Key Takeaways

A CFD broker facilitates trader access to financial markets and executes orders via trading platforms, analytical tools, and pricing feeds.

Retail traders require a broker to trade CFDs, as these instruments are not directly accessible on exchanges.

Trading expenses arise from the spread or commissions and from overnight financing fees when positions remain open beyond the trading day.

When selecting a broker, consider regulatory compliance and client fund segregation, platform robustness, product diversity, educational resources, customer support, and transparent fee structures.

Leverage amplifies both profit potential and risk exposure, making effective risk management and high-quality trade execution critical.

What is a Broker in CFD Trading

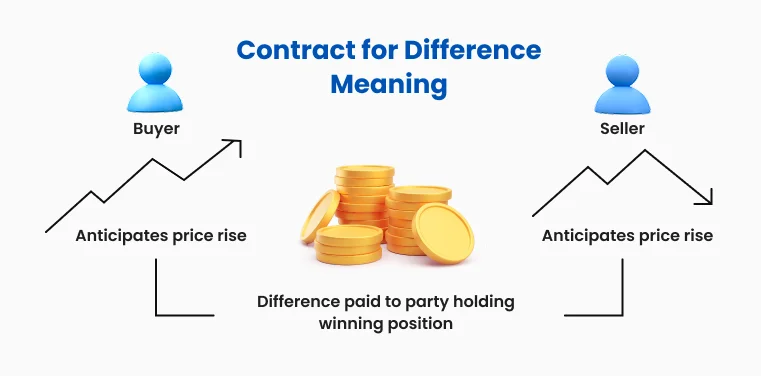

What is a broker in CFD trading? This is a fundamental question every new trader should address before entering the markets. As Contract for Difference (CFD) trading grows in popularity among retail traders, understanding the role of a CFD broker becomes essential.

A broker serves as an intermediary between traders and financial markets, providing the necessary infrastructure, trading platforms, and execution tools. Without a clear grasp of what a broker is in trading, beginners may find it challenging to navigate the complexities of leveraged instruments such as CFDs.

Types of CFD Brokers

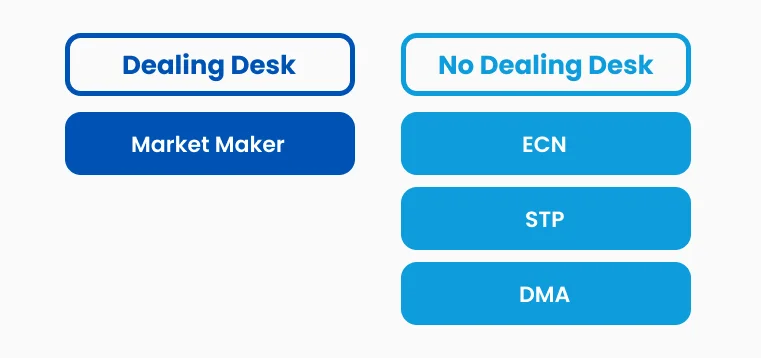

The CFD brokerage sector includes various models. Market makers, the most prevalent type, set their own bid/ask prices and provide tight spreads with rapid execution, making them suitable for active traders.

Electronic Communication Network (ECN) brokers link traders directly to liquidity providers, offering transparent pricing and variable spreads. Direct Market Access (DMA) brokers provide direct access to real-time order books and market depth, appealing to professional traders who prioritize transparency and accept higher commission fees. CFD broker types like ECN, DMA, and STP (Straight Through Processing) operate as Non-Dealing Desk (NDD) brokers, connecting traders directly to the interbank market rather than taking the opposite side of client trades.

Figure 1: Market makers function as Dealing Desk (DD) brokers; ECN, DMA, and STP are Non-Dealing Desk (NDD) brokers, facilitating direct market access instead of internalizing client orders.

What Do CFD Brokers Do?

When examining what a broker does in CFD trading, it’ is evident that CFD brokers provide trading platforms equipped with advanced charting tools, technical indicators, and sophisticated order management systems.

A comprehensive CFD broker such as TMGM offers access to a broad spectrum of financial instruments, including equities, indices, commodities, forex, and cryptocurrencies, all accessible via a single trading account.

Risk management is another vital function, with brokers enforcing margin requirements, stop-loss orders, and position sizing controls to assist traders in managing their exposure.

To fully comprehend what a broker does, it’ is important to recognize that their responsibilities also encompass regulatory compliance, adherence to financial legislation, and maintaining segregated client accounts to safeguard client funds.

Figure 2: What is a broker in CFD trading, and how do they operate?

How CFD Brokers Generate Revenue

A CFD broker earns income through multiple channels, with spreads being the primary revenue source for most market makers. The spread—the difference between bid and ask prices—allows brokers to profit from each trade executed.

Another significant income stream for a CFD broker is overnight financing charges, where interest is applied to positions held overnight, reflecting the underlying asset’s financing costs.

Choosing a Reliable CFD Broker

Selecting a suitable CFD broker demands careful evaluation of factors beyond competitive spreads and commissions. Regulatory oversight is paramount, as regulated brokers comply with stringent financial standards and ensure client fund segregation.

Traders should confirm that their broker holds licenses from reputable regulatory authorities and provides adequate investor protection schemes.

The distinction between broker and dealer is particularly relevant when assessing trade execution models, as some brokers act as dealers by taking the opposite side of client trades, whereas others operate solely as intermediaries.

Reliable customer support, comprehensive educational materials, and transparent pricing policies further differentiate professional brokers from less reputable providers.

Figure 3: Understanding the inherent risks of operating as a CFD broker

Risks and Responsibilities

While a CFD broker provides market access, traders must be aware of the risks associated with leveraged trading. The distinction between broker and dealer responsibilities is critical in risk evaluation, as market maker brokers may face conflicts of interest when client losses translate into their profits.

Counterparty risk is another key consideration, as traders risk losses if their broker becomes insolvent or fails to meet its obligations.

Additionally, traders bear responsibility for understanding leverage effects, margin requirements, and the possibility of losses exceeding their initial capital.

Trade smarter with TMGM

Understanding what a broker is, especially in the trading context, is fundamental for a successful trading career. A CFD broker acts as a financial intermediary, providing market access, trading platforms, and essential tools while ensuring compliance with regulatory standards.

Traders should assess a broker’s regulatory status, trading conditions, and business model, and understand what a broker does, including how their revenue model impacts trading costs and execution quality.

Choosing a reputable and well-regulated CFD broker enables traders to manage risk effectively and focus on their trading strategies. It also clarifies the difference between a broker and a dealer, supporting informed decision-making.

For those interested in exploring CFD trading, it is advisable to test trading strategies initially using a TMGM demo account before committing real capital. Once familiar with the platform and trading mechanics, users can open a live trading account with TMGM, utilizing the TMGM Mobile App or desktop application.