POPULAR ARTICLES

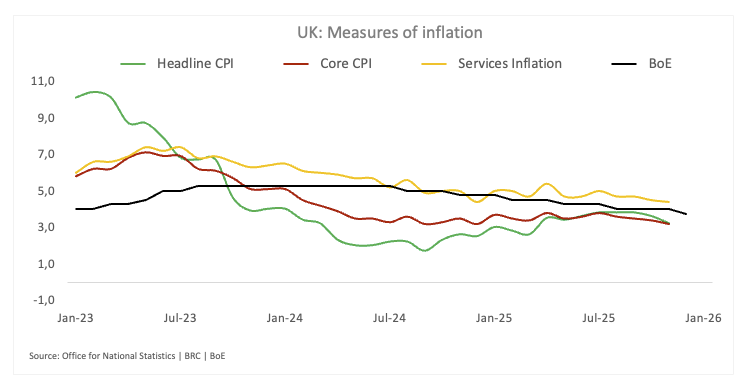

Inflation in the UK, as measured by the change in the Consumer Price Index (CPI), rose to 3.4% in December from 3.2% in November, the UK's Office for National Statistics reported on Wednesday. This reading came in above the market expectation of 3.3%.

On a monthly basis, the CPI increased 0.4% after declining 0.2% in November.

Other details of the report showed that the Retail Price Index rose 4.2%, compared to the 3.8% increase recorded in November, and the core CPI was up 3.2% on a yearly basis, matching the market expectation and November's print.

Finally, the Producer Price Index - Input rose 0.8% in the 12 months to December, down from 1.1% in November.

Market reaction to UK inflation data

GBP/USD showed no immediate reaction to these data and was last seen trading marginally lower on the day at 1.3435.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.14% | -0.62% | 0.22% | -0.57% | -1.13% | -1.80% | -1.22% | |

| EUR | 1.14% | 0.52% | 1.35% | 0.57% | -0.01% | -0.68% | -0.09% | |

| GBP | 0.62% | -0.52% | 0.59% | 0.05% | -0.52% | -1.19% | -0.61% | |

| JPY | -0.22% | -1.35% | -0.59% | -0.75% | -1.31% | -1.97% | -1.40% | |

| CAD | 0.57% | -0.57% | -0.05% | 0.75% | -0.55% | -1.22% | -0.66% | |

| AUD | 1.13% | 0.00% | 0.52% | 1.31% | 0.55% | -0.67% | -0.10% | |

| NZD | 1.80% | 0.68% | 1.19% | 1.97% | 1.22% | 0.67% | 0.58% | |

| CHF | 1.22% | 0.09% | 0.61% | 1.40% | 0.66% | 0.10% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

This section below was published as a preview of the UK inflation data.

- The UK’s ONR Office publishes the December CPI data on Wednesday.

- The UK headline inflation is expected to have ticked higher to 3.3%.

- Core inflation is seen as sticky above 3.0% from a year earlier.

The UK Office for National Statistics (ONS) will release the December Consumer Price Index (CPI) figures on Wednesday at 07:00 GMT, a print that will matter for markets. Consensus expectations point to a modest re-acceleration in inflation pressures.

UK consumer inflation remains one of the most important inputs for the Bank of England (BoE) and typically carries real weight for the British Pound (GBP). With the Monetary Policy Committee (MPC) meeting on February 5, investors broadly expect the ‘Old Lady’ to keep the bank rate unchanged at 3.75%, but this week’s data will help shape the tone of that decision.

What to expect from the next UK inflation report?

Headline UK CPI is expected to have edged higher to 3.3% in the year to December, up from 3.2% in November. On a monthly basis, inflation is seen rebounding by 0.4%, reversing the 0.2% decline recorded the previous month.

Core inflation, which strips out the more volatile food and energy components and is therefore more closely watched by the BoE, is forecast to have remained unchanged at 3.2% on an annual basis. From a month earlier, core CPI is expected to have accelerated to 0.3%, after slipping 0.2% in November.

How will the UK CPI data affect GBP/USD?

The BoE’s rate-setting MPC voted 5–4 to cut the bank rate by 25 basis points to 3.75% in December, its fourth reduction in 2025. While the decision acknowledged softer inflation dynamics and early signs of cooling in the labour market, the Committee stressed that any further easing would be gradual.

The December Decision Maker Panel (DMP) survey did little to challenge the prevailing narrative around the bank’s rate outlook. In short, it leaves the status quo firmly in place, with persistent wage pressures limiting the scope for any meaningful repricing at the front end of the curve.

One-year-ahead wage expectations edged up to 3.7% from 3.6%, while realised pay growth over the past year remains stuck in the mid-4% range. Both metrics continue to sit uncomfortably above levels consistent with inflation returning sustainably to target.

The bottom line is that the survey fails to move the needle, reinforcing the case against bringing forward rate cuts.

So far, implied rates pencil in just over 42 basis points of easing this year, while the BoE is widely anticipated to maintain its policy rate unchanged next month.

Back to technicals, Senior Analyst at FXStreet, Pablo Piovano, notes that GBP/USD appears to have encountered some contention at its current yearly lows near 1.3340 (January 19). “Further weakness from here could expose a move toward the interim support at the 55-day SMA at 1.3309 ahead of the December floor at 1.3179 (December 2),” Piovano adds.

“In case bulls regain the upper hand, the YTD ceiling at 1.3567 (January 6) should emerge as the immediate up barrier. North from here, there are no resistance levels of note until the September 2025 high at 1.3726 (September 17),” he concludes.

Piovano also points out that momentum indicators remain bullish for now, as the Relative Strength Index (RSI) bounces to around 54 and the Average Directional Index (ADX) near 20 suggests a fairly firm trend.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.