POPULAR ARTICLES

- XRP edges lower, targeting Monday’s low amid mixed signals from technical indicators.

- The XRP Ledger records a sharp increase in economic activity and on-chain transactions.

- Institutional demand for XRP ETFs steadies with inflows extending their positive streak to 13 consecutive days.

Ripple (XRP) is trading under pressure at the time of writing on Thursday, after bulls failed to break the short-term resistance at $2.22. The reversal may extend toward Monday’s low of $1.98, especially if risk-off sentiment persists in the broader cryptocurrency market.

XRP Ledger records highest on-chain activity in 2025

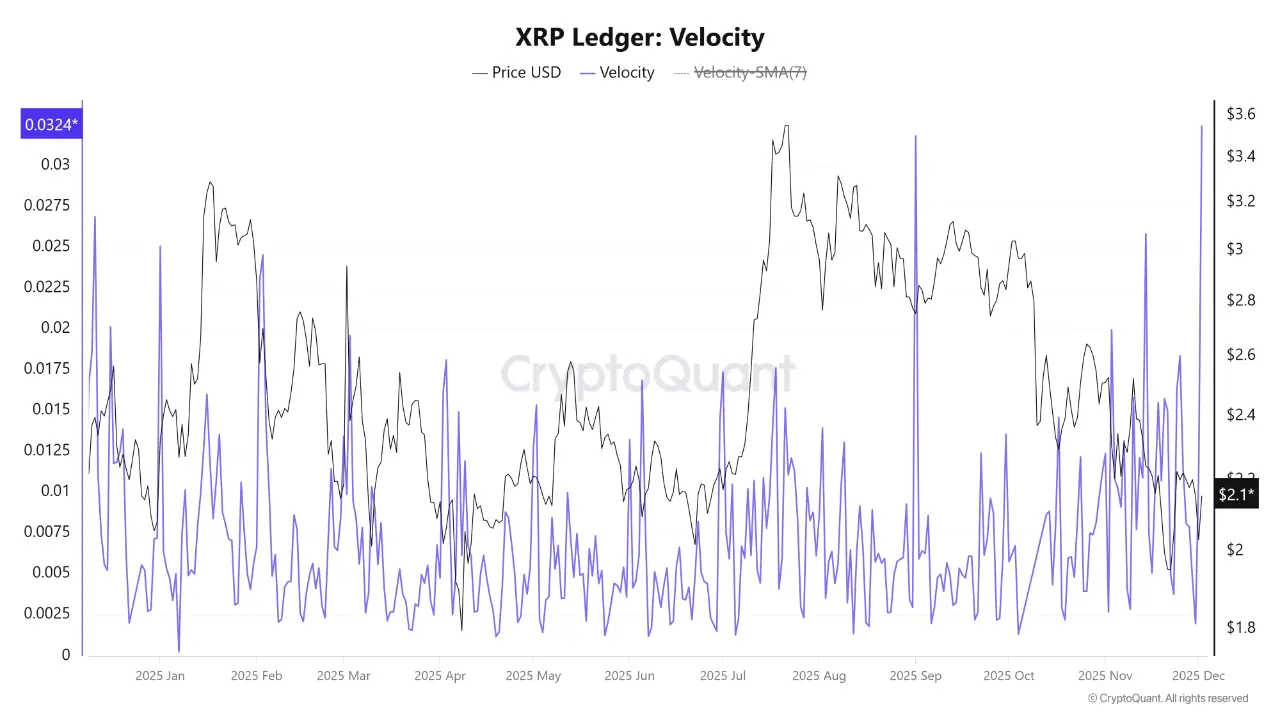

The XRP Ledger (XRPL) Velocity indicator shows that the blockchain recorded a significant spike in on-chain activity, with the index reaching a yearly high of 0.0324 on Tuesday.

According to CryptoQuant data, the Velocity metric, which tracks the frequency of an asset’s movement across the network, saw a sharp increase in economic activity and on-chain transactions.

“This level of circulation velocity suggests that instead of remaining dormant in cold wallets or being held for the long term (HODL), XRP coins are rapidly changing hands among market participants,” CryptoOnchain analyst stated on CryptoQuant's Quicktake section.

The XRPL on-chain data shows that the network is experiencing a significant surge in user engagement, regardless of market direction.

The XRP derivatives market also saw a minor increase in retail demand, with futures Open Interest (OI) averaging $3.85 billion on Thursday, up from $3.75 billion on the previous day. OI, which measures the notional value of outstanding futures contracts, had declined to $3.19 billion on November 22, the lowest level since April 22.

