- Gold price climbs nearly 0.50% after Federal Reserve’s expected rate cut.

- Split Fed vote reveals policy uncertainty; Powell maintains a neutral outlook.

- Monetary statement highlights employment risks and persistent inflation pressures.

Gold (XAU/USD) registered gains of nearly 0.50% on Wednesday as the Federal Reserve cut rates by 25 basis points as expected, split with a 9 to 3 split vote, followed by the Chair Jerome Powell press conference, in which he struck a neutral stance. XAU/USD trades at $4,227 after bouncing off daily lows of $4,182.

Fed’s 25-basis-point rate cut lifts gold; Powell signals cautious optimism

Earlier, the Fed cut rates 25 bps with three dissenters being Governor Stephen Miran who opted for a 50-bps cut. Two Regional Fed Presidents, Jeffrey Schmid and Austan Goolsbee voted to keep rates steady.

The monetary policy statement was almost unchanged as it highlighted that employment risks are tilted to the downside, while inflation pressures continued to remain high. This was acknowledged by the Fed Chair Jerome Powell at his press conference, saying that there’s tension between the central bank’s dual mandate.

Daily digest market movers: Gold rallies on Fed’s dovish stance

- US Treasury yields are diving, with the 10-year benchmark note rate down three and a half basis points at 4.155%. US real yields, which correlate inversely with Gold prices, falls three and a half basis points to 1.895%, a tailwind for Bullion.

- The US Dollar Index (DXY), which tracks the Greenbacks’ performance against a basket of six peers, is down 0.58% to 98.65.

- Fed Chair Jerome Powell said that the central bank is “well positioned” to “wait and see” how the economy evolves, after easing policy 75 basis points this year. He added that the Fed funds rate is within the upper range of estimates for neutrality and that they will wait for economic data, which could be “distorted”.

- Powell said that after 175 basis points of cuts, “we have moved back our policy back down to where it is certainly not strongly restrictive at this point,” he said. “I think it is sort of in the range of neutral.”

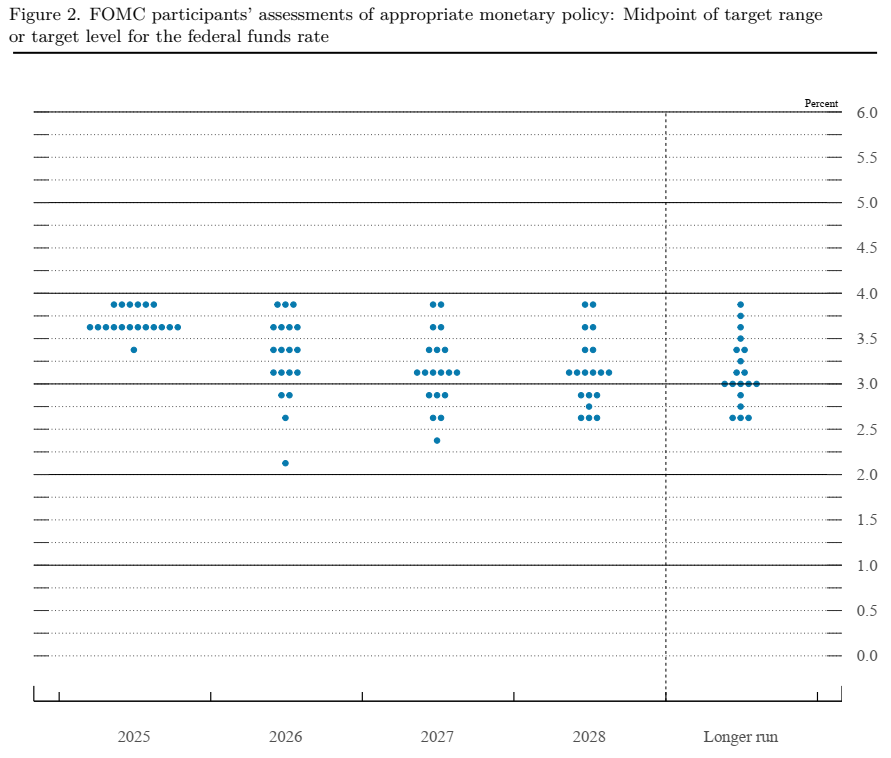

- The Summary of Economic Projections (SEP) revealed the “dot-plot” which showed that most members hinted that the fed funds rates for the next year would be at around 3.4%, implying that policymakers could cut 25 bps next year. For the longer term beyond 2028, Fed policymakers see neutral rates at around 3%.

Technical Analysis: Gold hovers around $4,200 amid dull session

Gold’s technical picture suggests that the uptrend might continue, but a slightly hawkish Fed could prompt traders to sell the yellow metal below the $4,200 milestone. Although momentum remains bullish, as shown by the Relative Strength Index (RSI), Bullion’s downside risks remain.

If XAU/USD drops below $4,200, the next support would be the 20-day Simple Moving Average (SMA) at $4,153, followed by the 50-day SMA at $4,090 and the $4,000 mark. On the flip side, if the Fed is dovish, Bullion could skyrocket towards $4,300 ahead of the record high of $4,381.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.