POPULAR ARTICLES

Huang’s CES 2026 speech marked a change in tone. This time, he didn’t focus on gaming GPU performance. Instead, he systematically explained Nvidia’s strategic pivot from “generative AI” toward “physical AI.”“Physical AI” refers to artificial intelligence that not only generates text and images, but also understands the causal laws of the physical world and takes action in real environments—whether it’s driving a car or operating a robot.Despite the grand vision, capital markets reacted cautiously: Nvidia’s share price dipped slightly after the keynote.

Key Highlights From Jensen Huang’s Speech

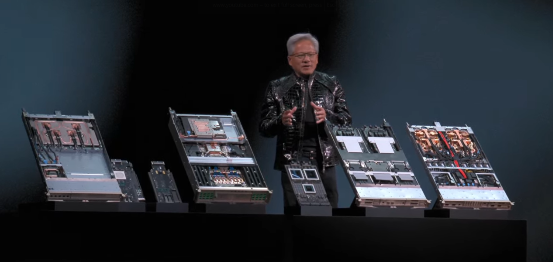

1. Vera Rubin Superchip Platform in Full Production

The first major bombshell was the announcement that the new-generation AI superchip platform Vera Rubin has entered full production and is expected to start shipping as early as the second half of this year.

According to Nvidia’s figures, Rubin’s performance is striking:

Training performance is 3.5× that of the previous-generation Blackwell;

AI software runtime efficiency is 5× higher;

The cost per “token” of generated inference output has fallen to one-tenth of Blackwell’s.

In other words, the cost and energy consumption of running large-scale AI models could come down dramatically.

Huang emphasized that this breakthrough stems from “deep co-design” with TSMC in advanced process nodes, advanced packaging, and even silicon photonics—an extreme, system-level innovation that pushes past the slowdown of Moore’s Law. Tech giants such as Amazon, Google, and Microsoft are already planning to be first-wave adopters in 2026.

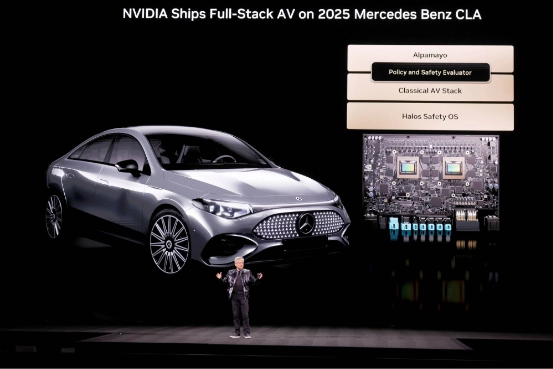

2. Alpamayo – An Open-Source Inference Model for Autonomous Driving

Huang then introduced Alpamayo, an inference model custom-built for autonomous driving.

The model is designed as an end-to-end system with “thinking and reasoning” capabilities, enabling vehicles to understand unexpected situations such as malfunctioning traffic lights, and to explain their own decision-making. The first mass-production car equipped with this technology, the 2025 Mercedes-Benz CLA, is set to hit U.S. roads this quarter.

More importantly, Nvidia has decided to open-source Alpamayo. Huang’s rationale:

“Only when it is open-sourced can you truly trust how the model was created.”

Behind this lies a clear platform strategy: by open-sourcing a core model, Nvidia aims to attract the entire industry to build on its hardware and software ecosystem—much like how Android became the foundational platform in the mobile era.

These two major announcements ultimately serve a much bigger story: Physical AI.Huang stressed that the next decisive wave of AI is about taking AI out of the purely digital world, enabling it to perceive, reason, and act in real environments. Autonomous driving and general-purpose robotics are the two most important application arenas for Physical AI.To support this, Nvidia showcased its full-stack capabilities integrating training, inference, and simulation. Using the Omniverse digital-twin platform, robots can carry out massive trial-and-error learning in virtual worlds before being deployed in the real world.This marks a clear shift in Nvidia’s ambition—from merely providing compute chips to defining the “brain” and “nervous system” of intelligent entities.

