What is Leverage in Forex Trading and How Does it Work?

Leverage is a powerful tool in forex trading that allows you to control larger positions with a smaller amount of capital. Essentially, it gives you the ability to do "more with less." Instead of paying the full value of a trade upfront, you put down a small deposit, and your broker provides the rest of the buying power. By magnifying your potential returns, leverage also significantly increases your risk. It acts as a double-edged sword: the same multiplier that boosts your profit can also accelerate your losses. In this guide, we will explore the concept of forex leverage, how margin trading impacts your bottom line, and the factors to consider when using it to maximize potential while managing risk effectively.

Key Takeaways

Definition: Leverage acts as a multiplier, allowing you to control large market positions with a small initial deposit.

The Risk: It is a double-edged sword. While it magnifies potential profits, it amplifies losses just as fast

The Relationship: Leverage and Margin work inversely. Higher leverage (e.g. 1:500) requires a smaller margin deposit but carries higher risks.

Best Practice: Beginners should keep leverage low (1:10 or less) and always use Stop-Loss orders to protect capital.

What is Leverage?

In trading, leverage allows you to open trades that are much bigger than your actual account balance. It is expressed as a ratio.

If you have 1:100 leverage, every $1 in your account can control $100 in the market. If you have 1:500 leverage, that same $1 controls $500.

Why do traders use it? Because currency prices move very slowly. Unlike stocks that might crash or soar 10% in a day, currencies often move by fractions of a cent. Without leverage, a small price move would earn you pennies. With leverage, those pennies are magnified into meaningful dollars.

Why Do You Need Leverage in Forex Trading

Leverage plays a pivotal role in forex trading, enabling traders to maximise their exposure to the market with a relatively small amount of capital. Unlike other financial markets, such as stocks, forex involves minimal price fluctuations, often measured in fractions of a cent.

Without leverage, these small movements would yield negligible profits, limiting the potential for meaningful returns. By amplifying purchasing power, leverage transforms these modest price changes into significant opportunities, allowing traders to capitalize on even the slightest market shifts. However, while leverage offers the potential for greater gains, it also introduces increased risks, underscoring the importance of using it wisely.

Margin vs Leverage: Understanding the Relationship

Leverage is your buying power (the ratio).

Margin is the cost to use that power (the deposit).

Margin isn't a fee you pay; it's a "good faith deposit" your forex broker holds to keep the trade open.

There is a simple rule here: The higher your leverage, the lower the deposit you need.

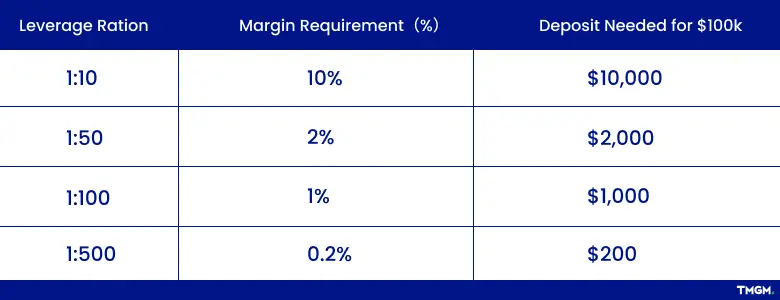

You can see the relationship clearly in the table below for a standard $100,000 position:

Note: 1:500 leverage is cheaper to start, but it accelerates your risk significantly.

How to Calculate Leverage in Forex

If you want to manually check your leverage or exposure, the math is simple. There are two main formulas traders use:

1. To Find Your Total Exposure:

Account Balance X Leverage Ratio = Total Market Exposure

Example: $1,000 X 100 = $100,000 (You control $100K)

2. To Find Your Real Leverage:

If you open a position size of $50,000 with only $2,000 in your account:

Total Position Size/ Account Balance = Real Leverage

Example: $50,000/ $2,000 = 25:1 Leverage

Tip: You don't need to do this math manually. The TMGM Trading Calculator allows you to calculate your used margin and free margin.

