Key Takeaways:

- Microsoft’s ownership is widely distributed among major asset managers and a broad base of retail investors, resulting in corporate governance heavily influenced by large index funds and long-term institutional investors.

- The company’s free float is primarily held by institutional investors (≈71.46%), with insiders (~6%) and retail investors (~24%) providing liquidity and alignment, reflecting diversified oversight and stable capital structure.

- Vanguard, BlackRock, State Street, Fidelity, and T. Rowe Price collectively hold significant stakes, impacting proxy voting outcomes, board accountability, and long-term strategic direction.

- Among individual shareholders, Steve Ballmer is the largest, followed by Bill Gates, with Satya Nadella, Brad Smith, and Amy Hood holding smaller executive stakes that align management interests with shareholders.

- Through TMGM, investors can gain exposure to Microsoft price movements via CFDs, enabling speculation without owning the underlying shares; however, leverage magnifies both profits and losses, necessitating disciplined risk management.

Microsoft Ownership: Shareholder Structure

Founded in 1975 by Bill Gates and Paul Allen, Microsoft rapidly became a technology sector leader. Its rapid growth was driven by strategic partnerships, such as with IBM, and pioneering products like MS-DOS, Windows, and Internet Explorer. Over time, Microsoft expanded into productivity software, consumer entertainment, and enterprise solutions, becoming one of the world’s most valuable companies.

Today, Microsoft’s portfolio includes artificial intelligence, cloud computing, and innovative platforms such as LinkedIn and Microsoft Azure. Its stock is a core holding for many investors, with ownership split as follows: 71.46% institutional investors, 6% insiders, and 24% retail investors.

Top 5 Institutional Shareholders

#1 Vanguard Group

- Overview: Founded in 1975, Vanguard is among the world’s largest asset management firms, renowned for its low-cost index funds and ETFs. It serves both institutional and retail clients, managing assets worth trillions of dollars.

- Relative Stake: 8.7%

- Shares Held: 649.2 million

- Market Value: $268 billion

- Notable: Vanguard’s extensive holdings grant it significant influence across major corporations, making it one of the most powerful institutional investors globally.

#2 BlackRock Inc

Overview: Founded in 1988, BlackRock is a leading global investment management and financial services firm. It manages assets for a diverse client base, including pension funds and government entities. BlackRock also operates Aladdin, a sophisticated risk management platform widely used in the industry.

Relative Stake: 7.25%

Shares Held: 538.9 million

Market Value: $214 billion

Notable: BlackRock is recognized for its proactive role in corporate governance, often shaping company policies through its equity stakes.

#3 State Street Corporation

- Overview: Established in 1792, State Street is a longstanding financial services and asset management firm providing a range of services including asset management, research, and trading solutions.

- Relative Stake: 4.01%

- Shares Held: 297.6 million

- Market Value: $118 billion

- Notable: State Street, Vanguard, and BlackRock are collectively known as the “Big Three” index fund managers, wielding substantial influence over corporate America.

#4 Fidelity (FMR LLC)

Overview: Founded in 1946 by Edward C. Johnson II, Fidelity Investments provides a wide range of financial services, including personal financial planning and asset management. Its clientele includes both individual and institutional investors.

Relative Stake: 2.9%

Shares Held: 215.87 million

Market Value: $89.38 billion

Notable: Fidelity is well-known for its active management strategies and extensive mutual fund offerings, making it a key player in the investment industry.

#5 T. Rowe Price Associates

Overview: Founded in 1937, T. Rowe Price is an independent investment management firm serving a global client base, including individuals and institutions. It is known for its disciplined, long-term investment philosophy.

Relative Stake: 2%

Shares Held: 151.92 million

Market Value: $62.9 billion

Notable: T. Rowe Price is respected for its rigorous research and commitment to delivering client value through diversified investment strategies.

Top 5 Individual Shareholders

#1 Steve Ballmer

Background: Former Microsoft CEO Steve Ballmer joined the company in 1980 as its first business manager. He played a crucial role in securing the IBM partnership and expanding Microsoft’s software business. Ballmer succeeded Bill Gates as CEO in 2000 and led the company until retiring in 2014.

Relative Stake: 4.48%

Shares Held: 333.2 million

Market Value: $115.8 billion

Notable: Ballmer’s substantial equity stake makes him the largest individual shareholder, providing significant influence over Microsoft’s strategic direction.

#2 Bill Gates

Background: Microsoft co-founder Bill Gates served as CEO until 2000 and stepped down from the board in 2020 to focus on philanthropic efforts. Gates was instrumental in developing foundational products like Windows and Office, shaping the modern digital landscape.

Relative Stake: 0.53%

Shares Held: 39.2 million

Market Value: $13.7 billion

Notable: Although Gates has reduced his holdings over time, his legacy as Microsoft’s visionary remains deeply influential.

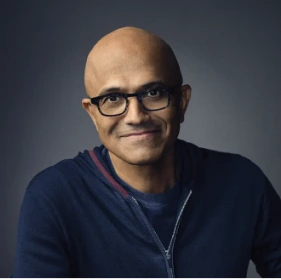

#3 Satya Nadella

Background: Joining Microsoft in 1992, Nadella was pivotal in developing the company’s cloud computing platform, Microsoft Azure. He became CEO in 2014, steering Microsoft’s focus toward AI, cloud services, and digital transformation.

Relative Stake: 0.01%

Shares Held: 800,000

Market Value: $271.6 million

Notable: Nadella’s leadership has revitalized Microsoft, solidifying its position as a global technology leader.

#4 Bradford L. Smith

Background: Smith joined Microsoft in 1993 and oversees legal and corporate affairs, including antitrust issues and corporate social responsibility initiatives.

Relative Stake: 0.008%

Shares Held: 570,826

Market Value: $200 million

Notable: As Vice Chair and President, Smith represents Microsoft on critical issues including cybersecurity, human rights, and AI ethics.

#5 Amy E. Hood

Background: Hood joined Microsoft in 2002 and was appointed CFO in 2013. She manages Microsoft’s global financial operations and is credited with driving the company’s financial performance and strategic growth.

Relative Stake: 0.007%

Shares Held: 520,000

Market Value: $170 million

Notable: Hood plays a key role in Microsoft’s leadership, steering financial strategy and capital allocation priorities.

How to Gain Exposure to Technology and Market Trends with TMGM

Although TMGM does not offer direct equity purchases for companies like Microsoft, you can gain exposure to leading companies through Contracts for Difference (CFDs) available on the TMGM platform.

CFDs enable you to speculate on price fluctuations of assets such as stocks, indices, and commodities without owning the underlying securities.

With TMGM, you can:

Open a TMGM Account: Begin by opening a trading account with TMGM.

Access the TMGM Web Platform: Once your account is set up, access the platform for a full-featured trading experience.

Configure Your Trade: Tailor your trade size, and set stop-loss and take-profit orders in line with your trading strategy.