- XRP bulls aim for a breakout above the 50-day EMA as the cryptocurrency market rebounds on Wednesday.

- Active addresses on the XRP Ledger increase by 40% to approximately 32,000, signaling growth and adoption within the ecosystem.

- Retail demand for XRP remains significantly subdued, with the Open Interest sliding below $4 billion.

Ripple (XRP) is experiencing a mild rebound, trading above $2.40 at the time of writing on Wednesday. The uptick can be attributed to risk-on sentiment, as Bitcoin (BTC) extends gains above $104,000.

Still, sentiment in the derivatives market remains subdued, calling for caution until a steady uptrend is established.

XRP active addresses surge, backing bullish outlook

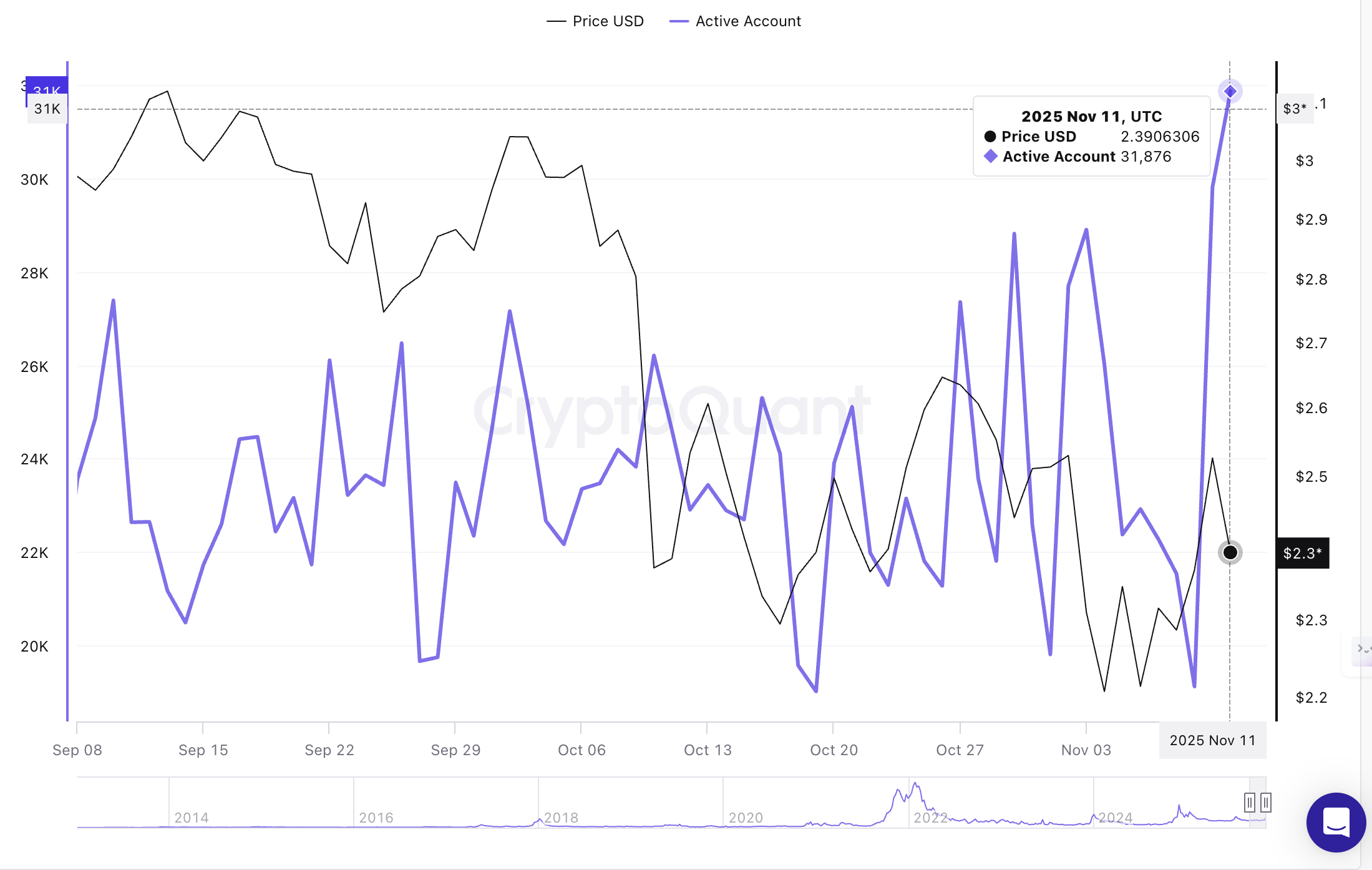

The number of active addresses on the XRP Ledger (XRPL) has increased by 40% to approximately 32,000 as of Tuesday from 19,000 on Sunday. This surge indicates rising user activity and engagement within the network, which in turn increases on-chain demand for XRP and the odds of price momentum.

A steady uptrend in active addresses also supports the XRPL's utility and adoption – key factors driving long-term growth and investor confidence in the ecosystem.