Why Was the Market Reaction So Muted?

Given such a bold vision, why did Nvidia’s share price fall instead of rise? The subdued reaction reflects how investors are recalibrating their frameworks now that the AI trade has entered a new stage.

1. High Expectations and the Pressure of a Lofty Base

Nvidia’s share price has already booked an extraordinary rally in recent years, with its market capitalization at one point surpassing USD 5 trillion. The market already assumes it will maintain a dominant industry lead.While Rubin is undeniably powerful, it still sits within the “one-generation-per-year” upgrade cycle that many investors already anticipated. When the most optimistic scenarios are fully priced in, any development that does not dramaticallyexceed expectations can trigger profit-taking.

2. Markets Now Want Concrete Returns

At the end of 2025, companies such as Oracle and Broadcom saw their shares tumble due to aggressive AI capex, sounding an alarm for the broader AI sector.

Investors are paying closer attention to:

the payback period for massive AI investments, and

the extent of real-world demand.

So even though Huang repeatedly said that “AI demand is bursting through the roof,” the market wants to see more concrete evidence on:

customer adoption rates,

pricing power, and

the sustainability of profit margins.

This keynote focused primarily on long-term technological positioning rather than near-term financial guidance, and it did not fully quell those concerns.At the same time, open-sourcing Alpamayo is a savvy ecosystem move, but it also raises questions about technical moats and monetization. In an increasingly competitive AI-chip landscape, investors have to weigh whether open-sourcing could erode Nvidia’s long-term pricing power.

3. A Sober View of the Challenges of Physical AI

Autonomous driving and general-purpose robotics are widely recognized as “hard bones to chew.” Their commercialization complexity and regulatory hurdles far exceed those of data-center AI.

The market acknowledges their enormous potential, but has a more realistic view of how long it might take for these technologies to scale profitably. The keynote paints an inspiring future—but the road to that future is still long and full of uncertainty.

Outlook: Reframing How We See Nvidia

Short-term share price swings do not change Nvidia’s status as the undisputed king of AI infrastructure. In essence, this CES keynote represents a pivotal moment in Nvidia’s evolution—from a leading chip supplier to a foundational platform provider in the era of AI and Physical AI.

1. The Moat Is Widening, Not Narrowing

Nvidia’s edge now extends far beyond GPUs. Through CUDA-X software libraries, the Omniverse simulation platform, open-source models, and full-stack system design from chips to switches, Nvidia has built an ecosystem that is extremely complex and sticky.As some analysts have noted, even if major cloud providers push ahead with in-house chips, Nvidia’s deeply integrated platform is becoming “increasingly difficult to dislodge.” Rubin’s eye-popping performance gains and cost reductions are a tangible expression of this system-level advantage.

2. Physical AI: The Next Trillion-Dollar Track

Huang estimates the market opportunity for Physical AI in manufacturing and logistics alone at USD 50 trillion.By entering autonomous driving and robotics, Nvidia is tapping into a potential incremental space even larger than its current data-center market. Its deep partnerships with industrial giants such as Siemens suggest that Nvidia is extending its reach into the core of the real economy.

3. An Evolving Investment Thesis

Investing in Nvidia can no longer be viewed simply as a cyclical bet on AI chips. It is increasingly a long-term investment in the digitization of the physical world through AI.

Going forward, its valuation will hinge more on the health of its platform ecosystem, market share in emerging Physical AI domains, and its ability to translate technological leadership into stable free cash flow.

Jensen Huang’s CES 2026 keynote opens a new chapter for Nvidia in the age of Physical AI. The center of gravity in AI competition is shifting—from generating content to acting in the physical world.

For traders, however, clearly understanding the market’s prevailing expectations and risk appetite may be even more important than the grandness of the long-term vision in the short run.