POPULAR ARTICLES

- Monero hit a new all-time high of $598 on Monday as interest in privacy-focused coins grows.

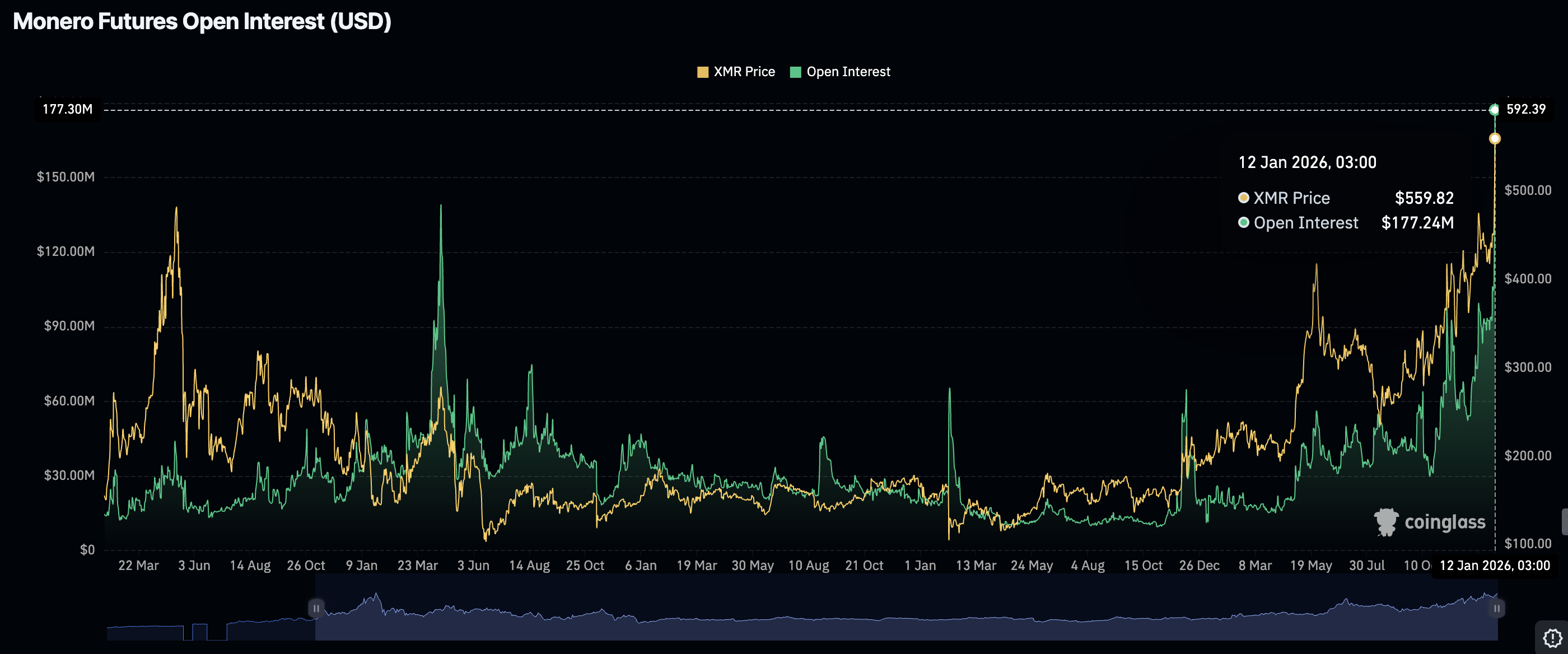

- Retail traders lean into risk as XMR’s derivatives market strengthens, with futures Open Interest swelling to $177 million.

- Bitcoin and altcoins lag as early profit booking snuffs out recovery attempts.

Monero (XMR) is trading near its new record high of $598 at the time of writing on Monday, after defying lethargic sentiment in the broader cryptocurrency market since the year started.

The privacy-oriented token is up by almost 15% over the past 24 hours and approximately 39% over the past 30 days, according to CoinGecko. XMR’s market capitalization has also surged to exceed $10 billion and ranks 18th in the crypto market.

Intense volatility remains a concern across the crypto market, as Bitcoin (BTC) rose above $92,000 and then corrected to test support at $90,000 on Monday. The majority of altcoins, including Ethereum (ETH) and Ripple (XRP), also face headwinds attributed to macroeconomic factors and geopolitical tensions.

Investors pile into Monero as derivatives expand

Monero continues to outperform major crypto assets as traders focus on networks with the potential for returns amid growing macroeconomic uncertainty. CoinGlass data shows that the XMR derivatives market is at its strongest level in history, with futures Open Interest (OI) hitting a record $177 million on Monday, from approximately $116 billion on Sunday.

Retail interest in Monero has steadily grown over the past three months, since October, as shown in the chart below. This could suggest that investors are aligning with privacy coins such as Monero and ZCash (ZEC) as governments push toward widespread regulation of crypto markets.

The steady increase in OI, representing the notional value of outstanding futures contracts, indicates that traders anticipate a continued rally. Meanwhile, there is the risk-off profit-taking, especially after the rally, which could dampen the uptrend. If selling increases the supply of XRM, a healthy correction would be followed by consolidation before resuming the uptrend.

Technical outlook: Is Monero’s rally over?

Monero is trading at $560 at the time of writing on Monday. The token holds above the uptrending 200-day Exponential Moving Average (EMA) at $415, the 100-day EMA at $441 and the 50-day EMA at $458, all of which support a short-term bullish outlook.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart reinforces XMR’s bullish thesis, highlighting an expanding green histogram and a positive divergence that has been maintained since January 6.

A close below the initial demand zone at $560 would accelerate profit-taking, and Monero could drop by almost 6% to $525. The Relative Strength Index (RSI) is at 81 in the overbought region, suggesting that bulls have the upper hand.

Still, if the RSI dips into the bullish region, a deeper breakdown to $500 would be on the cards. Meanwhile, holding above $560 may allow bulls to regroup ahead of a 7% push to retest resistance around $600.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.