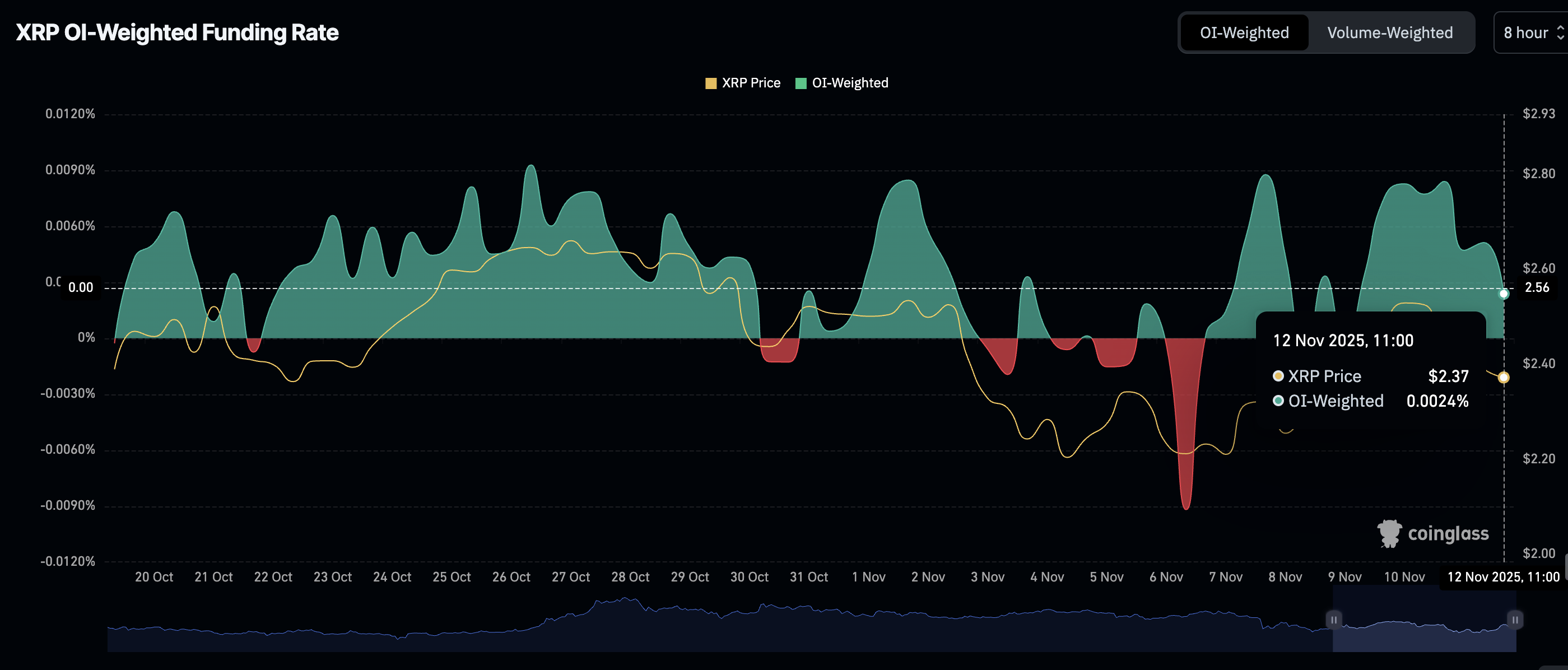

Meanwhile, retail demand for XRP has not picked up following the October 10 deleveraging event. CoinGlass data on the XRP derivatives market shows the futures Open Interest (OI) averaging $3.95 billion on Wednesday, down from $4.11 billion the previous day and $8.36 billion on October 10.

A steady increase in OI is required to support XRP's short-term recovery, indicating that investors have confidence in the token and the ecosystem and are willing to increase their risk exposure.

A subsequent sharp drop in the OI-Weighted Funding Rate metric to 0.0024% on Wednesday, from 0.0084% the previous day, coincides with the low retail demand. This means that traders are leaning bearishly, piling into short-term positions due to a lack of conviction in a sustainable bullish outlook.

Technical outlook: XRP edges higher as bulls tighten their grip

XRP is trading above $2.40 at the time of writing on Wednesday, supported by a strengthening short-term technical structure, the surge in on-chain activity, and improving sentiment in the broader cryptocurrency market.

A buy signal maintained by the Moving Average Convergence Divergence (MACD) indicator underpins XRP’s short-term bullish outlook. If the blue MACD line holds above the red signal line as the indicator generally rises, risk appetite will increase, driving risk exposure.

The Relative Strength Index (RSI) is poised to enter the bullish region above the midline, improving the odds of a sustained rebound. Key areas of interest for traders include the 50-day Exponential Moving Average (EMA) at $2.55, the 200-day EMA at $2.58 and the 100-day EMA at $2.64, all of which highlight key resistance levels.

If investors start to realize profits early and dampen the uptrend, a short-term correction below $2.40, the nearest support, may follow, bringing the next levels at $2.23, tested on Sunday, and $2.07, tested on November 4, within reach.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.