ARTICLES POPULAIRES

- XRP ticks up above $1.40 support, but waning retail demand suggests caution.

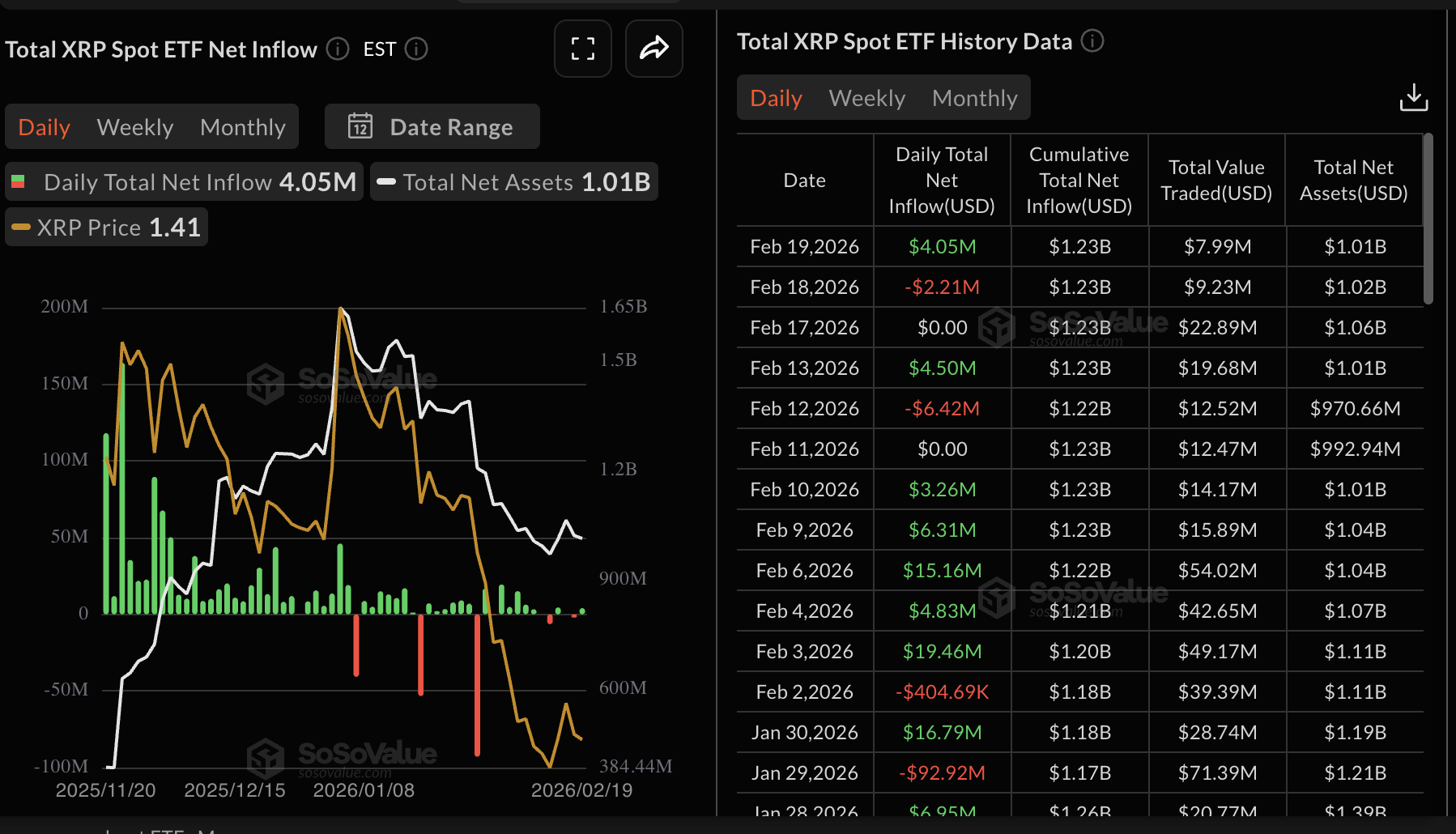

- XRP attracts $4 million in spot ETF inflows on Thursday, signaling renewed institutional investor interest.

