POPULAR ARTICLES

- The Dow Jones gained solid footing on Friday, bolstered by fresh hopes for Fed rate cuts.

- US CPI inflation rose less than expected in September, stoking market sentiment.

- Investors have further priced in a firm two rate cuts from the Fed this year.

The Dow Jones Industrial Average (DJIA) lumbered into record highs on Friday, posting intraday bids north of 47,300 for the first time ever. Investor sentiment hit high gear after US Consumer Price Index (CPI) inflation came in below expectations, keeping hopes for further interest rates from the Federal Reserve (Fed) pinned to the ceiling.

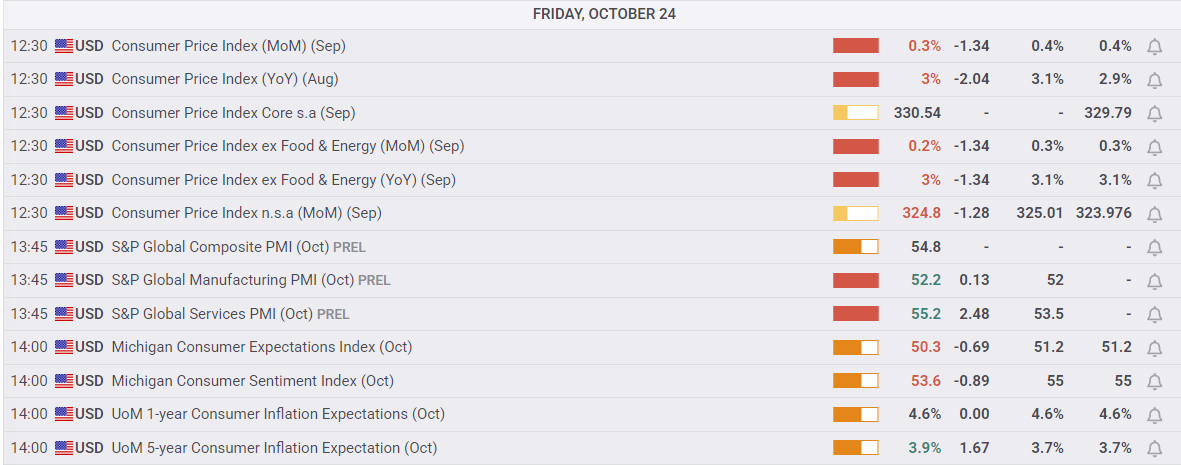

Headline CPI inflation came in at 3.0% YoY in September, clocking in just below the expected hold at 3.1% and sending investors scrambling to pick up risk assets on expectations that the Fed is now locked into two quarter-point interest rate cuts by the end of the year. US CPI metrics broadly came in below expectations, and markets are brushing off the fact that most inflation readings continue to run well above the Fed’s 2% mandate.

Rate cut bets continue to climb on not-hot inflation data

According to the CME’s FedWatch Tool, rate market bets of back-to-back interest rate cuts in October and December are over 95%. Rate traders have also pulled forward the date for the first interest rate cut in 2026 up to March from April.

September’s Purchasing Managers Index (PMI) survey results also surprised markets to the upside, with the Services component rising to 55.2 versus the expected 53.5. However, despite the upswing in business confidence, consumers remain notably more downbeat, with the University of Michigan Consumer Sentiment Index declining to 53.6 from 55.0. UoM Consumer 5-year Inflation Expectations also rose again, climbing to 3.9% from 3.7%.

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Nov 13, 2025 13:30

Frequency: Monthly

Consensus: -

Previous: 3%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.