFDs without a broker?

Account

Account

Instantly