POPULAR ARTICLES

As 2026 gets underway, global financial markets have been rocked by a major shock. The United States launched a surprise military operation against Venezuela, directly arresting President Nicolás Maduro and his wife. The move is widely seen as the most direct and dramatic intervention in Latin America since the US invasion of Panama in 1989.

This is not just a political event, but yet another powerful reaffirmation of gold’s status as the ultimate safe-haven asset. Against the backdrop of pervasive global uncertainty, the bull market in gold appears to be entering a new, more intense phase.

On 3 January 2026, US special forces arrived by helicopter in Caracas, swiftly breaking through Maduro’s security detail and extracting him from a safe house. Then, on Monday 5 January, the Maduro couple were brought before a federal court in New York, facing multiple serious charges including “narco-terrorism” and conspiracy to import cocaine.

President Trump has made no effort to conceal the motives behind the operation. Beyond targeting what he calls a major drug-trafficking network, he has openly stated that the United States intends to open up Venezuela’s vast oil resources, bringing US oil companies back in to rebuild the country’s energy infrastructure. He has even warned that if the new Venezuelan government does not cooperate, a second strike will be launched — and hinted that operations could extend to Colombia and Mexico.

The action has shaken the international community. The UN Security Council convened an emergency session to debate its legality; Russia and other countries issued strong condemnations, while many of Washington’s traditional allies adopted a restrained tone, merely stressing the importance of dialogue and the rule of law. Inside Venezuela, Vice President Delcy Rodríguez was sworn in as interim president. Although she voiced support for Maduro, her stance was relatively moderate and fell short of calling for outright resistance.

Though brief, the raid has fundamentally altered the geopolitical landscape in Latin America. Uncertainty around energy supply has risen sharply, prompting global investors to rush into gold as a safe haven.

Market Commentary:

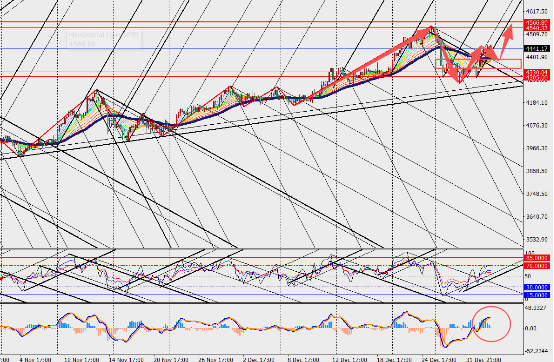

As we enter 2026, the gold market has extended the strong momentum seen in 2025. Last year, supported by geopolitical flashpoints and a dovish Federal Reserve rate cycle, gold rallied 64% for the year, repeatedly setting fresh record highs.

The Venezuelan situation has clearly reawakened safe-haven demand at a time when markets were already on edge over geopolitics, energy supplies and monetary policy. If tensions continue to escalate, gold is highly likely to make another run at new record levels.