Bitcoin Crashes, YTD Gains Wiped Out as Market Sentiment Turns Deeply Bearish

On Sunday, 16 November, Bitcoin briefly fell to as low as 93,392.3 US dollars, meaning it has completely given back all of its gains from 2025. This decline marks a roughly 20% drop from the all-time high of 126,251 US dollars set on 6 October 2025, technically confirming that Bitcoin has entered a bear market.

(Image: chart, histogram – description auto-generated)

Wave of Liquidations Hits, Sentiment Turns Gloomy

According to data from Coinglass, nearly 160,000 traders saw their positions liquidated in the crypto market over the past 24 hours, with total liquidations reaching 580 million US dollars. Long positions accounted for 410 million US dollars in liquidations, while shorts made up 170 million US dollars, underscoring how leveraged long traders have borne the brunt of the latest downturn.

Sentiment analytics platform Santiment reports that negative discussions around Bitcoin, Ethereum and XRP have surged sharply, while the ratio of positive to negative comments has dropped significantly. Overall sentiment is now well below normal levels.

Capital Pulls Back as Whales Dump Holdings

Patrick Munnelly of Tickmill Group noted in a report that major investment funds, ETF investors and corporate treasury departments have withdrawn from Bitcoin, removing the “key pillars that supported this year’s rebound” and thereby “ushering in a new phase of market fragility.”

On-chain data shows that long-term Bitcoin holders have sold around 815,000 BTC over the past 30 days — the highest level of selling activity since early 2024. More importantly, “whale” wallets that have held Bitcoin for more than seven years have been offloading coins at a pace of more than 1,000 BTC per hour.

Institutional Views and Market Outlook

Research firm 10x Research has stated outright that the crypto market has entered a “confirmed bear market phase.” Weaker ETF inflows, continued selling from long-term holders and subdued retail participation all point to a stealth deterioration in sentiment.

Matthew Hougan, CIO of Bitwise Asset Management, commented: “Overall sentiment across markets has turned risk-off. Crypto is the canary in the coal mine — it’s the asset that retreats first.” That said, he still regards the current pullback as a buying opportunity.

Fed Watch: Minutes Due, Hawkish Expectations Curb Room for Rate Cuts

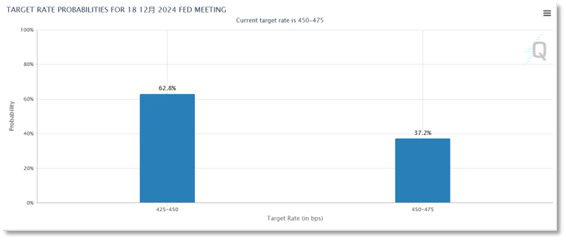

The Federal Reserve will release the minutes of its October monetary policy meeting at 3:00 a.m. Beijing time on 21 November. The document will shed light on how officials debated inflation and the path for rate cuts, particularly against the backdrop of Trump’s tariff policies that could add upward pressure to inflation.

According to the CME FedWatch tool, expectations for a December rate cut have cooled significantly. Markets now assign roughly a 37% probability to the Fed keeping rates unchanged in December, down from 24% one month ago. Bloomberg’s interest-rate futures indicate that markets are now pricing in just 40 basis points of rate cuts for the whole of 2025 — less than two cuts in total.

Fed officials at the October meeting broadly supported a cautious approach to future rate reductions. Some policymakers suggested that if inflation remains elevated, the Fed may consider pausing rate cuts and keeping borrowing costs at restrictive levels. Economists at BofA Securities believe that two consecutive 0.3% readings on core PCE inflation would prompt the Fed to reassess its policy outlook.

