POPULAR ARTICLES

- 道琼斯指数周三下跌350点,因特朗普政府再次发出贸易战威胁。

- 特朗普团队正在考虑对向中国出口软件实施额外的贸易限制。

- 次级贷款计划持续疲软,另一家贷款机构申请破产。

道琼斯工业平均指数(DJIA)周三表现挣扎,全天最低点下跌超过500点。由于特朗普政府继续玩弄美中之间已经紧张的贸易摩擦,投资者面临新的风险规避情绪。另一家次级贷款机构宣布破产,突显出信贷和贷款领域日益扩大的裂痕。

据消息人士透露,特朗普政府正在考虑对向中国出口软件实施限制,这一举措旨在回应中国最近进一步加强对其境内稀土矿物出口的政府控制。美国的关键行业,特别是科技行业,严重依赖于对中国稀有金属市场的开放访问。

次级贷款机构PrimaLend申请破产,进一步加大了投资者对美国贷款领域健康状况的担忧。这一破产事件紧随几周前一家汽车贷款机构的倒闭。

美国农民对美国总统特朗普因其复杂的计划而愤怒,该计划旨在从阿根廷进口牛肉,以弥补其政府对所有巴西进口商品征收50%关税后造成的短缺。美国牛肉农民对这一举措表示强烈反对,特朗普对此表示批评,称美国牛肉农民“不理解”他的关税如何使他们受益。

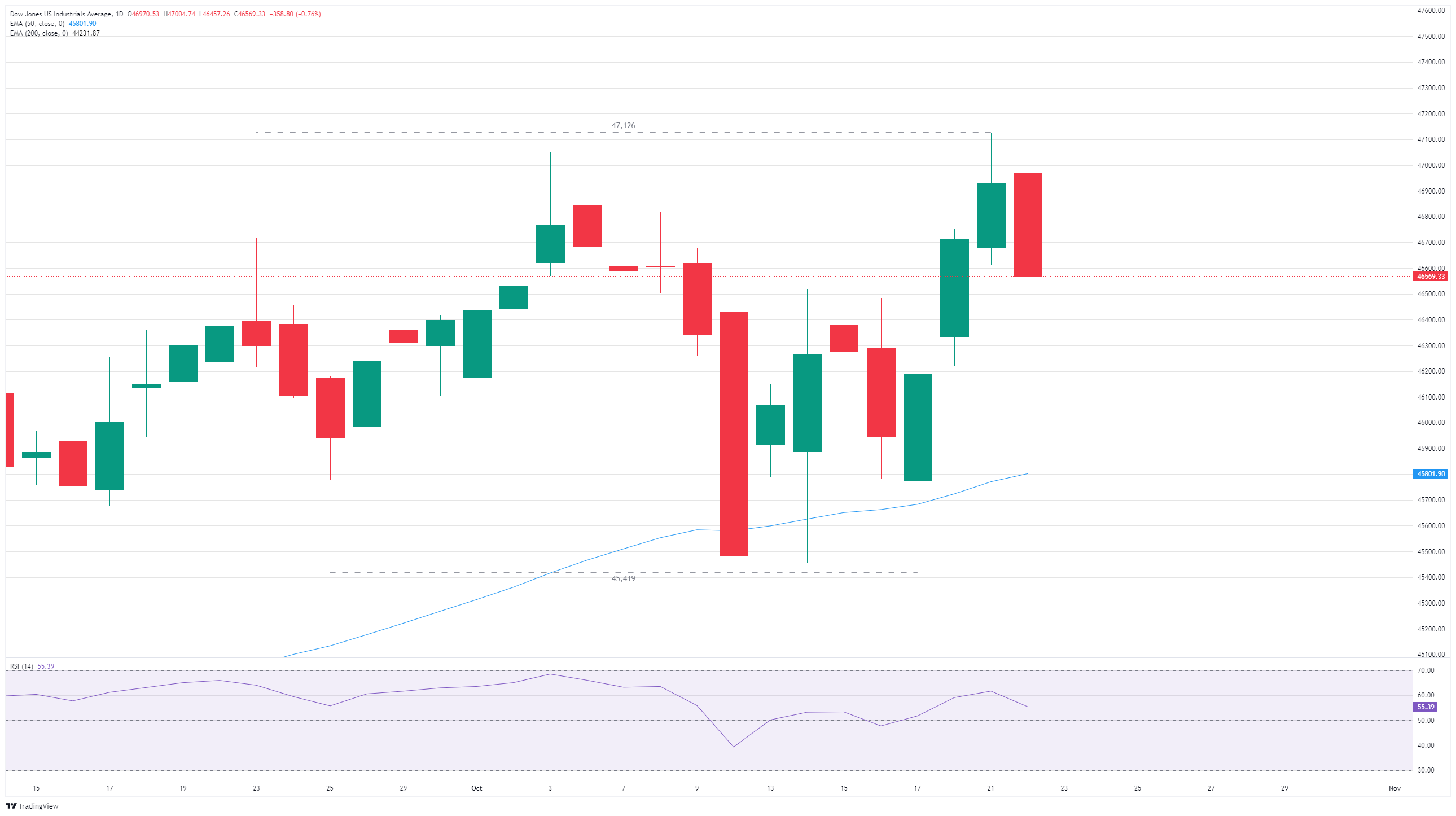

道琼斯日线图

经济指标

美国核心消费者物价指数年率

通胀或通缩趋势是通过定期汇总一篮子代表性商品和服务的价格来衡量的,并将数据以消费者物价指数(CPI)的形式呈现。CPI数据是由美国劳工统计局每月编制并发布的。同比读数将参考月份的商品价格与前一年同月的价格进行比较。剔除食品和能源的CPI排除了所谓波动较大的食品和能源成分,以提供更准确的价格压力测量。一般来说,高读数对美元(USD)是利多的,而低读数则被视为利空。

阅读更多下一次发布: 周五 10月 24, 2025 12:30

频率: 每月

预期值: 3.1%

前值: 3.1%

来源: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.