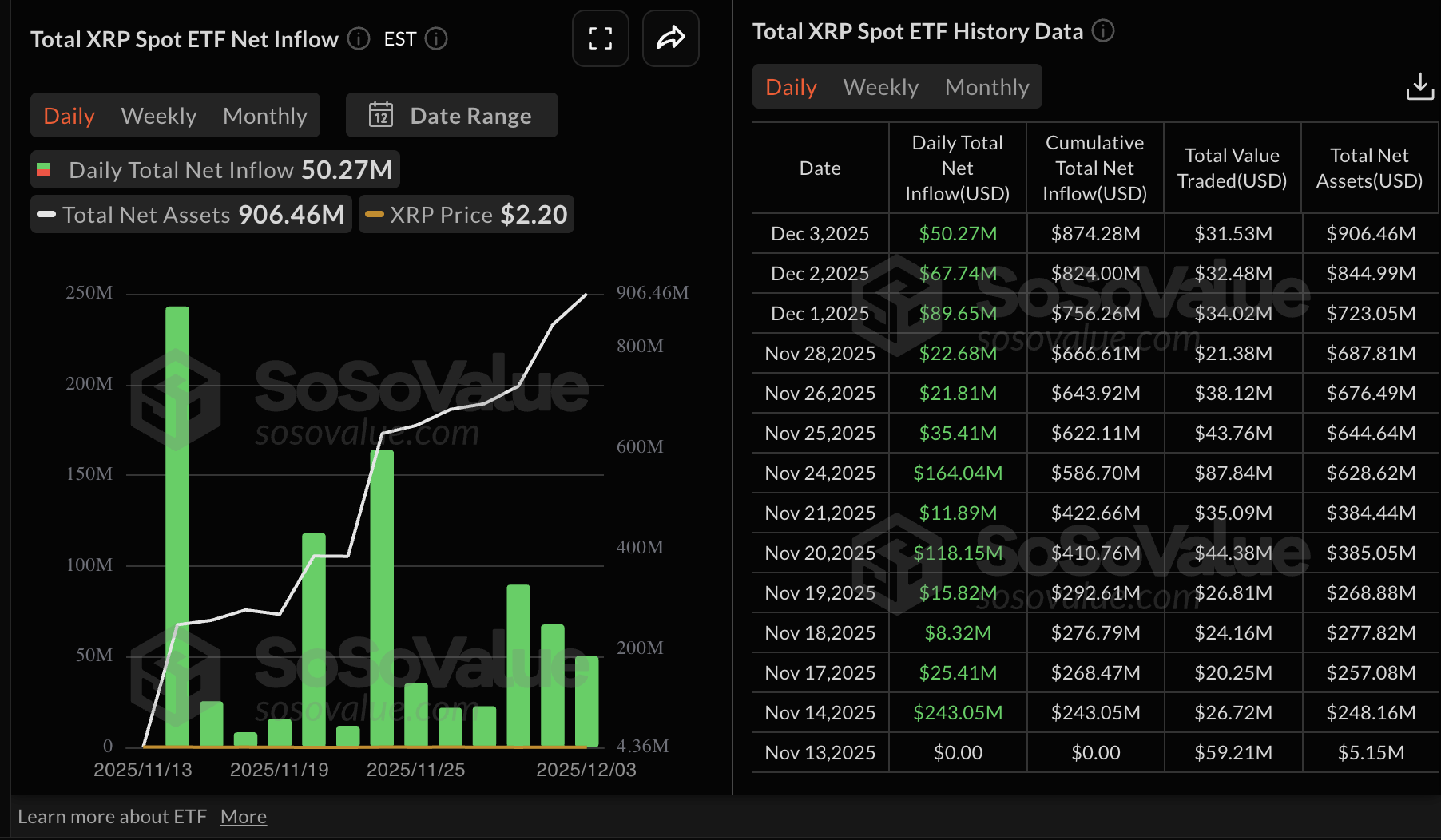

Institutional interest in XRP spot Exchange Traded Funds (ETFs) has also remained steady since their debut on November 13. SoSoValue data shows that US-listed XRP ETFs recorded approximately $50 million in inflows on Wednesday, bringing cumulative inflows to $874 million and net assets to $906 million.

Steady ETF inflows support positive sentiment, encouraging investors to increase exposure and anticipate a sustained uptrend.

Technical outlook: XRP recovery falters amid mixed signals

XRP is sitting above Monday’s low of $1.98 at the time of writing on Thursday. The cross-border remittance token also holds below the descending 50-day Exponential Moving Average (EMA) at $2.31, the 100-day EMA at $2.47, and the 200-day EMA at $2.49, all of which point to a bearish bias.

The Relative Strength Index (RSI) at 46 remains in bearish territory on the daily chart, as bullish momentum wobbles. If the RSI dips further toward the oversold region, it will signal increasing bearish momentum.

Still, the Moving Average Convergence Divergence (MACD) indicator on the same chart has maintained a buy signal since November 25. XRP would repair its bullish outlook if the blue MACD line remains above the red signal line, while the green histogram bars expand.

To invalidate the bearish thesis, the 50-day EMA at $2.31 should flip into support, while a break above the descending trendline could boost XRP’s recovery potential toward $3.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.