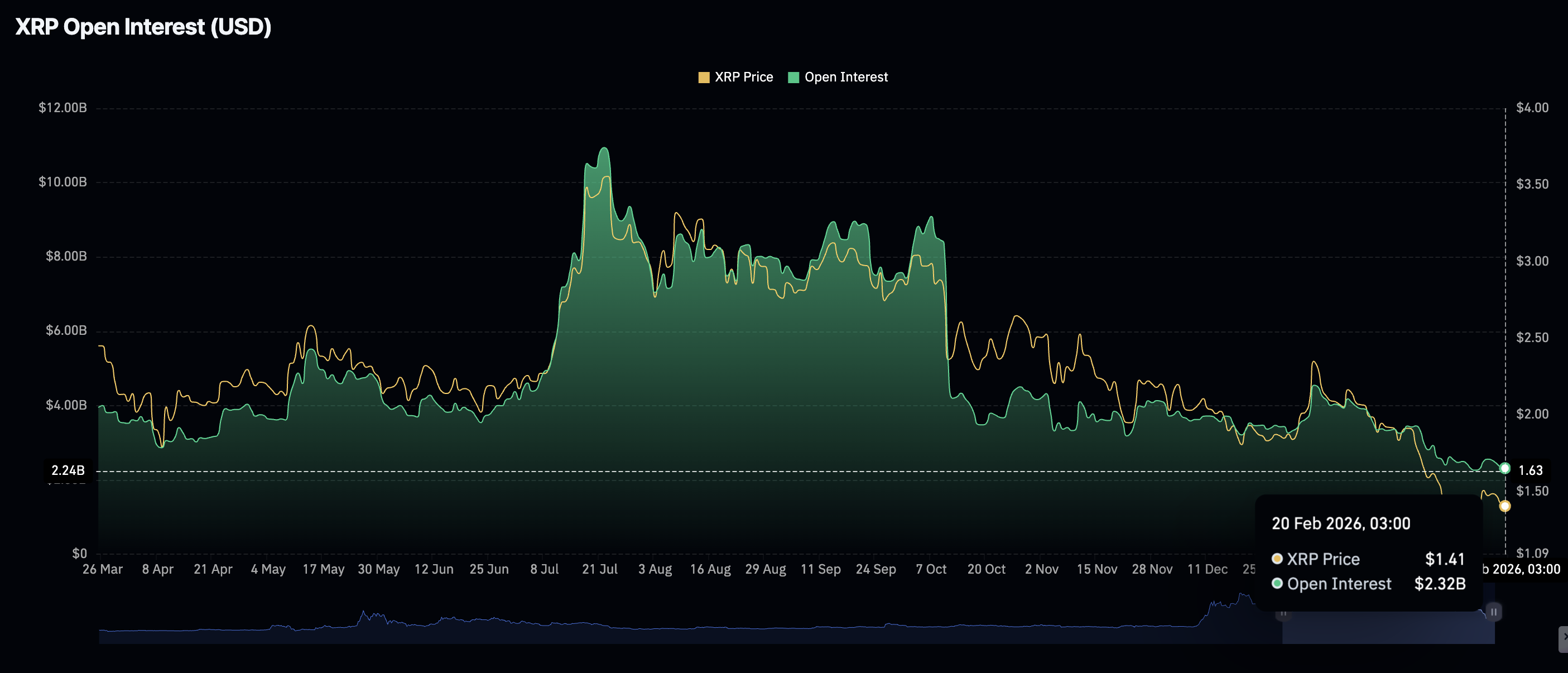

- A weak derivatives market, with futures Open Interest dropping to $2.32 billion, may restrict XRP’s ability to sustain recovery.

Ripple (XRP) is trading above a critical support at $1.40 at the time of writing on Friday, signaling stability ahead of a potential breakout toward the weekly open of $1.48.

The remittance token’s short-term bullish outlook mirrors subtle intraday gains characterising major crypto assets such as Bitcoin (BTC) and Ethereum (ETH).

XRP maintains stability as ETF inflows return

XRP spot Exchange-Traded Funds (ETFs) attracted $4 million in inflows on Thursday, outpacing both Ethereum and Bitcoin ETFs, which saw outflows of $166 million and $130 million, respectively.

The cumulative ETF inflows stand at $1.23 billion, and total assets under management have risen above $1 billion. Despite the mild increase on Thursday, overall sentiment remains shaky, considering net assets have declined from the record $1.65 billion seen in early January.

The XRP derivatives market paints a grimmer picture, with futures Open Interest (OI) falling to $2.32 billion on Friday from $2.45 billion the previous day. For context, retail interest peaked at an annual high of $4.55 billion on January 6, which was significantly below the OI record high of $10.94 billion reached in July.

Notably increased demand from retail traders indicates that investors are confident in XRP’s outlook and its ability to sustain an uptrend. Hence, traders should temper their expectations as futures OI continues to wane.

Technical outlook: XRP holds key support, eyes on a potential breakout

XRP remains above support at $1.40 despite its upside appearing limited by the downward-sloping 50-day Exponential Moving Average (EMA) at $1.69, the 100-day EMA at $1.90 and the 200-day EMA at $2.12.

The SuperTrend indicator on the daily chart holds above XRP, seemingly capping potential rebounds at $1.72. This indicator integrates the Average True Range (ATR) to gauge market volatility and highlight the overall trend.

Until the price rises above the SuperTrend and its colour turns green, the path of least resistance could remain adamantly downward. Subsequently, a daily close below the immediate $1.40 support may accelerate XRP downward toward the October 10 low at $1.25. The February 6 low sits slightly below at $1.12.

Still, the Moving Average Convergence Divergence (MACD) indicator remains above the signal line. At the same time, the green histogram bars expand, hinting at potential stability ahead of a breakout toward the weekly open at $1.48. Other key levels of interest to traders include Sunday’s high at $1.67 and the 50-day EMA at $1.69, which, if reclaimed, could mark a possibly bullish shift.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.