- XRP is stable above $2.00 as bulls eye a short-term recovery in a generally bearish cryptocurrency market.

- XRP ETFs record nearly $16 million in inflows as institutional demand steadies.

- A weak derivative market, with Open Interest averaging $3.79 billion, could suppress XRP recovery potential.

Ripple (XRP) steadies above the critical $2.00 level on Thursday, as bulls push to regain control as volatility and bearish sentiment persist across the crypto market.

XRP needs the support of institutional investors through the recently launched Exchange Traded Funds (ETFs) and other related investment products to ensure stability above $2.00 support and sustain its recovery in the fourth quarter.

XRP ETF demand signals institutional appetite

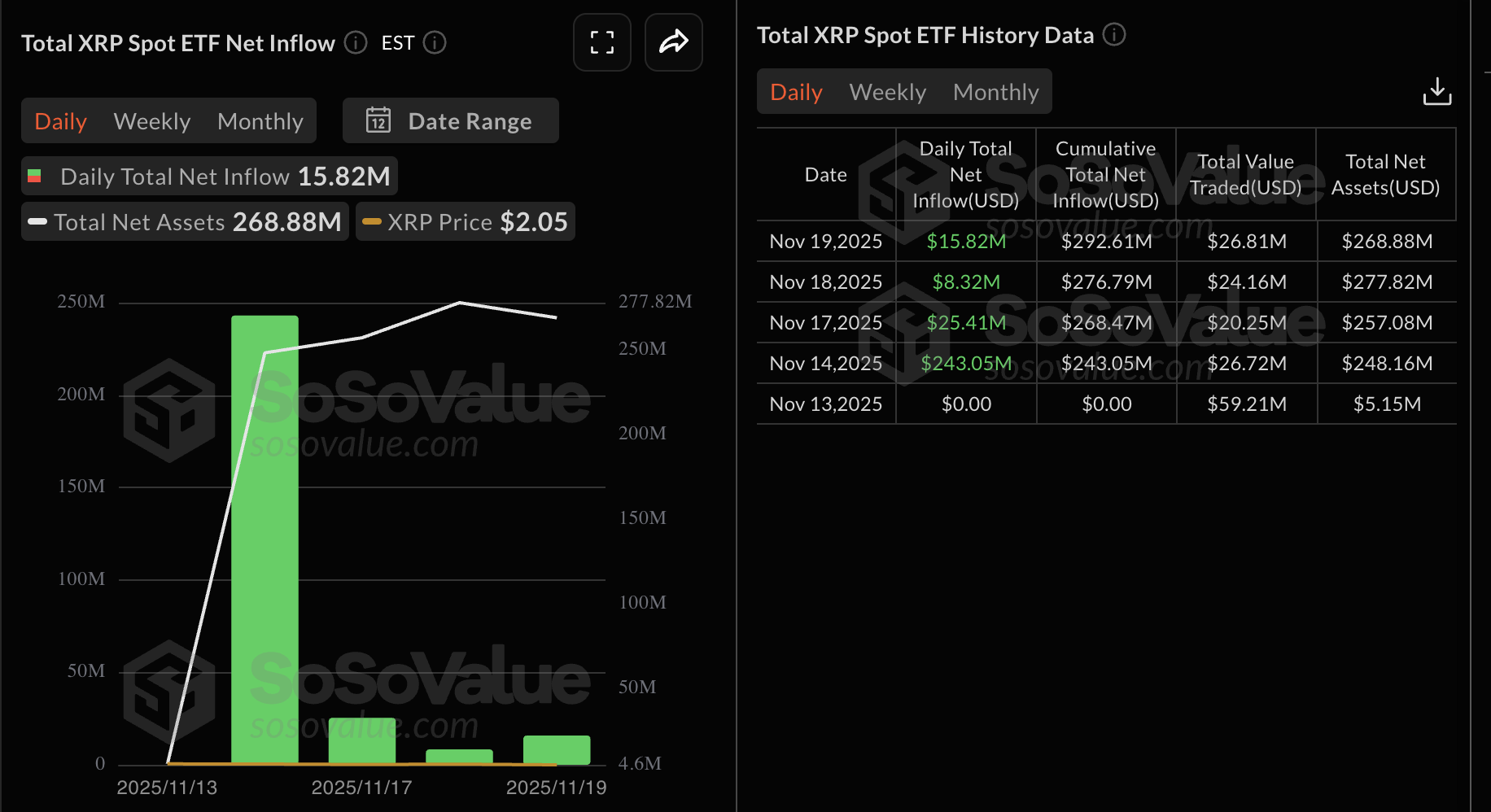

XRP spot ETFs extended their inflow streak with nearly $16 million streaming in on Wednesday. There are two XRP ETFs listed in the United States (US): Canary Capital's XRPC and Bitwise XRP. Combined, they have a total net inflow of approximately $293 million, with net assets averaging $268 million.

Since their October 28 debut, XRP ETFs have not experienced outflows, underscoring the growing risk appetite in altcoin-related investment products.

On the other hand, the XRP derivatives market has remained relatively muted since the October 10 flash crash. The futures Open Interest (OI) averages $3.79 billion on Thursday, down from Wednesday's $3.85 billion, according to CoinGlass data.

OI is a measure of the notional value of outstanding futures contracts; hence, a steady rise is required to support an XRP rebound in the near term.

Technical outlook: XRP seeks stability amid downward pressure

XRP holds above its short-term support at $2.00 on Thursday, as bulls strive to shape the trend in upcoming sessions. The cross-border remittance token remains below the 50-day Exponential Moving Average (EMA), the 100- and 200-day EMAs at $2.45, $2.57 and $2.54, respectively, with all three sloping lower.

The 50-day EMA running beneath the 200-day EMA highlights a Death Cross pattern, which reinforces a bearish setup. At the same time, the Moving Average Convergence Divergence (MACD) indicator remains below its signal and under the zero line, with the negative histogram slightly widening, suggesting strengthening bearish momentum.

The Relative Strength Index (RSI) at 37 stays under the midline, indicating sellers have the upper hand. A descending trend line from $3.66, XRP's record high reached on July 18, caps rebounds, with resistance seen near $2.72.

Overhead, the SuperTrend indicator descends near $2.58, aligning with the 200- and 100-day EMAs to form a heavy resistance band at $2.54-$2.57. The moving averages continue to roll over, so any bounce would face the first cap at the 50-day EMA at $2.45, and a daily close above that barrier could ease downside pressure.

The MACD indicator's stance beneath zero reinforces a bearish bias. Beneath these trend filters, bears remain in control; a break above $2.72 would be needed to improve the tone. Holding below the cited averages keeps risk skewed lower.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

(The technical analysis of this story was written with the help of an AI tool)