POPULAR ARTICLES

- Litecoin price hovers around $99 on Tuesday, nearing a key psychological level.

- Bullish sentiment builds ahead of the spot Litecoin ETF launch on Nasdaq, set for Tuesday under the ticker LTCC.

- On-chain data paints a positive outlook, with transaction volume hitting its highest level since June 2023 and social dominance on the rise.

Litecoin (LTC) price hovers around $99 at the time of writing on Tuesday, after rallying 7% in the previous week. LTC’s spot Exchange Traded Fund (ETF) is set to debut on Nasdaq on Tuesday, sparking renewed investor interest and fueling bullish momentum. Moreover, on-chain data support a bullish outlook, as transaction volumes are at their highest levels since mid-2023 and social engagement around Litecoin is surging.

Litecoin Spot ETF sets to debut on Tuesday

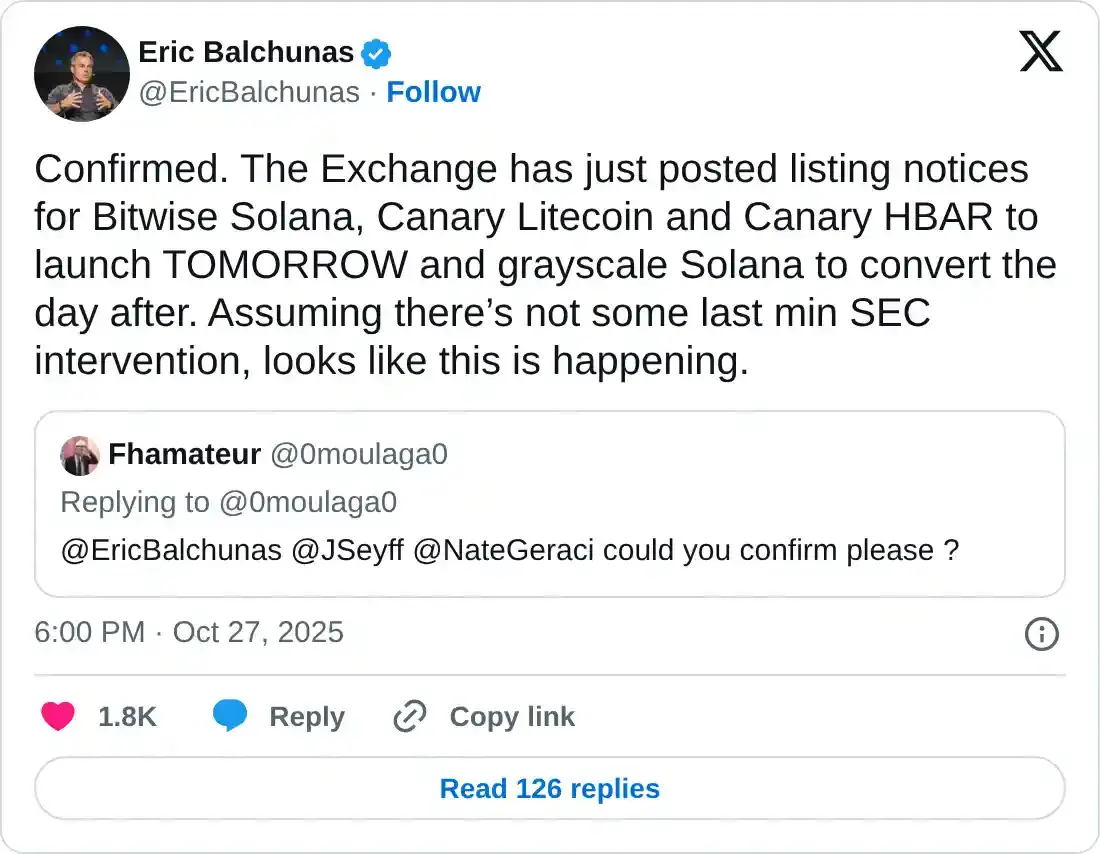

Eric Balchunas, Senior ETF Analyst for Bloomberg, confirmed on his X post on Monday that the exchange has just posted listing notices for Bitwise Solana, Canary Litecoin, and Canary HBAR, all set to launch on Tuesday.

Balchunas continued, “Assuming there’s not some last-minute SEC intervention, it looks like this is happening.”

If approved on Tuesday, this ETF would mark a significant milestone for Litecoin. Moreover, it is bullish on its native token, LTC, in the long term, as it allows investors to gain exposure without directly holding LTC while also enhancing liquidity, legitimacy, and overall adoption.

Litecoin’s on-chain data shows bullish bias

Santiment data shows that Litecoin’s transaction volume rose from $127.31 million on October 18 to $157.94 million on Monday, the highest since June 2023. This rising transaction volume indicates a recent surge in traders’ interest and liquidity in the LTC chain, which bodes well for its price.

[08-1761623057930-1761623057933.54.37, 28 Oct, 2025].png)

LTC transaction volume chart. Source: Santiment

Another factor bolstering the platform’s bullish outlook is surging social engagement around Litecoin, signaling growing market enthusiasm.

[07-1761623074160-1761623074162.45.04, 28 Oct, 2025].png)

Litecoin Price Forecast: LTC could rally if it closes above $104 mark

Litecoin price broke above the weekly resistance level at $96.30 on Saturday and rose 3.15% the next day. However, on Monday, LTC faced a slight rejection from the 200-day Exponential Moving Average (EMA) at $103.13. At the time of writing on Tuesday, it hovers at around $99.78.

If LTC breaks above the 200-day EMA and closes above $104 level, it could extend the rally towards the October 10 high of $135.99.

The Relative Strength Index (RSI) on the daily chart is 48, near its neutral level of 50, suggesting fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on Saturday, providing a buy signal and supporting a bullish view.

LTC/USDT daily chart

On the other hand, if LTC faces a correction, it could extend the decline toward the weekly support at $96.30.