The Key Battleground for US Bulls and Bears: Nvidia Earnings

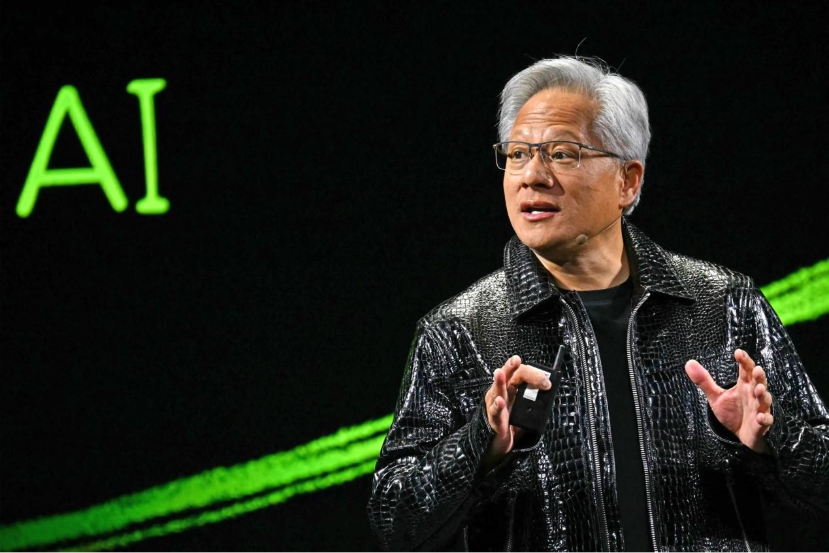

Nvidia is scheduled to report its fiscal Q3 2026 results in the early hours of 21 November Beijing time. The market is watching closely, as this is not only a scorecard for the chip giant itself but is also viewed as a crucial litmus test for the strength of the AI boom.

Despite concerns around the upcoming report, some analysts remain bullish on the stock — as highlighted by coverage from The Wall Street Journal.

Given that Nvidia accounts for around 8% of the S&P 500’s weight, large swings in its share price can directly drive the index higher or lower. Its earnings are seen as a barometer for AI-related demand and the overall health of the sector. A strong set of results could lift AI names broadly (such as AMD, Broadcom and other semiconductor firms). Conversely, a miss could reignite worries about an AI bubble and trigger a sector-wide pullback.

At the same time, Nvidia’s earnings will provide the most direct read-through on capital expenditure plans among downstream players such as cloud providers and AI application companies. If Nvidia delivers strong results and guidance, it would suggest that major customers like Microsoft and Amazon are still ramping up investment in AI infrastructure — a clear sign that global AI spending remains in a high-growth cycle. Investors are likely to focus on the following key areas in this report:

AI Chip Supply–Demand Dynamics and the Blackwell Platform

The biggest question for the market is whether AI chip orders from large cloud service providers (such as Microsoft and Amazon) remain robust. Investors are hoping the numbers and guidance will offer solid evidence of sustained demand, alleviating concerns that the AI boom may be slowing.

As Nvidia’s new-generation AI chip architecture, the Blackwell platform is at the center of attention. Markets are watching closely to see whether its ramp-up in production is progressing smoothly and whether it can become the core growth engine in the coming quarters. Previous reports have described demand for Blackwell chips as “staggering,” and the actual delivery performance will directly influence market sentiment.

CEO Jensen Huang has previously said that the company’s supply chain team is “doing an excellent job” in boosting Blackwell output. Investors will be looking for signs that bottlenecks in critical components such as CoWoS packaging and high-bandwidth memory (HBM) are easing.

Margins and Forward Guidance

Although Wall Street is forecasting a relatively high gross margin for this quarter, one risk to watch is that the initial ramp of the new Blackwell chips could temporarily pressure overall margins due to higher upfront costs. Gross margin already slipped slightly in the previous fiscal quarter.

The company’s revenue and profit guidance for the next quarter will matter even more than past performance. Market expectations currently center on next-quarter revenue of around 43 billion US dollars. Any guidance meaningfully above or below that level could trigger sharp moves in the share price.

Competitive Landscape and Geopolitics

Investors will also be monitoring whether companies such as DeepSeek — which claim to build AI models at significantly lower cost — pose any tangible threat to Nvidia from the demand side.

In addition, US export controls on advanced AI chips destined for China remain a major source of uncertainty for Nvidia. The market wants to hear more about the company’s progress in adapting to these rules and in developing compliant products that can still serve key markets.