POPULAR ARTICLES

- VisionSys AI announces plans to launch a Solana treasury worth up to $2 billion, in partnership with Marinade Finance.

- The firm stated that it aims to purchase $500 million worth of SOL within the next six months.

- SOL is testing the resistance near $219 after rising 7% over the past 24 hours.

Solana (SOL) posts a 7% gain on Wednesday after VisionSys AI revealed plans to launch a $2 billion SOL treasury, in partnership with staking protocol Marinade Finance.

VisionSys unveils $2 billion Solana treasury plan

AI healthcare and biotech solutions company VisionSys said it plans to launch a Solana-based treasury program in partnership with staking protocol Marinade Finance, according to a statement on Wednesday

VisionSys stated that its subsidiary, Medintel Technology, has signed an exclusive framework agreement with Marinade to develop a digital treasury initiative valued at up to $2 billion. The treasury will begin with a $500 million acquisition and staking of SOL over the next six months.

Marinade Finance will serve as the firm's exclusive staking and ecosystem partner, responsible for overseeing staking operations, ensuring security and optimizing performance.

"By leveraging Marinade's unparalleled expertise, we are not just strengthening our treasury; we are building a foundation for the future," said Heng Wang, Chief Executive Officer of VisionSys.

The partnership aims to combine VisionSys's AI capabilities with the Solana blockchain to develop new DeFi applications. VisionSys added that the initiative will also bolster its balance sheet and improve liquidity.

VisionSys joins a growing list of public companies that have recently established a SOL treasury, including Forward Industries, which raised $1.65 billion to begin a similar initiative in September. The firm is the largest public holder of Solana, with a balance of over 6 million SOL.

Other corporate holders of SOL include DeFi Development Corp., Sol Strategies and Upexi. These firms have amassed a combined 20.92 million SOL, worth $4.59 billion, according to the Strategic SOL Reserve website.

SOL tests $219 resistance after rising 7%

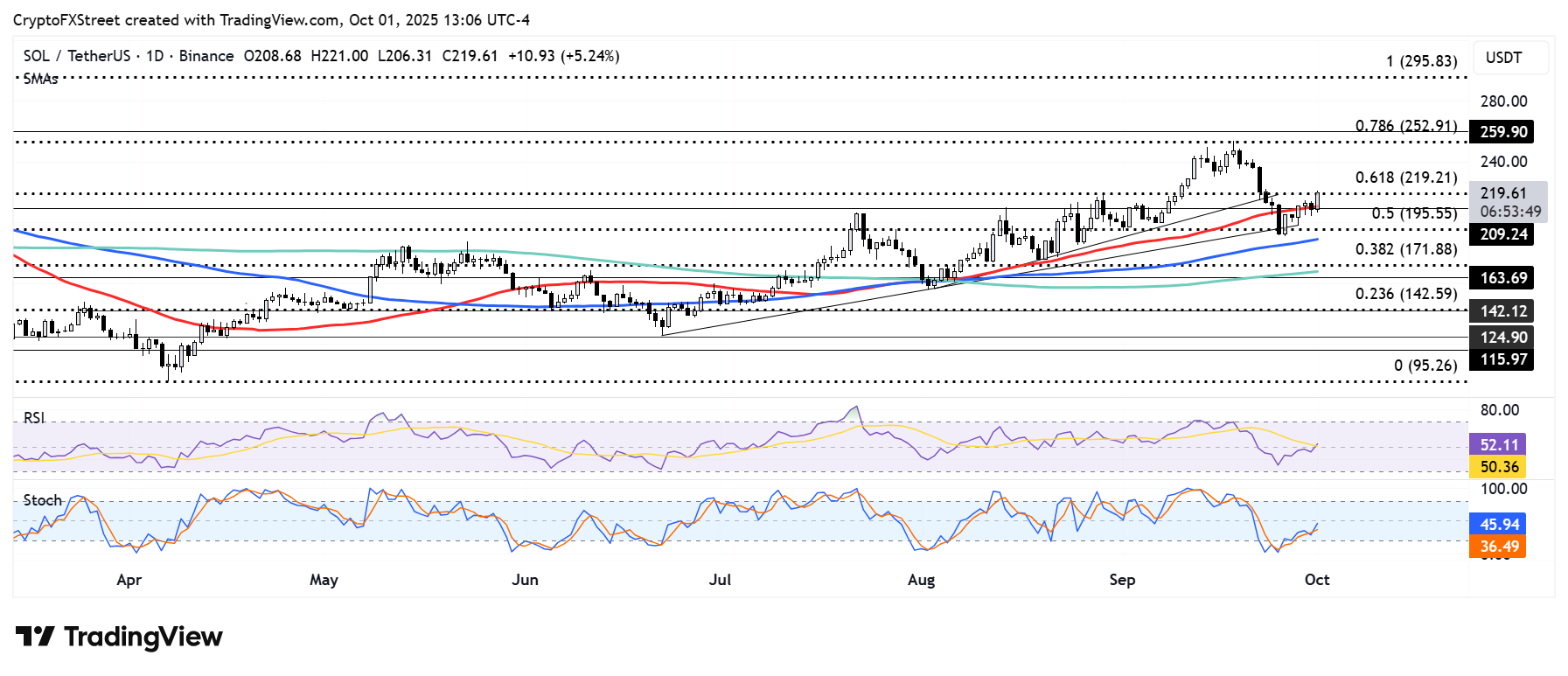

SOL is up 7% over the past 24 hours after bulls defended the $209 support. The Layer 1 token has cleared its 50-day Simple Moving Average (SMA) resistance and is testing the 61.8% Fibonacci (Fib) Retracement level at $219. A firm move above $219 could push SOL toward the 78.6% Fib Retracement level at $252.

SOL/USDT daily chart

However, a rejection at $219 could send SOL back to the $209 support.

The Relative Strength Index (RSI) is testing its moving average and neutral level line, while the Stochastic Oscillator (Stoch) is approaching its midline. A firm cross above in both indicators will strengthen the bullish momentum.