- Stellar price is finding support at the daily level of $0.253, suggesting a recovery ahead.

- On-chain data points to a potential rebound, with large whale accumulation and rising buy dominance supporting bullish sentiment.

- The technical outlook flashes early recovery signals, as the RSI shows bullish divergence.

Stellar (XLM) hovers around $0.258 at the time of writing on Monday, finding support around the key level, hinting at early signs of recovery. XLM's on-chain activity, led by whale accumulation and improving buy-side pressure, hints at a potential shift in momentum. Alongside this, bullish divergence in the Relative Strength Index (RSI) adds to the likelihood of a short-term recovery, as traders await confirmation of an upward move.

Stellar’s on-chain data suggests a bullish bias

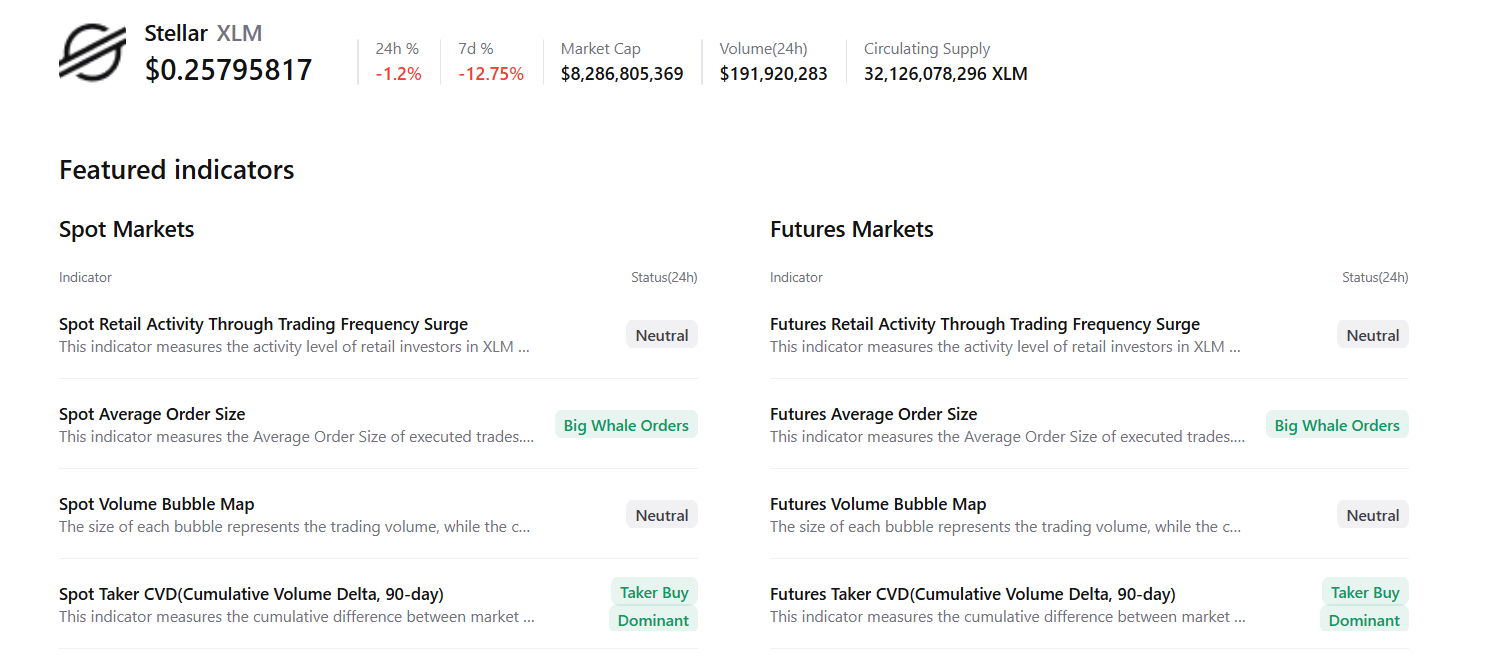

CryptoQuant summary data supports a positive outlook for XLM as both spot and futures markets show large whale orders and buy dominance, signaling a potential rally ahead.

Stellar Price Forecast: XLM shows bullish divergence in play

Stellar price faced rejection at the daily resistance at $0.297 last week and declined by nearly 12%. At the time of writing on Monday, it hovers around $0.258.

The daily XLM chart shows a bullish RSI divergence. The formation of a lower low on Sunday contrasts with the RSI’s higher highs during the same period. This development is termed a bullish divergence and often signals a trend reversal or a short-term rally.

If XLM recovers, it could extend the advance toward the daily resistance at $0.297.

However, if XLM continues its correction, it could extend the decline toward the weekly resistance at $0.221.