Real - World Leverage Examples

To truly respect leverage, you have to see the math. Let's look at a standard trade on EUR/USD using a $1,000 account and 1:100 leverage.

Scenario A: The Winning Trade

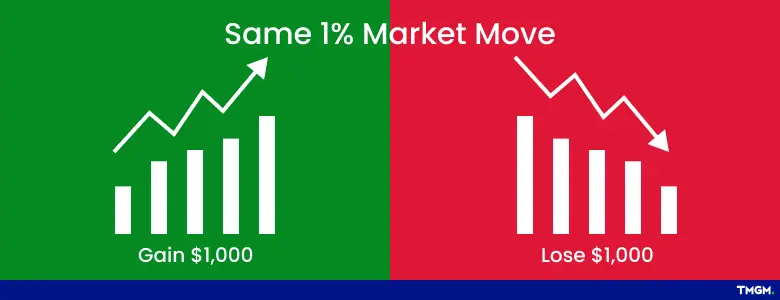

You use your $1,000 to control a $100,000 position. If the market price rises by just 1%, your position gains $1,000 in value.

Since you only started with $1,000, you have just doubled your account (100% ROI) on a single trade.

Scenario B: The Losing Trade

Now imagine the market goes the other way. If the price falls by just 1%, that $100,000 position loses $1,000 in value.

Because your account balance was only $1,000, you have lost 100% of your capital. Your account is now zero.

This is why leverage is dangerous. It doesn't change the market; it changes the value of every single price tick relative to your wallet.

Leverage by Market: How Much Can You Use?

Not all markets are safe for high leverage. Brokers set limits based on how volatile the asset is.

Leverage in Forex (Up to 1:500)

Currencies are liquid and stable. They rarely move more than 1% a day, so high leverage is necessary to make a profit.

Leverage in Commodity Trading (Up to 1:20 - 1:50)

Gold and Stock Indices are faster and more volatile than currencies. A 1:500 leverage here would be reckless because a standard daily move could wipe you out instantly.

Leverage in Stocks & Crypto (Up to 1:2 - 1:5)

These are the most volatile assets. A stock can close at $100 and open the next morning at $80. Because of this "Gap Risk," leverage is kept very low to protect you.

The Risks: What You Need to Know Before Choosing Leverage

Leverage is a power tool. It helps you build wealth faster, but it can cause injury if you don't handle it with care.

The Cost of Borrowing (Swaps)

Since leverage is technically a loan, you may pay interest on it if you hold the trade overnight (past 5:00 PM New York time). These are called "Swap Rates." If you are a long-term trader, these costs can add up.

Margin Calls & Stop Outs

This is the danger zone. If your trade moves against you and your account balance falls below a safety level (usually 50% of your margin), the broker will trigger a Stop Out.

This means the system automatically closes your trades to prevent you from losing more money than you have.

How to Manage Leveraged Positions

You don't need to fear leverage, you just need to respect it. Here is how professionals stay safe.

Always Use Stop-Loss Orders

Never trade without a safety net. A "hard" stop-loss order ensures that a losing trade is cut off automatically before it destroys your account balance.

Calculate Your Position Size

Use the TMGM Position Size Calculator to check exactly how much you are risking. A good rule of thumb is to never risk more than 1% or 2% of your account on a single trade.

Start Small

If you are a beginner, start with lower leverage like 1:10. This gives you "breathing room" to make mistakes without blowing up your account.

Diversification Practice on a Demo Account

The best way to learn is with virtual money. A TMGM demo account lets you feel the speed of leveraged trading without risking a single cent of your own capital.

Leverage in Conclusion

Leverage is the defining feature of Forex trading. It allows retail traders with $500 to access the global currency markets. However, the golden rule remains: Leverage increases your risk just as much as your reward.

Treat it with respect, calculate your risk, and ensure you understand the mechanics of margin before you click "Buy."

Trade Smarter Today

Frequently Asked Questions

What leverage is good for beginners?

Can I trade forex without leverage?

What happens if you lose with leverage?

What does 10x leverage mean?

How does TMGM protect traders using leverage?

Account

Account

Instantly