POPULAR ARTICLES

Jensen Huang’s latest speech marked a key shift in focus: away from a narrow “compute race” and toward a broader “data infrastructure race.”

He laid out a simple but powerful logic: more powerful and complex AI models don’t just need faster processors for training and inference — they also require massive, high-speed memory to access data in real time, plus virtually unlimited storage space to hold the raw data “fuel” used to train those models.

This view goes straight to the heart of today’s industry bottleneck. As global cloud giants and AI firms race to build out data centres, demand for AI-server-grade memory (such as HBM) has exploded. That demand has been so intense that it has severely squeezed production capacity previously allocated to traditional consumer electronics (such as smartphones and PCs).

Market-research firm TrendForce notes that since February 2025, prices for certain memory chips have more than doubled. A growing industry consensus is taking shape: memory has become the next key constraint — and investment hotspot — for AI development, following on from leading-edge logic chips.

During U.S. trading on 6 January, memory-semiconductor stocks staged a broad-based surge. SanDisk jumped more than 24%, Western Digital climbed over 16%, and Seagate Technology gained more than 14%. These double-digit moves stood out sharply across the broader U.S. market that day.

As America’s largest DRAM maker, Micron was the undisputed focal point of the move. Its share price closed 10.04% higher on 6 January at USD 343.48, with exceptionally heavy volume. Even more striking, its one-day trading value reached USD 15.974 billion, ranking third among all U.S. stocks. This was clearly not just a technical rebound, but a wave of aggressive, trend-driven buying by large pools of capital.

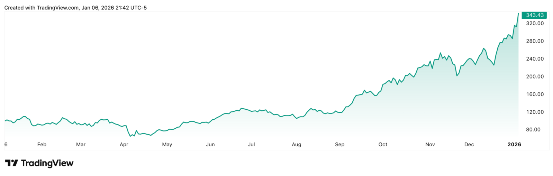

Historical Lesson: The “Storage Winners” Behind the S&P 500 in 2025

Looking back at 2025 as a whole, the standout stars of the S&P 500 were not the much-talked-about “Magnificent Seven” tech giants, but a handful of “old-school” data-storage infrastructure names.Western Digital, Micron Technology and Seagate Technology delivered annual share-price gains of roughly 268%, 227% and 219%, respectively — taking the top three spots on the S&P 500 performance leaderboard.

In the early phase of the AI boom, investors locked their attention on Nvidia’s compute chips. But as the tidal wave of capex flowed downstream along the value chain, the market gradually realised that massive data storage and high-speed access are just as critical as compute itself — and were rapidly becoming the new bottleneck.

The industrial logic behind this “storage miracle” is crystal clear. On one hand, training and running large language models requires handling enormous volumes of data, driving requirements for storage capacity and bandwidth far beyond that of traditional servers. On the other hand, global semiconductor capacity has been shifting toward high-end memory products such as HBM, which has objectively squeezed supply of more conventional storage products.

The result has been a broad-based price surge across the storage industry, from NAND flash to HDDs. As Morgan Stanley analysts put it, data is the “crude oil that powers artificial intelligence,” and storage manufacturers are the key players responsible for extracting and refining this “oil.”

Looking Ahead: “Supercycle” or Cycle Peak?

From today’s vantage point, the market narrative for storage stocks is increasingly framed around the idea of a “supercycle.”Views from top-tier investment banks are converging. Analysts at JPMorgan and others estimate that the current uptrend could extend into 2027 or even beyond. Micron’s CEO has previously suggested that tight market conditions in memory may persist beyond 2026.

In China, leading research firm CCID Consulting used the term “storage ‘supercycle’” explicitly in its 2026 IT Trendsreport, arguing that surging AI demand combined with mid-range capacity shortages will ignite the storage market in 2026. Meanwhile, Citi and Morgan Stanley’s Asia-Pacific teams, factoring in expectations for higher memory-chip prices, have sharply raised their 2026 operating-profit forecasts for Samsung and SK Hynix — by as much as 253% and 224%, respectively.

However, history also serves as a stark reminder that the storage industry is highly cyclical. Soaring prices inevitably spur capex and capacity expansion, which may eventually lead to a supply-demand reversal at some point down the road.Some analysts are already sounding a note of caution: when investors start piling into second-tier names simply because the leaders’ share prices look too expensive, it often signals that the cycle has entered its later stage.

In addition, Jensen Huang’s remarks at CES about next-generation chip-cooling technologies triggered a sharp sell-off in data-centre liquid-cooling stocks — once again underscoring how even subtle shifts in technology roadmaps can spark violent moves in niche segments during an AI investment boom.