POPULAR ARTICLES

Ethereum price today: $2,900

- Ethereum's open interest growth, alongside the sharp drop in funding rates, suggests increased short positioning.

- Long traders have seen more than $610 million in liquidations over the past three days.

- ETH could fall to $2,627 if it breaks below $2,880.

Ethereum (ETH) fell further on Tuesday, registering a 3.8% decline over the past 24 hours and stretching its weekly loss to about 14%. The sustained decline aligns with the broader crypto market, which is facing immense risk-off pressure amid ongoing geopolitical tensions in Greenland.

Ethereum open interest surges but funding rates flip negative

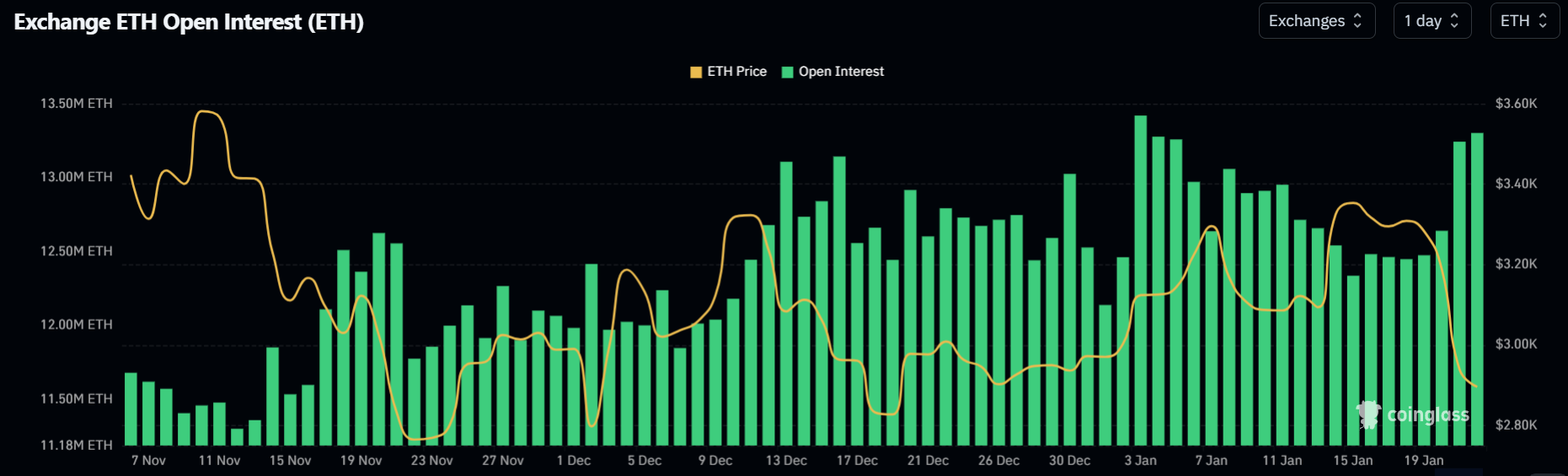

Despite the price decline, Ethereum's open interest (OI) jumped from 12.64M ETH to 13.30M ETH over the past 24 hours.

Open interest is the total worth of outstanding contracts in a derivatives market. The jump in OI shows new money is flowing into the market, increasing leverage.

