Understanding What is Lot Size in Trading

When trading assets like stocks, forex, or futures, individual units aren't typically bought or sold directly; instead, traders use lot sizes as the standard unit of measurement. A lot size represents a specific quantity of an asset being traded. Whether you're dealing with stocks, currencies, or bonds, lot size helps to standardize the quantity being transacted, allowing for easier comparison across different markets. The concept of lot size is fundamental for traders, as it dictates how much of a particular asset you're buying or selling and can significantly impact your risk management and profit potential. In this guide, we'll delve into the intricacies of lot size, discuss its applications across various asset classes, and explain how you can use a lot size calculator to manage your trades more effectively.

What is a Lot Size in Trading?

A lot size is a predetermined quantity of a financial instrument being traded. Essentially, it defines how many units of an asset you buy or sell in a given trade. Lot sizes make it easier for traders to standardize the quantity across various trades, ensuring uniformity in trading activities.

The typical lot size in stock trading might be 100 shares, but in markets like forex, futures, or bonds, the lot size varies depending on the instrument being traded. Understanding lot size cannot be overstated, as it directly influences a trade's potential profit or loss.

What is Lot Size in Forex Trading

What is Lot Size in Forex Trading

Types of Lot Sizes Across Markets

Different financial markets use various lot sizes, each tailored to the asset class. Below are the key examples:

1. Stocks

In the stock market, a standard lot size is 100 shares. For example, when you hear someone is trading a "lot" of XYZ stock, they generally trade 100 shares at a time. This is a basic measure for equity trading, though fractional shares and smaller lot sizes are becoming more common with certain brokers.

2. Bonds

Bonds typically involve much larger lot sizes compared to stocks. In contrast to the standard 100 shares for equities, bond lot sizes are often issued in denominations of $100,000 or more, with many institutional bonds being traded in multiples of a million dollars.

For the average investor, bond funds or exchange-traded funds (ETFs) may offer a more accessible way to gain bond exposure without purchasing such large lot sizes.

3. Futures

Lot sizes in the futures market are called "contract sizes." These vary significantly depending on the underlying asset. A futures contract could represent equities, bonds, interest rates, or even commodities.

For instance, one contract of Japanese yen represents 12,500,000 yen, while one British pound contract represents 62,500 GBP. Futures contract sizes are fixed, meaning traders cannot adjust the lot size within a single contract.

