POPULAR ARTICLES

- The total crypto market inches closer to the record high of $3.73 trillion, targeting the $4 trillion mark.

- A resurgence of risk-on sentiment drives the total market Open Interest to a record high of over $171 billion.

- The crypto market experienced liquidations exceeding $1 billion over the last 24 hours, as Bitcoin inches closer to $120,000.

The cryptocurrency market trades for the fourth consecutive day in green on Friday, driven by Bitcoin’s (BTC) seemingly unstoppable rally towards $120,000. At the time of writing, Bitcoin is holding above $118,000, fueling Open Interest in the derivatives market to record highs and short liquidations exceeding $1 billion in the last 24 hours. A clear bullish bias is evident in the market, which could drive the total crypto market capitalization to the $4 trillion threshold.

Bitcoin above $118,000 fuels market-wide optimism

Bitcoin’s sudden boost in bullish momentum could have been catalyzed by the rising anticipation of interest rate cuts by the US Federal Reserve (Fed) after the release of the Fed’s minutes on Wednesday. The bullish run in BTC fuels optimism in derivatives, resulting in a record-high in open interest.

CoinGlass’ data shows that the total crypto derivatives market Open Interest (OI) reached $171.65 billion, while the BTC OI hit $81.36 billion at press time on Friday.

Open Interest data. Source: Coinglass

Sidelined investors may view this as a bullish signal, as capital inflows in the derivatives market, driven by increased buying activity, fuel the OI surge.

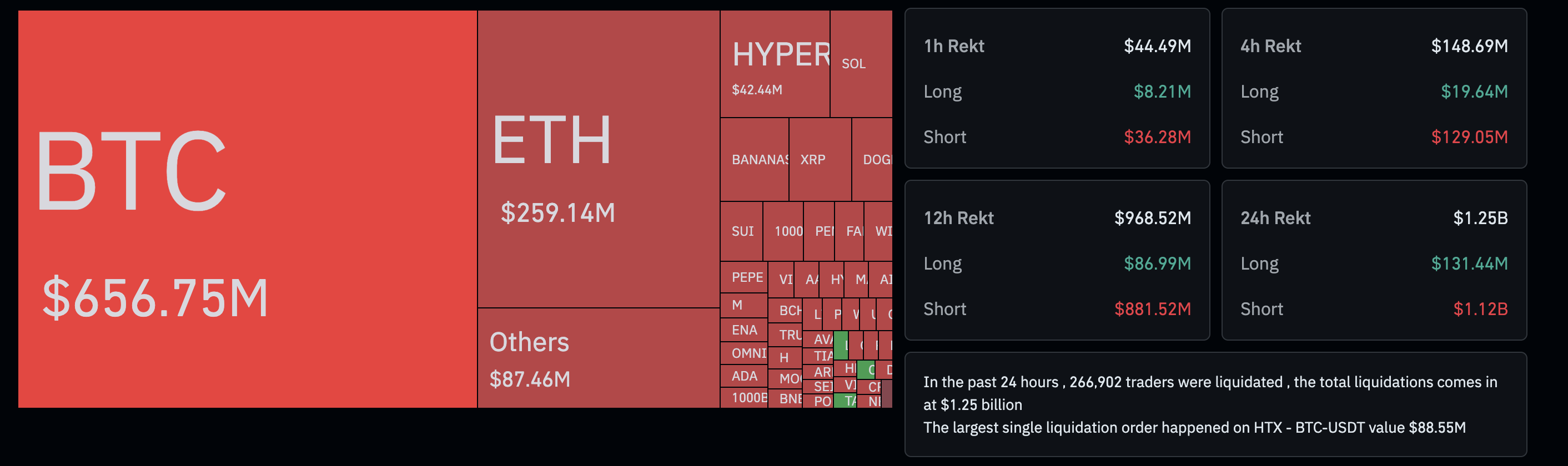

Alongside the rising OI, liquidations in the crypto market reached $1.25 billion in the last 24 hours, resulting in a massive shakeout of bearish positions worth $1.12 billion, compared to $131.44 million of long positions. It is worth noting that the single largest liquidation occurred on the HTX exchange in the BTC/USDT pair, valued at $88.55 million.

Crypto Liquidations. Source: Coinglass

Overall, the increased Open Interest in the market and the wipeout of bearish positions indicate rising optimism in the derivatives market, which increases the possibility of a leverage-driven rally ahead.

Crypto market eyes $4 trillion valuation as bullish momentum builds

The total crypto market capitalization is valued at $3.62 trillion at press time on Friday, supported by Bitcoin’s rally to a record high, with BTC accounting for over 64% of the total market capitalization. The bullish run in the crypto market is inching closer to its highest valuation of $3.73 trillion, recorded on December 17.

Total crypto market capitalization. Source: Tradingview

CoinMarketCap’s Fear and Greed Index, at 67, suggests a gradual rise in greed among investors, indicating an increased risk appetite in the broader market sentiment.

Fear and Green Index. Source: CoinMarketCap

If the trend continues, the crypto market capitalization could reach a new record in just eight months. In such a case, investors could witness increased inflows in the market, potentially driving the valuation to $4 trillion mark, at par with NVIDIA’s market capitalization.