POPULAR ARTICLES

- 道琼斯指数周一回落约200点。

- 股市在关键的美国CPI通胀数据公布前削减涨幅。

- 上升的通胀压力可能威胁到美联储降息预期。

道琼斯工业平均指数(DJIA)周一回落,跌约200点,再次测试44,000点以下,因为投资者为周二即将公布的最新美国(US)消费者物价指数(CPI)通胀数据做好准备。市场已完全消化了美联储(Fed)在9月17日的下一次利率会议上降息的预期,但通胀压力的复苏可能会打击降息的希望。

道琼斯周一的回调使主要股指更接近整合阶段,经过从50日指数移动平均线(EMA)附近43,720的技术反弹,道琼斯在44,400和43,600之间波动。道琼斯仍然比接近45,130的历史高点低约2.5%,但该指数稳固地位于200日EMA附近42,500的牛市区域。

美联储降息希望可能面临上升通胀的挑战

根据CME的FedWatch工具,利率交易者预计9月17日至少有90%的可能性会降息25个基点。然而,市场对连续降息的希望仍然面临威胁:利率市场仅预计10月29日有约50%的可能性进行第二次降息。

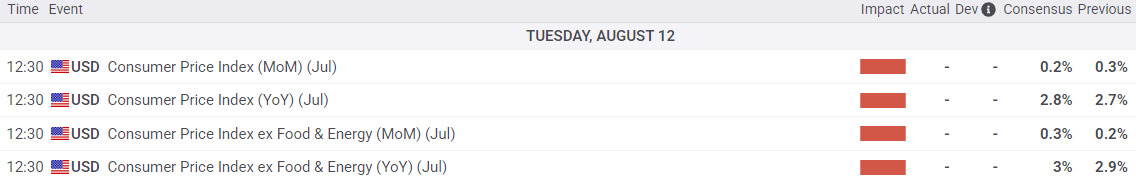

美国7月份的CPI通胀数据将于周二公布,预计将比平时吸引更多投资者的关注。预计总体和核心CPI通胀将按年上升,投资者希望通胀的上升幅度足够小,以免使美联储偏离当前的降息轨迹。预计总体CPI通胀将从2.7%上升至2.8%,而核心CPI预计将从之前的2.9%上升至3.0%。

阅读更多股票新闻:Nvidia推动历史新高,富国银行上调目标价

道琼斯日线图

经济指标

美国核心消费者物价指数年率

通胀或通缩趋势是通过定期汇总一篮子代表性商品和服务的价格来衡量的,并将数据以消费者物价指数(CPI)的形式呈现。CPI数据是由美国劳工统计局每月编制并发布的。同比读数将参考月份的商品价格与前一年同月的价格进行比较。剔除食品和能源的CPI排除了所谓波动较大的食品和能源成分,以提供更准确的价格压力测量。一般来说,高读数对美元(USD)是利多的,而低读数则被视为利空。

阅读更多下一次发布: 周二 8月 12, 2025 12:30

频率: 每月

预期值: 3%

前值: 2.9%

来源: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.