The Best Stocks for Day Trading

Day traders have certain advantages over regular traders. They make quicker profits enjoy the benefits of highly volatile markets, and have no overnight risks. Granted, day trading is no easy feat, but once you get the hang of it, you’ll be able to gain opportunities in various markets and the ability to leverage small price movements and make financial gains. Identifying stocks with high potential can significantly increase the chances of a trader’s success. Here’s how to choose the best stocks for day trading

Best Stocks for Day Trading

Though there’s no guaranteed success with stocks, there are specific characteristics that traders can look out for to increase their likelihood of success:

Volume

Due to the nature of day trading, there is a very small amount of daily volume, so picking stocks with high volume makes a big difference. The gap between the buy and sell price will be higher, which can eat into any possible profits. Stocks with low volume can also be more volatile. Overall, high-volume stocks mean many traders actively trade in them, which leads to higher liquidity and lower spreads.

Trends

There are different ways to find stocks that are trending, and this is where technical day trading indicators come in handy:

Moving averages. This indicator helps level price action by filtering clamour from random price fluctuations.

The moving average convergence divergence (MACD) indicator identifies purchasing and selling momentum and price divergences. When the histogram goes above the zero line, it is considered bullish; when it goes below, it’s bearish.

Awesome oscillator. Provides traders with a clear way to study market trends. Positive values indicate an uptrend, while negative values indicate a downtrend.

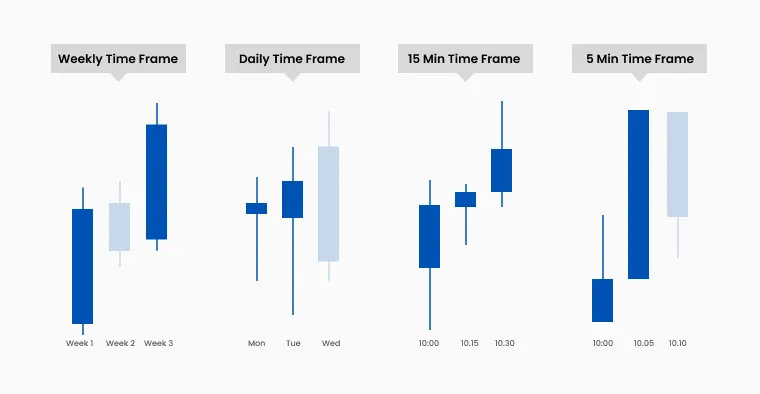

Timeframes

Trading time frames offer valuable information for day traders. For instance, candlesticks are a popular chart graphic that illustrates an asset's high, opening, closing and low prices. Time frames provide the information during a specific time period, common time frames include 1 minute (M1) chart, 5 minute (M5) chart, 15 minute (M15) chart and more.

Time frames help traders identify trends, align strategies, manage risk and find trading opportunities.

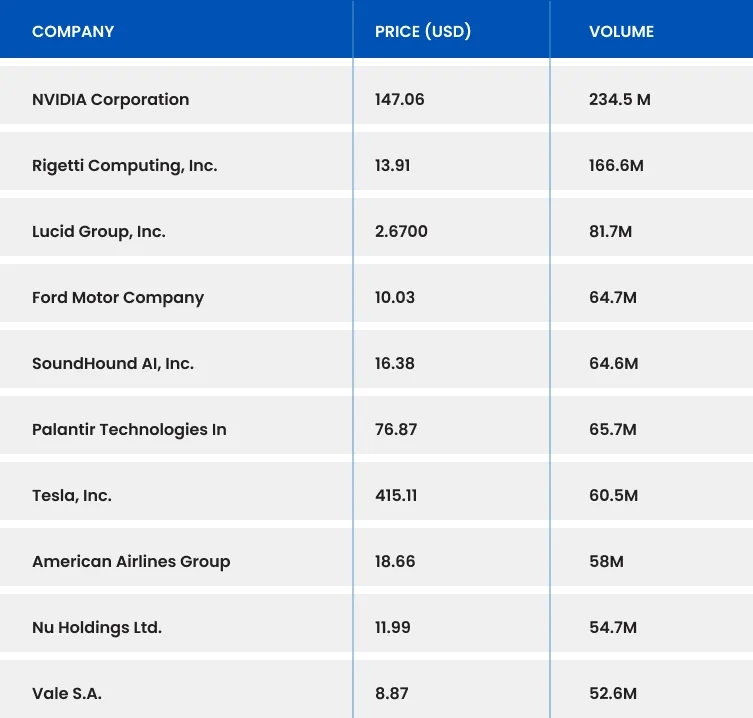

Day Trading Stock List

As stocks change frequently, staying updated on the latest list and news is important. Here’s a list of active stocks you might want to consider trading:

Trading CFDs on Stocks with TMGM

One of the easiest ways to start trading is to start a demo account; it not only simulates actual trading but also comes with zero risks. You can switch to a live account once you’ve determined your goals and risk tolerance.

Trade Smarter Today

Account

Account

Instantly