Netflix Stock Investment Guide: How to Buy, and Who Owns Netflix

Investing in large corporations and their stocks is common in the trading world. These big companies also have large market capitalization, which signifies that it is generally safer to invest in their stocks. As the largest streaming platform, Netflix is a prime investment option. Investors can buy shares directly or use a contract for differences (CFDs) to speculate on price movement. Share prices have risen recently, so is this a good time to invest in Netflix?

Netflix Stock: Market Evolution

Founded in 1997, Netflix initially started with DVD rentals, but it was a competitive industry as most people weren’t familiar with consuming online content.

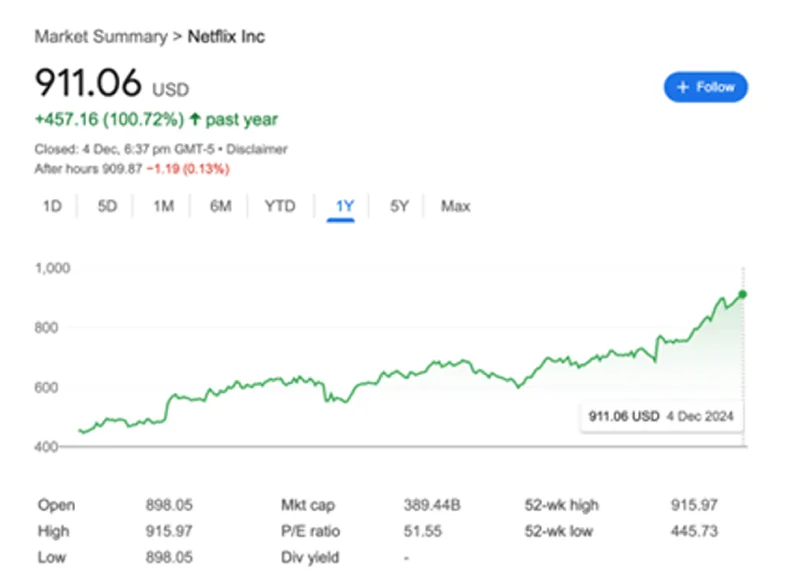

After some financial difficulties and proposal rejections, Netflix went public under the stock exchange symbol NFLX in 2002 to increase market liquidity. Netflix stock prices steadily climbed until October 2021 (US$678) but fell to US$182 in June 2022, highlighting periods when investors asked why is Netflix stock down. Despite these setbacks, Netflix’s stock reached a record high of 911.06 USD in December 2024. Inclusion in the S&P 500 has also reinforced long-term institutional demand.

This raises the question: is Netflix a good stock to buy now for long-term holders or short-term CFD traders?

Who Owns Netflix?

Institutional shareholders collectively own the majority of Netflix’s shares, much of it via passive index funds that track major indices like the S&P 500. Learn the mechanics of equity exposure through index trading.

- The Vanguard Group, Inc.: The single largest shareholder, holding more than 9% of Netflix's shares.

- BlackRock, Inc.: The second-largest shareholder, with a stake of approximately 8%.

- FMR LLC (Fidelity Investments): Holds the third-largest stake, at over 5%.

- State Street Corporation: Another major investment firm, holding over 4% of the company.

- Capital Research and Management Company: One of the top active managers, holding over 4% of the shares.

Besides institutional shareholders, individual shareholders—current and former executives—are the most prominent individual holders.

- Reed Hastings: A co-founder and former CEO, Hastings transitioned to Executive Chairman in early 2023. He remains a key individual shareholder, though his stake is just over 1%.

- Ted Sarandos: The co-CEO of Netflix since 2020, he is a notable individual shareholder.

- Greg Peters: The co-CEO of Netflix since 2023, he also holds a significant individual stake.

- Jay Hoag: A long-time member of Netflix’s board of directors, he is one of the top individual shareholders.

How to Invest in Netflix?

The two ways to purchase Netflix stocks are through cash or CFDs. For CFDs, there are two methods:

CFD trading on Netflix allows traders to profit from rising and falling stock prices. If traders can predict a price drop, they can go short (short-selling) and potentially make a profit. If you’re new to derivatives, see what CFD trading is.

Purchase Netflix stocks directly via shares trading.

Netflix Stock Performance So Far

Netflix’s stock performance has been volatile. Returns were 11% in 2021, 51% in 2022, and 65% in 2023. Prices in 2024 trended higher, supported by subscriber growth and password-sharing restrictions. For traders seeking short-term setups, review day trading explained and ensure you understand trading leverage and key trading conditions.

From January 2023 to September 2024, Netflix added over 50 million subscribers. Revenue is projected to grow by ~15% to almost $39 billion. To benchmark big-tech peers, you can also read how to invest in Meta stock and how to buy Amazon stock.

Does Netflix Pay Dividends per Share?

Unfortunately, Netflix shareholders do not receive dividends. Despite strong price performance, management has reiterated a focus on profitable growth and reinvestment instead of payouts. When evaluating total return, traders and investors should compare alternatives like benefits of trading CFDs.

Netflix Stock Technical Analysis

If you’re looking to invest in Netflix, stay updated on its upcoming earnings disclosures. Around results time, consult the Economic Calendar to plan risk and timing.

Positive estimate revisions can fuel momentum. For platform execution and analysis, consider MetaTrader 5 with research support from Trading Central.

Traders can invest in Netflix shares long-term, assuming stock prices will continue climbing, or trade CFDs to take advantage of price fluctuations. Before purchasing the stock, make sure you understand CFDs vs stocks, choose the right account type, and manage risk with the trading calculator.

Related reading: investing in airline stocks and Rolls-Royce stock for different sector dynamics.

Trade Smarter Today

Account

Account

Instantly