POPULAR ARTICLES

Japan’s equity market has underperformed and reversed some of the positive gains at the start of the year following the announcement from China that it would implement export controls on goods that could have a military benefit for Japan. The sharp drop in crude oil prices has had a limited impact on the yen despite reducing Japan’s energy import bill. President Trump announced that Venezuela would send 30-50bn barrels of oil to the US, sold at mkt prices and revenues used to benefit Venezuela but controlled by the US. The volume of oil is relatively modest but reinforces expectations that Trump will be pro-active in taking control of Venezuelan oil and bringing it to market quickly, MUFG's FX analyst Derek Halpenny reports.

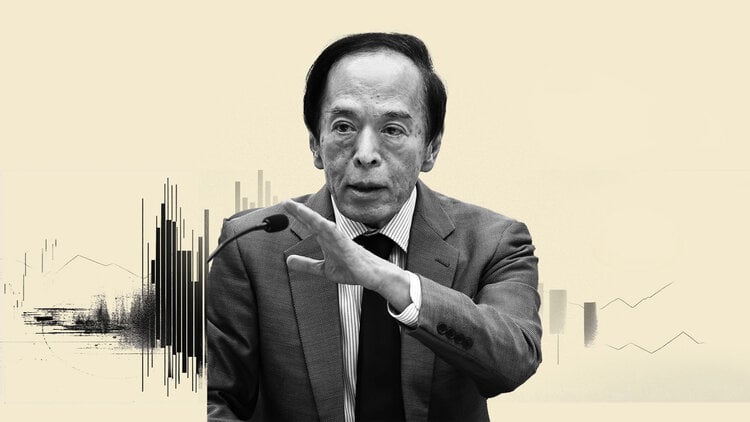

Export controls cloud BoJ rate-hike outlook

"But the escalation of tensions between China and Japan will garner most attention in Japan and a continued deterioration in relations could be used by the BoJ as reason for caution in hiking rates again. The export control could include rare earths from China and and have an impact. China has also just announced an 'anti-dumping' investigation into Japan’s exports to China of dichlorosilane, a component used in the production of semi-conductors. This further underlines the risk of a further escalation in tensions over the coming weeks. The risk of rare earths being included in the export controls could have a notable hit to the auto-sector in Japan."

"Despite the modest decline in yields in the US, Germany and the UK and this latest China news and the drop in crude oil prices, the super-long end of the JGB curve remains under downward pressure with a further modest rise in yields. It’s clear that investors remains nervous ahead of a 30-year JGB auction tomorrow. Last year’s run of 30-year auctions were worst after Liberation Day and were mixed following that period although the 30-year auction in December was stronger and suggested that yields have reached levels that are helping draw investor demand. With 30-year yields at a record high, it could be enough to help investor appetite."

"But sticky inflation, loose monetary policy and increased spending is an unfavorable mix and with the yen remaining at weak levels, the macro backdrop for bonds is not particularly positive. Under this backdrop, the yen is likely to continue to underperform. As well as the 30-year JGB auction, wage data released tonight will be another factor that could spark yen volatility. Wage growth is expected to moderate but remain at levels consistent with the BoJ achieving its price stability goal."