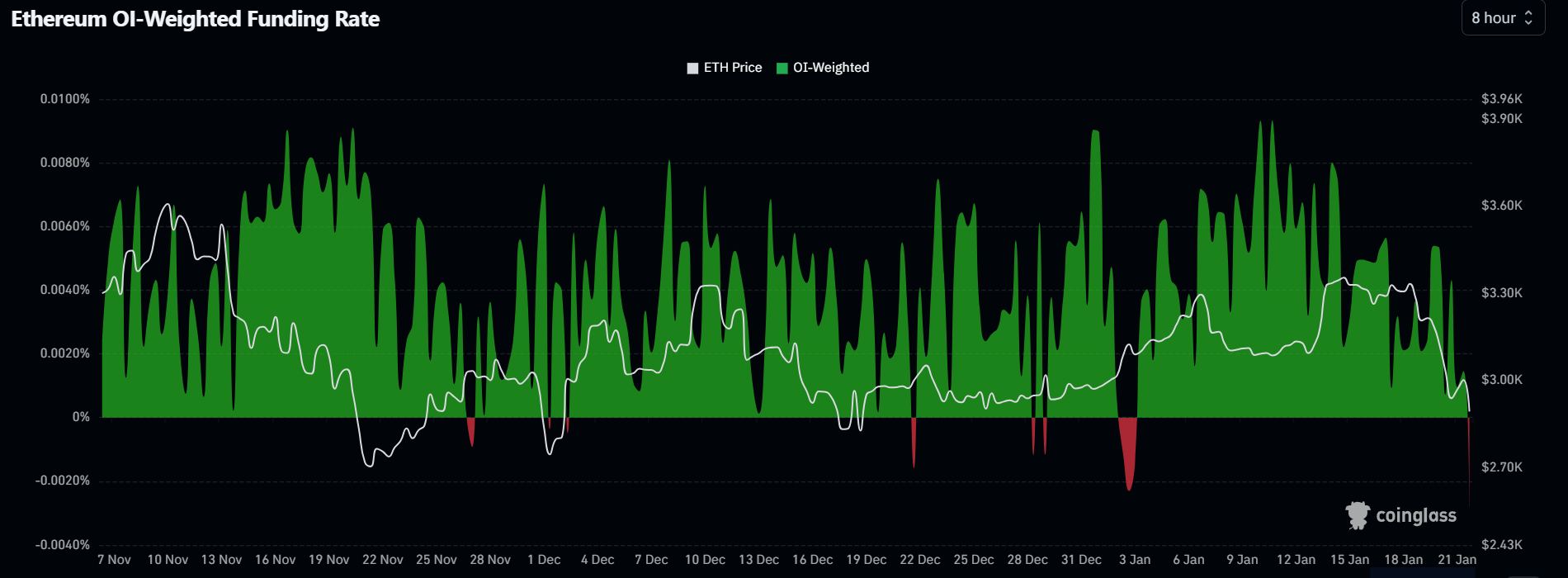

However, that new capital may not be primarily chasing long positions as ETH's funding rates flipped negative during the period, falling to -0.003%. Funding rates are periodic payments between long and short traders in perpetual futures markets to help keep a contract's price close to the spot price of the underlying asset it tracks.

A rise in OI accompanied by a decline in funding rates indicates that new capital is flowing toward short positioning. While the move appears bearish, an unexpected price rise could trigger a short squeeze in such scenarios.

The move comes as long bets on Ethereum are facing intense pressure. Over the past three days, long liquidations have exceeded above $610 million, the largest three-day stretch since November 21.

In the same vein, US spot ETH exchange-traded funds (ETFs) recorded net outflows of nearly $230 million on Tuesday.

Whales and Bitmine continue accumulation

While some investors are moving to the sidelines or flipping bearish, others are scooping the dip. According to EmberCN, a popular onchain Ethereum whale "Trend Research," which is known for using leveraged borrowing to stack ETH, withdrew 24,555 ETH from Binance on Tuesday. The entity now holds 651,300 ETH.

Ethereum treasury firm Bitmine Immersion Technologies (BMNR) also reported adding 35,628 ETH to its stash while staking an additional 581,920 ETH last week. The firm holds a total of 4.2 million ETH. From that figure, it has deployed 1.83 million ETH across three staking providers.

Ethereum Price Forecast: ETH could fall to $2,627 if it declines below $2,880

ETH is testing the $2,880 support level on Wednesday after breaching the lower boundary of a key ascending triangle and the $3,057 key level.

A decline below $2,880 could push ETH toward $2,627, a level that served as support during the November downturn. If prices fall harder, the $2,400 key support could provide a cushion.

The Relative Strength Index (RSI) has declined below its neutral level, while the Stochastic Oscillator (Stoch) is in the oversold region, indicating a rising bearish momentum.