Due to the lack of key U.S. data, the market has been missing potential catalysts. After two weeks of heavy declines, selling pressure in gold has eased.

Recently, precious-metals bulls have carved out a solid price floor. Still, investors need new, fundamentally bullish drivers to ignite a strong rally—something that has yet to emerge. As U.S. equities start to slip, a rebound in gold could follow.

Commerzbank notes gold may trade sideways in the short term. Although trade-policy tensions have cooled somewhat, broader conflicts remain unresolved. Thus, even with a recent uptick in the U.S. dollar, safe-haven demand for gold could persist.

Markets expect the Federal Reserve to deliver more aggressive rate cuts than currently priced. As U.S. economic data resume and the fog lifts, price action could move in the anticipated direction—supporting gold. With stagflation risks re-emerging, gold remains an attractive asset.

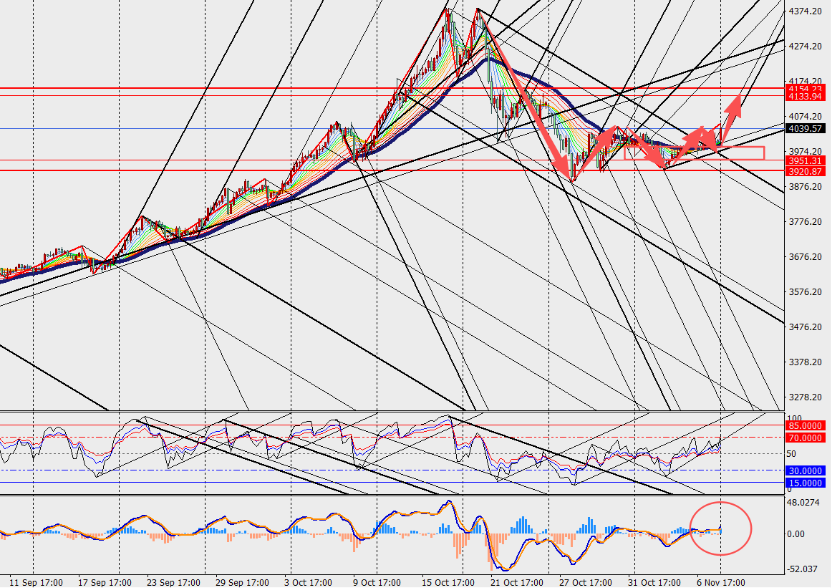

Gold’s consolidation around $4,000 reflects a tug-of-war between strong fundamental support—particularly central-bank buying and safe-haven inflows—and technical pressures from profit-taking and a firmer dollar.

The December FOMC meeting is a key focus. It could either trigger a breakout from the current range or cap further near-term upside. Despite the sideways pattern, upside room remains, and a sustained break below $4,000 may be difficult.

Beyond Fed policy, investors are also watching U.S. equities as a potential catalyst. With stocks near record highs, many see gold as a compelling portfolio diversifier.

Market take

Gold’s consolidation near $4,000 looks like a classic pause within a structural uptrend. Over the past week, prices have traded between $3,950–$4,060. The key question is skew: risks appear tilted to the upside.