POPULAR ARTICLES

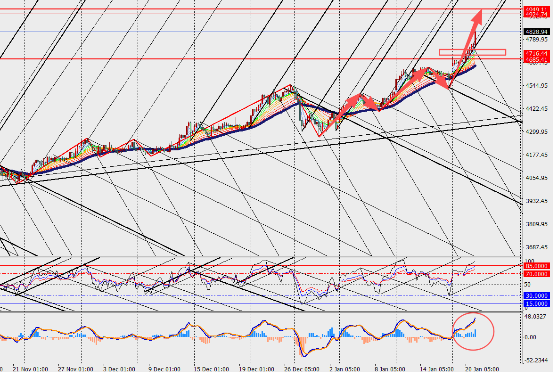

Trump’s hardline stance on Greenland has led to a sharp deterioration in US–EU relations. Renewed tariff threats have brought back the spectre of a trade war, while heightened geopolitical uncertainty—combined with a weaker US dollar and rising rate-cut expectations—has driven gold to a record high of USD 4,800.

With safe-haven demand surging, US equities and bonds have come under pressure. Investors are now closely watching whether the Davos Forum can help cool tensions. If the standoff persists, gold could challenge the psychological USD 5,000 level and cement its place as one of the most defensive assets of 2026.

Trump’s latest statement on Greenland has completely upended international relations. On Tuesday, he publicly declared on social media that there would be “no turning back” and said he did not rule out the use of force to seize the Arctic island from Denmark. He even shared AI-generated images of himself standing on Greenland, holding the US flag aloft.

This aggressive posture not only undermines NATO unity, but also directly threatens the trade interests of European allies. Last year, the US and Europe already endured months of turmoil over tariff disputes. Now Trump has once again brandished the tariff weapon, warning that if countries such as France block his plans, he will impose tariffs of up to 200% on wine and champagne. The move caught European leaders off guard. French President Emmanuel Macron bluntly stated that the EU must not bow to pressure, while European Commission President Ursula von der Leyen called for Europe to build a new form of strategic autonomy and reduce its dependence on the United States.

Gold’s latest surge is not an isolated move, but the result of geopolitical uncertainty and macroeconomic factors intersecting.

First, safe-haven demand is the primary engine behind the rally. With Trump’s tariff threats sending US–EU relations to the brink, investors fear a repeat of the market chaos seen after last year’s Liberation Day. As a non-yielding asset, gold tends to stand out in periods of economic and political instability. In 2025, gold prices already soared 64% in aggregate, and have risen a further 10% since the start of 2026. This powerful uptrend is a direct reflection of rising global tensions.

Second, dollar weakness is providing additional support for gold. The softer greenback stems from growing investor concerns about the United States, including potential retaliatory measures from its partners and an accelerating trend of de-dollarisation. This combination has amplified gold’s rally and pushed prices into uncharted territory. As demand for hedging political risk increases, gold is now firmly targeting the USD 5,000 psychological barrier—more than just a round number, it is a mirror of investor sentiment.

Market Commentary:

Overall, Trump’s Greenland ambitions have detonated a geopolitical earthquake that is shaking every corner of global financial markets. In this turmoil, gold has emerged as the clear winner—not only refreshing its all-time highs, but also reaffirming its status as the premier safe-haven asset. Looking ahead, if the deadlock between the US and Europe continues and trade tensions escalate further, a decisive break above USD 5,000 in gold prices is no longer out of reach.