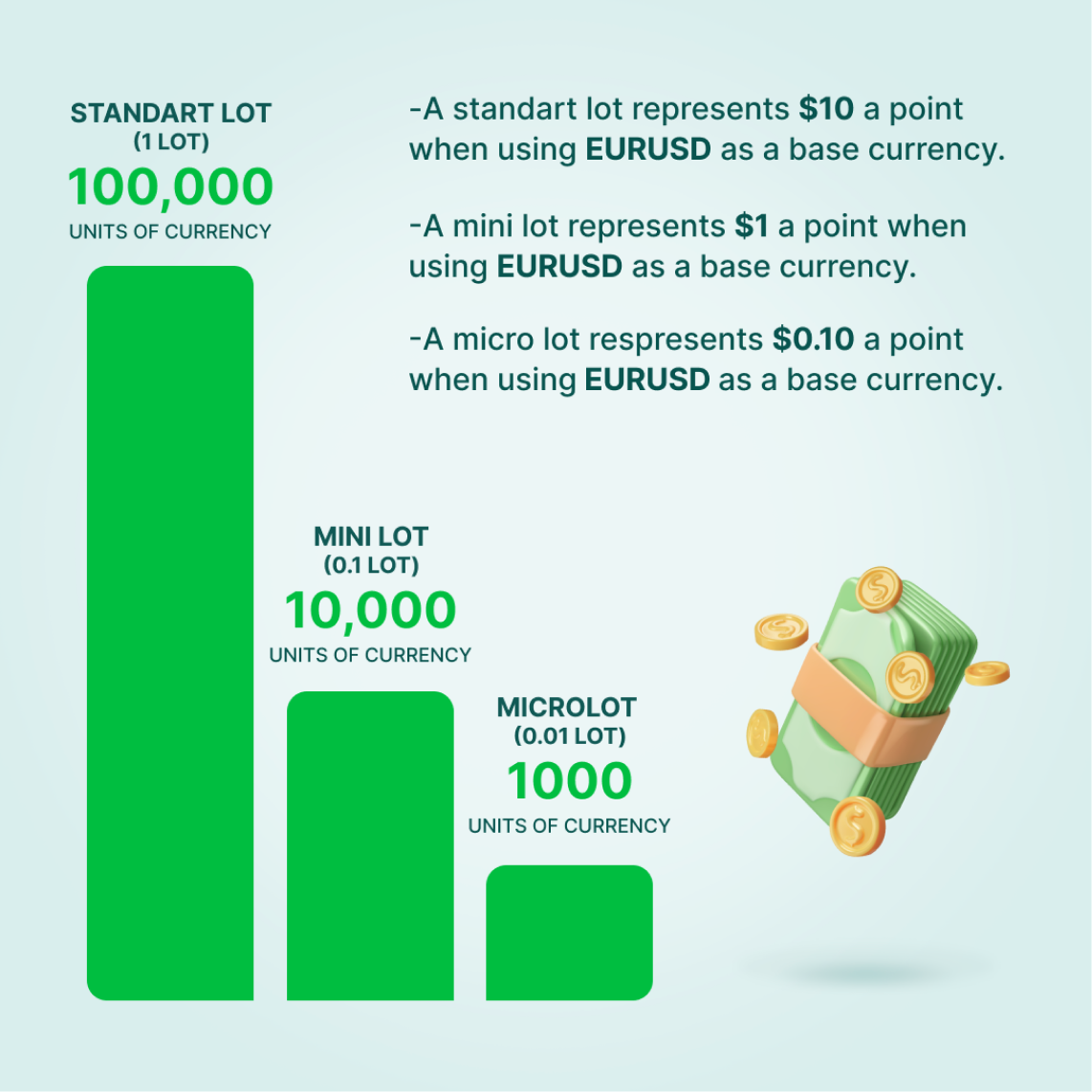

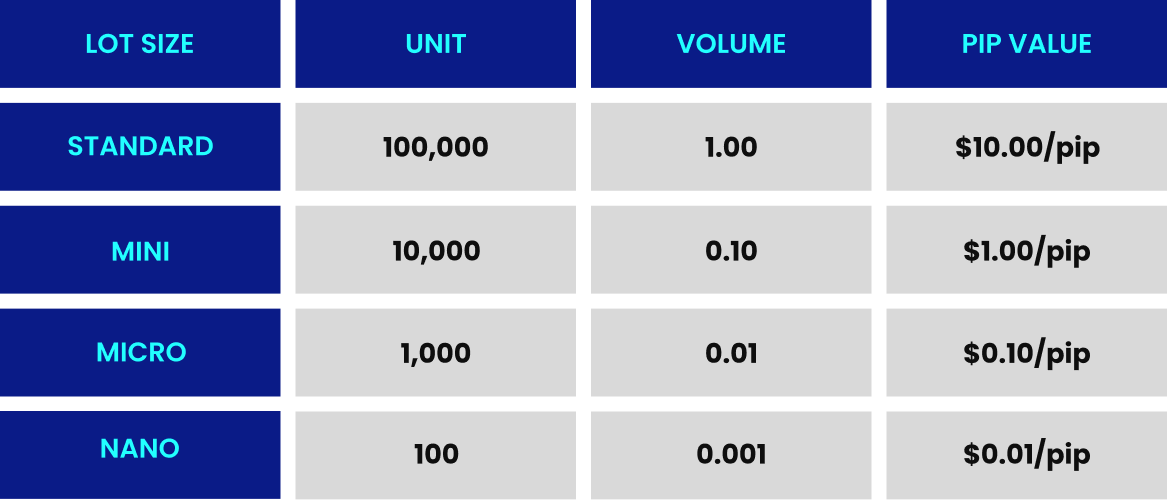

4. Forex

The forex market, where currencies are traded, also operates on standard lot sizes. A standard forex lot is 100,000 units of the base currency. Smaller lot sizes, such as mini lots (10,000 units) and micro lots (1,000 units), are also available, allowing traders with smaller capital to participate in the market.

Forex brokers often provide a lot size calculator to help traders determine the appropriate size based on their account balance, risk tolerance, and trade strategy.

Understanding Different Lot Sizes

How to Calculate Lot Size?

Understanding how to calculate your lot size is crucial for effective risk management. Several factors come into play when determining the correct lot size for your trades:

Risk Tolerance: Every trader has a different appetite for risk, which should be factored into lot size decisions. A general rule is to risk no more than 1% of your total account balance on any trade. This ensures that the loss is manageable even if a trade goes against you.

Account Balance: Your available capital plays a significant role in the lot size you can trade. Traders with larger account balances may opt for larger lot sizes, but ensuring the trade remains within your risk tolerance is essential.

Stop-Loss: A stop-loss order is a critical tool for managing risk in any trade. The distance between your entry point and stop-loss level will also influence your lot size. A wider stop-loss typically means you can afford a larger lot size, whereas a tight stop-loss would require a smaller lot size to avoid exceeding your risk limit.

By using the formula below, you can calculate the appropriate lot size based on your risk tolerance and other factors:

Position Size = (Risk Amount) / (Stop Loss in Pips x Pip Value)

For instance, if you want to risk $200 on a trade, with a stop-loss of 50 pips and a pip value of $10, the calculation would be as follows:

Position Size = $200 / (50 x $10) = 0.4 Standard Lots

This formula ensures you stay within your risk limit while determining the optimal lot size for each trade.

Using a Lot Size Calculator

Given the complexities of calculating lot size manually, many traders opt to use a lot size calculator. These calculators consider your risk tolerance, stop-loss levels, and account balance, providing an accurate lot size recommendation for any trade. With a lot size calculator, traders can avoid costly mistakes and better manage risk.

Why Lot Size Matters in Trading

The size of the lot you trade directly affects both your potential profit and your risk exposure. Trading larger lot sizes amplifies both potential gains and losses, making it essential to choose the right lot size based on your trading strategy, risk tolerance, and market conditions.

In forex trading, understanding the nuances between standard, mini, and micro lots is crucial. For beginners or traders with smaller accounts, starting with micro or mini lots can help limit risk while still participating in the market.

Lot size is a fundamental concept in trading that impacts your risk management and overall trading strategy. Whether you're trading stocks, bonds, futures, or forex, selecting the right lot size is crucial for achieving success and managing risk effectively.

Utilizing a lot size calculator and determining the appropriate lot size for each trade can improve your decision-making and potentially enhance your trading performance.

Trade Smarter Today

Account

Account

Instantly